Stock Analysis

In recent times, the Singapore market has faced a backdrop of global financial uncertainties, highlighted by significant events such as the collapse of Terraform Labs which reverberated through the cryptocurrency and broader financial sectors. Such turbulent conditions underscore the importance of stability and reliability in investment choices, qualities often attributed to high-yield dividend stocks.

Top 10 Dividend Stocks In Singapore

| Name | Dividend Yield | Dividend Rating |

| BRC Asia (SGX:BEC) | 7.62% | ★★★★★☆ |

| Civmec (SGX:P9D) | 6.00% | ★★★★★☆ |

| Singapore Exchange (SGX:S68) | 3.57% | ★★★★★☆ |

| UOB-Kay Hian Holdings (SGX:U10) | 6.97% | ★★★★★☆ |

| UOL Group (SGX:U14) | 3.80% | ★★★★★☆ |

| Bumitama Agri (SGX:P8Z) | 6.88% | ★★★★★☆ |

| Singapore Airlines (SGX:C6L) | 7.13% | ★★★★★☆ |

| Delfi (SGX:P34) | 6.64% | ★★★★☆☆ |

| Oversea-Chinese Banking (SGX:O39) | 5.94% | ★★★★☆☆ |

| Sing Investments & Finance (SGX:S35) | 6.03% | ★★★★☆☆ |

Click here to see the full list of 18 stocks from our Top SGX Dividend Stocks screener.

Let's dive into some prime choices out of from the screener.

Boustead Singapore (SGX:F9D)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Boustead Singapore Limited operates as an investment holding company, offering energy engineering, real estate, geospatial, and healthcare technology solutions across diverse global markets with a market capitalization of SGD 482.25 million.

Operations: Boustead Singapore Limited generates revenue from its geospatial, healthcare technology, energy engineering, and real estate solutions segments, totaling SGD 767.11 million.

