Boon Wee Kuah has been the CEO of MTQ Corporation Limited (SGX:M05) since 2010, and this article will examine the executive's compensation with respect to the overall performance of the company. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for MTQ.

See our latest analysis for MTQ

How Does Total Compensation For Boon Wee Kuah Compare With Other Companies In The Industry?

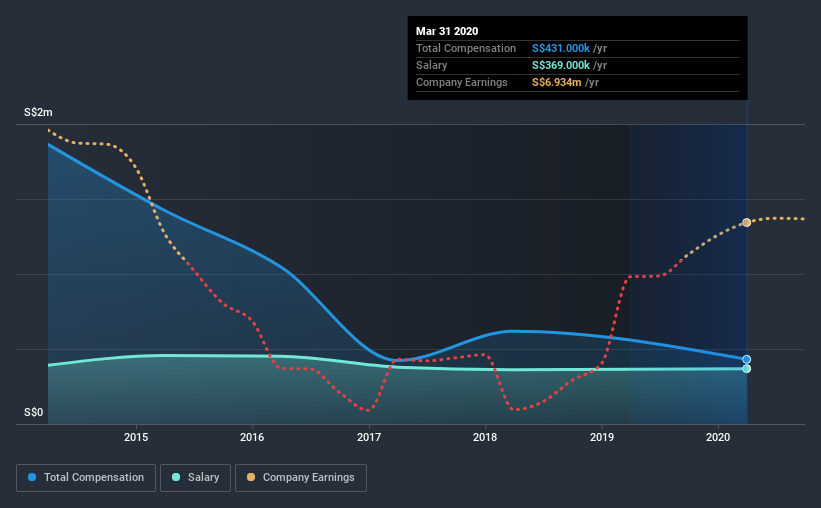

At the time of writing, our data shows that MTQ Corporation Limited has a market capitalization of S$45m, and reported total annual CEO compensation of S$431k for the year to March 2020. We note that's a decrease of 30% compared to last year. We note that the salary portion, which stands at S$369.0k constitutes the majority of total compensation received by the CEO.

On comparing similar-sized companies in the industry with market capitalizations below S$267m, we found that the median total CEO compensation was S$663k. In other words, MTQ pays its CEO lower than the industry median. Moreover, Boon Wee Kuah also holds S$1.6m worth of MTQ stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2020 | 2018 | Proportion (2020) |

| Salary | S$369k | S$362k | 86% |

| Other | S$62k | S$257k | 14% |

| Total Compensation | S$431k | S$619k | 100% |

On an industry level, roughly 79% of total compensation represents salary and 21% is other remuneration. There isn't a significant difference between MTQ and the broader market, in terms of salary allocation in the overall compensation package. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at MTQ Corporation Limited's Growth Numbers

Over the past three years, MTQ Corporation Limited has seen its earnings per share (EPS) grow by 102% per year. In the last year, its revenue is up 7.5%.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's good to see a bit of revenue growth, as this suggests the business is able to grow sustainably. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has MTQ Corporation Limited Been A Good Investment?

With a three year total loss of 30% for the shareholders, MTQ Corporation Limited would certainly have some dissatisfied shareholders. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

To Conclude...

As previously discussed, Boon Wee is compensated less than what is normal for CEOs of companies of similar size, and which belong to the same industry. Importantly though, the company has impressed with its EPS growth over three years. Considering EPS are on the up, we would say Boon Wee is compensated fairly. But shareholders will likely want to hold off on any raise for Boon Wee until investor returns are positive.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. We've identified 3 warning signs for MTQ that investors should be aware of in a dynamic business environment.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you decide to trade MTQ, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SGX:M05

MTQ

Provides engineering solutions for oilfield equipment in Singapore, the Kingdom of Bahrain, Australia, United Arab Emirates, and the United Kingdom.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives