- Singapore

- /

- Paper and Forestry Products

- /

- SGX:E6R

Here's Why Samko Timber (SGX:E6R) Is Weighed Down By Its Debt Load

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies Samko Timber Limited (SGX:E6R) makes use of debt. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Samko Timber

How Much Debt Does Samko Timber Carry?

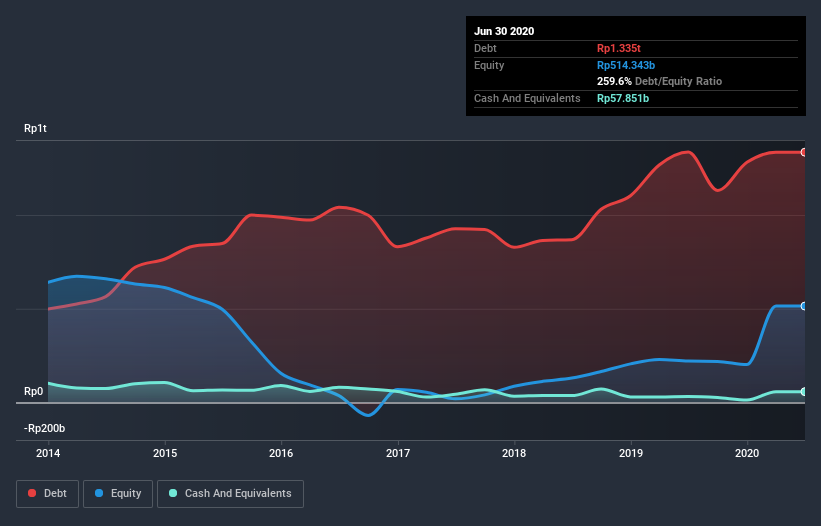

As you can see below, Samko Timber had Rp1.34t of debt, at June 2020, which is about the same as the year before. You can click the chart for greater detail. However, because it has a cash reserve of Rp57.9b, its net debt is less, at about Rp1.28t.

How Strong Is Samko Timber's Balance Sheet?

According to the last reported balance sheet, Samko Timber had liabilities of Rp1.88t due within 12 months, and liabilities of Rp551.0b due beyond 12 months. On the other hand, it had cash of Rp57.9b and Rp447.6b worth of receivables due within a year. So its liabilities total Rp1.93t more than the combination of its cash and short-term receivables.

The deficiency here weighs heavily on the Rp881.9b company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we'd watch its balance sheet closely, without a doubt. After all, Samko Timber would likely require a major re-capitalisation if it had to pay its creditors today.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Samko Timber shareholders face the double whammy of a high net debt to EBITDA ratio (7.2), and fairly weak interest coverage, since EBIT is just 0.66 times the interest expense. The debt burden here is substantial. Worse, Samko Timber's EBIT was down 67% over the last year. If earnings continue to follow that trajectory, paying off that debt load will be harder than convincing us to run a marathon in the rain. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Samko Timber's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we always check how much of that EBIT is translated into free cash flow. Over the last three years, Samko Timber saw substantial negative free cash flow, in total. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

To be frank both Samko Timber's EBIT growth rate and its track record of staying on top of its total liabilities make us rather uncomfortable with its debt levels. And furthermore, its interest cover also fails to instill confidence. Considering everything we've mentioned above, it's fair to say that Samko Timber is carrying heavy debt load. If you play with fire you risk getting burnt, so we'd probably give this stock a wide berth. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Consider for instance, the ever-present spectre of investment risk. We've identified 6 warning signs with Samko Timber (at least 1 which doesn't sit too well with us) , and understanding them should be part of your investment process.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you decide to trade Samko Timber, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SGX:E6R

Samko Timber

An investment holding company, provides timber related products.

Flawless balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success