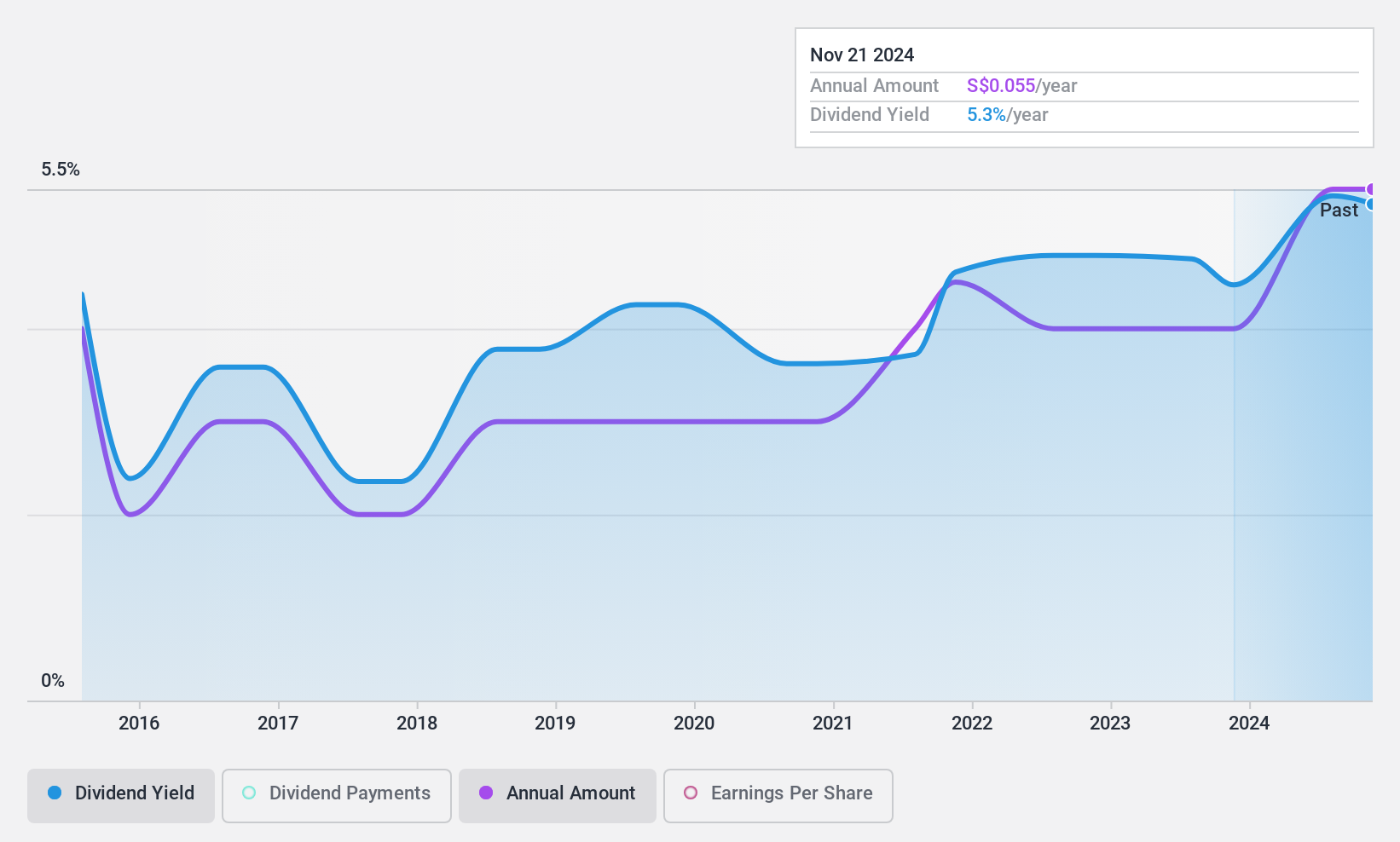

Dividend Yield: 5.4%

Boustead Singapore Limited showcased a robust financial performance for FY 2024, with sales rising to SGD 767.57 million and net income increasing to SGD 64.19 million. Despite a P/E ratio well below the Singapore market average at 7.5x, the company's dividends have shown volatility over the past decade, although they have increased overall during this period. Dividends are well covered by earnings and cash flows, with payout ratios of 40.9% and cash payout ratios at 28.6%, respectively; however, dividend yield remains modest at 5.45%, which is lower than top market payers in Singapore.

- Unlock comprehensive insights into our analysis of Boustead Singapore stock in this dividend report.

- In light of our recent valuation report, it seems possible that Boustead Singapore is trading beyond its estimated value.

China Sunsine Chemical Holdings (SGX:QES)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Sunsine Chemical Holdings Ltd. is an investment holding company that produces and distributes specialty chemicals across China, Asia, the US, Europe, and other international markets, with a market capitalization of SGD 382.58 million.

Operations: China Sunsine Chemical Holdings Ltd. generates revenue primarily from its Rubber Chemicals segment, which brought in CN¥4.38 billion, with additional contributions from Heating Power and Waste Treatment segments totaling CN¥221.29 million and CN¥29.76 million respectively.

