- Singapore

- /

- Oil and Gas

- /

- SGX:C9Q

Announcing: Sinostar PEC Holdings Stock Increased An Energizing 157% In The Last Five Years

Want to participate in a short research study? Help shape the future of investing tools and receive a $20 prize!

Sinostar PEC Holdings Limited (SGX:C9Q) shareholders might be concerned after seeing the share price drop 22% in the last quarter. But that doesn't change the fact that the returns over the last five years have been very strong. In fact, the share price is 157% higher today. So while it's never fun to see a share price fall, it's important to look at a longer time horizon. Only time will tell if there is still too much optimism currently reflected in the share price.

Check out our latest analysis for Sinostar PEC Holdings

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed, is to compare the earnings per share (EPS) with the share price.

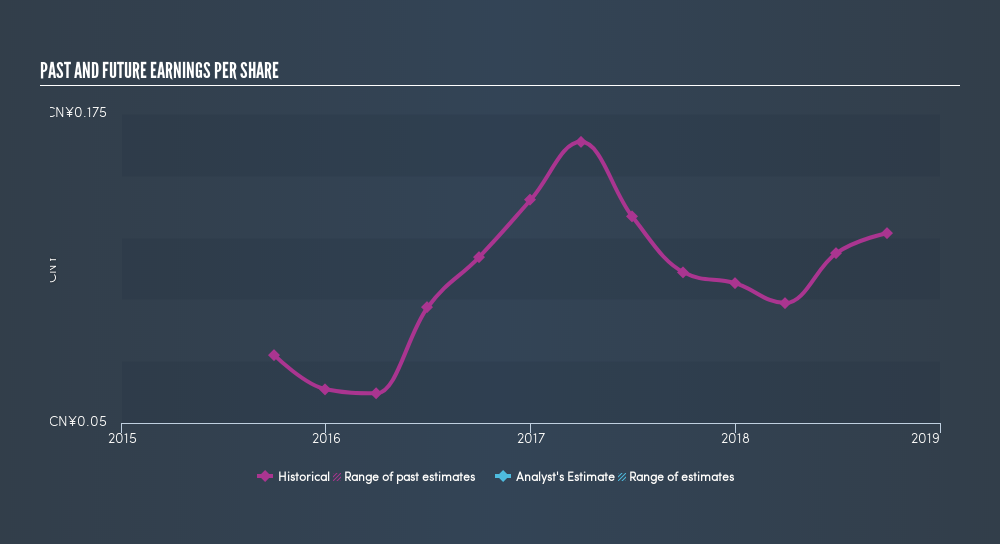

During the last half decade, Sinostar PEC Holdings became profitable. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here. Since the company was unprofitable five years ago, but not three years ago, it's worth taking a look at the returns in the last three years, too. We can see that the Sinostar PEC Holdings share price is up 140% in the last three years. During the same period, EPS grew by 54% each year. This EPS growth is higher than the 34% average annual increase in the share price over the same three years. Therefore, it seems the market has moderated its expectations for growth, somewhat. This unenthusiastic sentiment is reflected in the stock's reasonably modest P/E ratio of 7.09.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Sinostar PEC Holdings's TSR for the last 5 years was 227%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

While it's certainly disappointing to see that Sinostar PEC Holdings shares lost 1.3% throughout the year, that wasn't as bad as the market loss of 3.5%. Longer term investors wouldn't be so upset, since they would have made 27%, each year, over five years. In the best case scenario the last year is just a temporary blip on the journey to a brighter future. Before forming an opinion on Sinostar PEC Holdings you might want to consider these 3 valuation metrics.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this freelist of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SG exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SGX:C9Q

Sinostar PEC Holdings

An investment holding company, produces and supplies petrochemical products in the People’s Republic of China.

Flawless balance sheet and good value.

Market Insights

Community Narratives