The Market Doesn't Like What It Sees From Southern Packaging Group Limited's (SGX:BQP) Revenues Yet

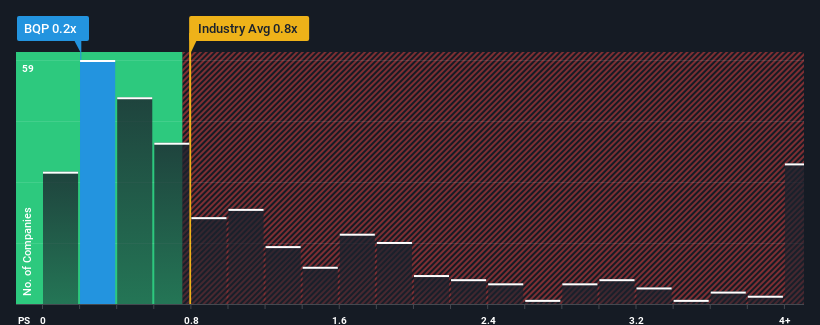

When close to half the companies operating in the Packaging industry in Singapore have price-to-sales ratios (or "P/S") above 0.8x, you may consider Southern Packaging Group Limited (SGX:BQP) as an attractive investment with its 0.2x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Southern Packaging Group

What Does Southern Packaging Group's P/S Mean For Shareholders?

Southern Packaging Group has been doing a good job lately as it's been growing revenue at a solid pace. It might be that many expect the respectable revenue performance to degrade substantially, which has repressed the P/S. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Southern Packaging Group will help you shine a light on its historical performance.Is There Any Revenue Growth Forecasted For Southern Packaging Group?

In order to justify its P/S ratio, Southern Packaging Group would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a decent 11% gain to the company's revenues. The latest three year period has also seen a 7.5% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

This is in contrast to the rest of the industry, which is expected to grow by 31% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's understandable that Southern Packaging Group's P/S sits below the majority of other companies. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Key Takeaway

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Southern Packaging Group revealed its three-year revenue trends are contributing to its low P/S, given they look worse than current industry expectations. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. If recent medium-term revenue trends continue, it's hard to see the share price experience a reversal of fortunes anytime soon.

There are also other vital risk factors to consider and we've discovered 4 warning signs for Southern Packaging Group (3 shouldn't be ignored!) that you should be aware of before investing here.

If you're unsure about the strength of Southern Packaging Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:BQP

Southern Packaging Group

An investment holding company, engages in the manufacture and trading of flexible and rigid packaging products in the People's Republic of China, Australia, Thailand, the Philippines, and internationally.

Slight risk and slightly overvalued.

Market Insights

Community Narratives