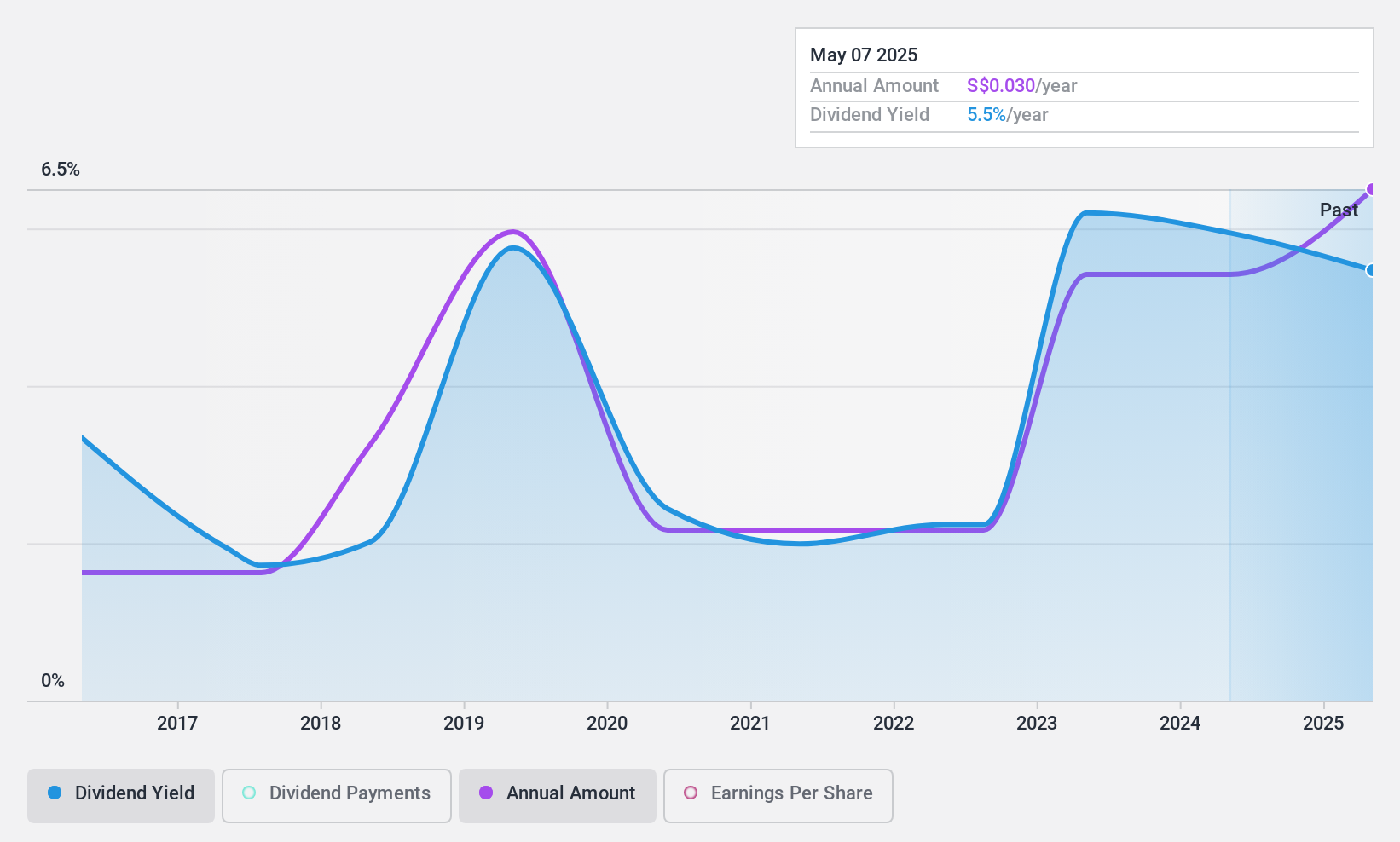

Dividend Yield: 6.2%

China Sunsine Chemical Holdings has a conservative payout ratio of 20.8%, ensuring dividends are well-supported by earnings and cash flows, with a cash payout ratio at 30.2%. However, its dividend track record shows volatility over the past decade, despite some growth in payments. Recent share buyback initiatives signal potential confidence by management in the company's valuation. The firm announced special dividends recently but maintains a modest yield of 6.18% compared to top Singapore dividend stocks.

- Dive into the specifics of China Sunsine Chemical Holdings here with our thorough dividend report.

- The valuation report we've compiled suggests that China Sunsine Chemical Holdings' current price could be quite moderate.

United Overseas Bank (SGX:U11)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: United Overseas Bank Limited operates globally, offering a diverse range of banking products and services, with a market capitalization of approximately SGD 51.17 billion.

Operations: United Overseas Bank Limited generates its revenues from a variety of banking products and services offered globally.

