It is a pleasure to report that the Mermaid Maritime Public Company Limited (SGX:DU4) is up 33% in the last quarter. Meanwhile over the last three years the stock has dropped hard. Indeed, the share price is down a tragic 50% in the last three years. So the improvement may be a real relief to some. While many would remain nervous, there could be further gains if the business can put its best foot forward.

View our latest analysis for Mermaid Maritime

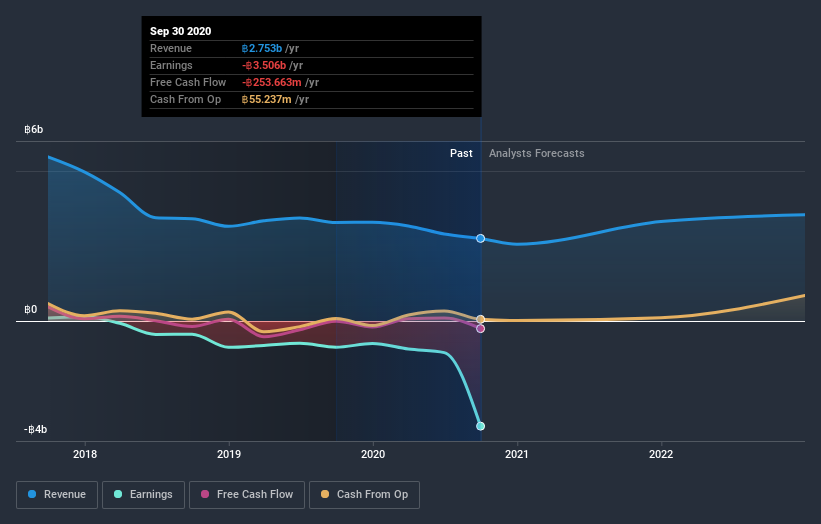

Mermaid Maritime wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over the last three years, Mermaid Maritime's revenue dropped 19% per year. That's definitely a weaker result than most pre-profit companies report. With no profits and falling revenue it is no surprise that investors have been dumping the stock, pushing the price down by 15% per year over that time. Bagholders or 'baggies' are people who buy more of a stock as the price collapses. They are then left 'holding the bag' if the shares turn out to be worthless. It could be a while before the company repays long suffering shareholders with share price gains.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

This free interactive report on Mermaid Maritime's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

We regret to report that Mermaid Maritime shareholders are down 31% for the year. Unfortunately, that's worse than the broader market decline of 5.6%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 6% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Mermaid Maritime better, we need to consider many other factors. To that end, you should be aware of the 2 warning signs we've spotted with Mermaid Maritime .

We will like Mermaid Maritime better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SG exchanges.

When trading Mermaid Maritime or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SGX:DU4

Mermaid Maritime

Operates as a subsea and offshore services company in Thailand, Qatar, the United Arab Emirates, the United Kingdom, and Saudi Arabia.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives