Here's Why We Think Wilmar International (SGX:F34) Might Deserve Your Attention Today

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

In contrast to all that, many investors prefer to focus on companies like Wilmar International (SGX:F34), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Wilmar International with the means to add long-term value to shareholders.

Check out our latest analysis for Wilmar International

How Fast Is Wilmar International Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. That makes EPS growth an attractive quality for any company. Impressively, Wilmar International has grown EPS by 24% per year, compound, in the last three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

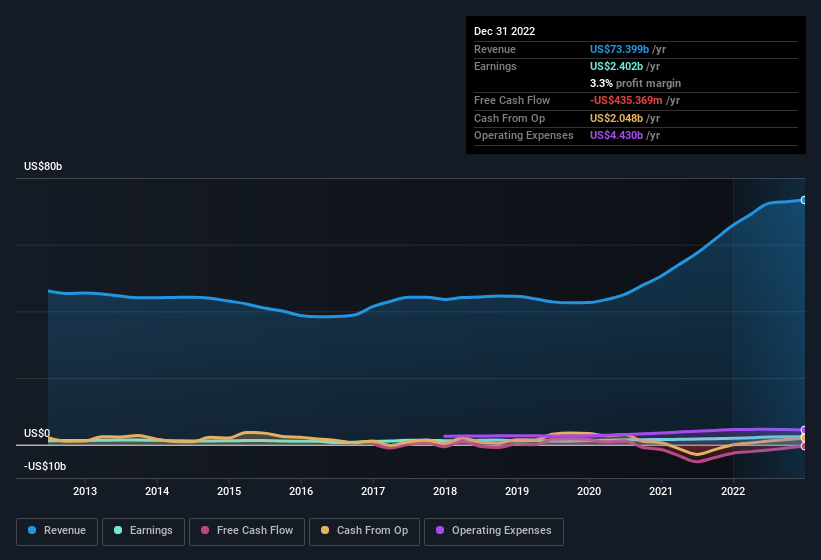

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Wilmar International maintained stable EBIT margins over the last year, all while growing revenue 12% to US$73b. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Wilmar International?

Are Wilmar International Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Even though there was some insider selling over the last year, that was outweighed by Co-Founder Khoon Hong Kuok's huge outlay of US$44m, spent buying shares. The average price paid was about US$3.96. Big purchases like that are well worth noting, especially for those who like to follow the insider money.

The good news, alongside the insider buying, for Wilmar International bulls is that insiders (collectively) have a meaningful investment in the stock. We note that their impressive stake in the company is worth US$1.6b. This suggests that leadership will be very mindful of shareholders' interests when making decisions!

Is Wilmar International Worth Keeping An Eye On?

You can't deny that Wilmar International has grown its earnings per share at a very impressive rate. That's attractive. On top of that, insiders own a significant piece of the pie when it comes to the company's stock, and one has been buying more. These things considered, this is one stock worth watching. Don't forget that there may still be risks. For instance, we've identified 3 warning signs for Wilmar International (2 shouldn't be ignored) you should be aware of.

The good news is that Wilmar International is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Wilmar International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:F34

Wilmar International

Operates as an agribusiness company in Singapore, South East Asia, the People's Republic of China, India, Europe, Australia/New Zealand, Africa, and internationally.

Undervalued with mediocre balance sheet.