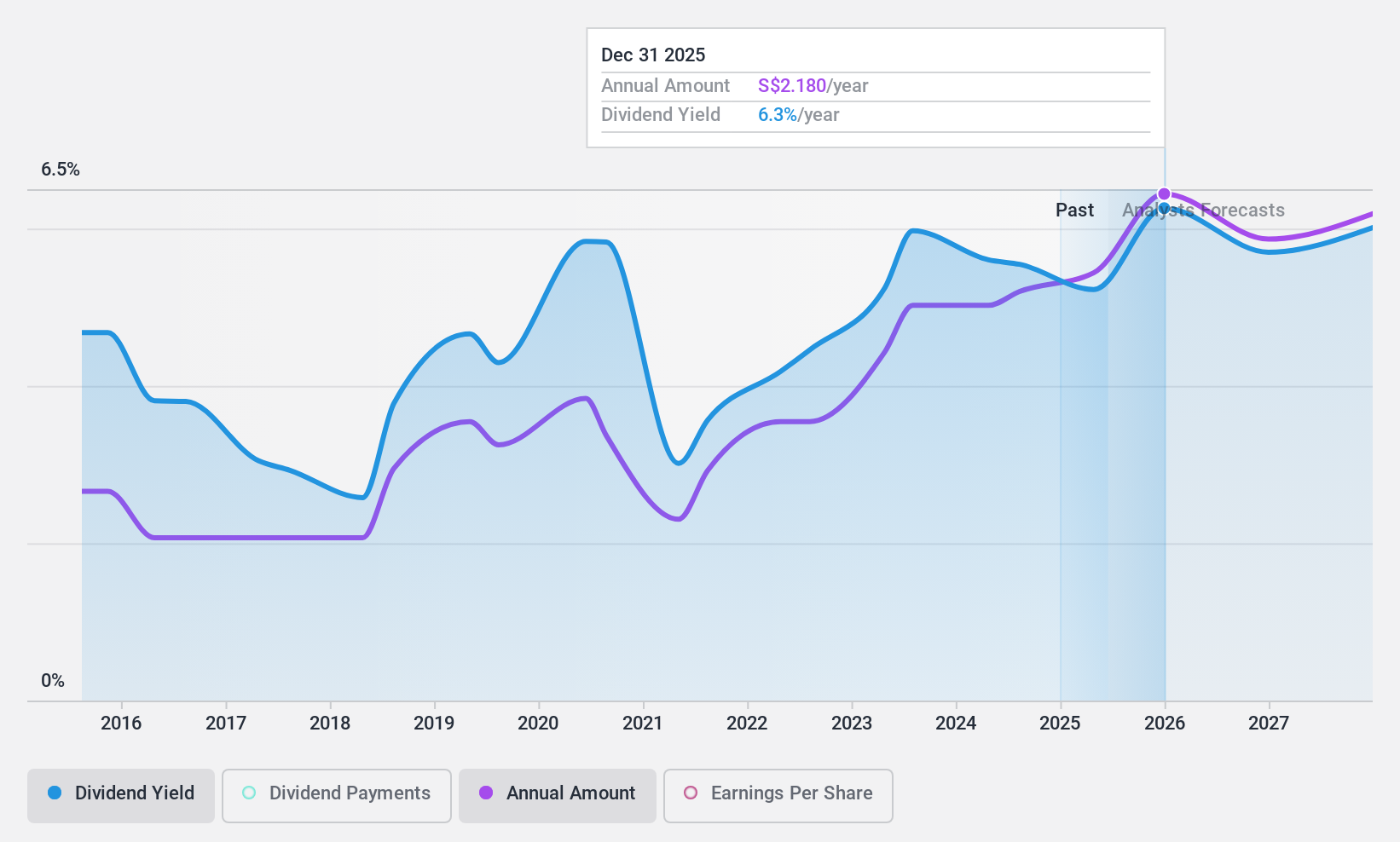

Dividend Yield: 5.6%

United Overseas Bank's dividend yield of 5.56% is below the top quartile in Singapore's market, although its payout ratio stands at a reasonable 50.8%, suggesting dividends are supported by earnings. Over the past decade, dividend payments have shown volatility and unreliability, with some growth noted. Despite trading at a significant discount to estimated fair value and having low bad loan allowances (85%), earnings growth projections remain modest at 4.54% annually. Recent executive changes and share buyback announcements underscore ongoing corporate adjustments and shareholder return strategies.

- Click to explore a detailed breakdown of our findings in United Overseas Bank's dividend report.

- The analysis detailed in our United Overseas Bank valuation report hints at an deflated share price compared to its estimated value.

Summing It All Up

- Discover the full array of 18 Top SGX Dividend Stocks right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether China Sunsine Chemical Holdings is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:QES

China Sunsine Chemical Holdings

An investment holding company, manufactures and sells specialty chemicals in the People’s Republic of China, rest of Asia, the United States, Europe, and internationally.

Flawless balance sheet established dividend payer.