- Sweden

- /

- Real Estate

- /

- OM:NIVI B

Exploring 3 Undervalued Small Caps With Recent Insider Activity Across Global Regions

Reviewed by Simply Wall St

As global markets react to political shifts and economic policy changes, small-cap stocks have captured investor attention with their potential for growth amid fluctuating conditions. The Russell 2000 Index, a key benchmark for small caps, recently led market gains, highlighting the sector's resilience despite remaining below record highs. In this environment, identifying promising stocks involves looking at factors such as recent insider activity and valuation metrics that suggest potential undervaluation in diverse global regions.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Paradeep Phosphates | 23.9x | 0.8x | 28.71% | ★★★★★☆ |

| Maharashtra Seamless | 9.2x | 1.6x | 40.51% | ★★★★★☆ |

| Avia Avian | 17.2x | 3.9x | 5.69% | ★★★★☆☆ |

| Coveo Solutions | NA | 3.9x | 34.73% | ★★★★☆☆ |

| NCL Industries | 13.7x | 0.5x | -64.61% | ★★★☆☆☆ |

| Semen Indonesia (Persero) | 21.2x | 0.7x | 28.41% | ★★★☆☆☆ |

| L.G. Balakrishnan & Bros | 13.6x | 1.6x | -36.24% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Bajel Projects | 229.0x | 1.8x | 35.17% | ★★★☆☆☆ |

| Sabre | NA | 0.5x | -48.47% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

Nivika Fastigheter (OM:NIVI B)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Nivika Fastigheter focuses on real estate rental operations with a market capitalization of SEK 5.76 billion.

Operations: The company's primary revenue stream is from real estate rentals, amounting to SEK 675.74 million. Over recent periods, the gross profit margin has shown an upward trend, reaching 71.24% as of August 2024. Operating expenses have increased to SEK 52.78 million in the same period, impacting net income figures which have fluctuated significantly due to varying non-operating expenses.

PE: 28.5x

Nivika Fastigheter, a smaller player in the real estate sector, recently reported a turnaround with net income reaching SEK 0.88 million for Q4 2024, contrasting sharply with last year's loss of SEK 157.62 million. This indicates potential value amidst its size category. Insider confidence is evident as Niclas Bergman acquired 6,847 shares valued at approximately SEK 298,082 over recent months. Additionally, the company completed a SEK 400 million green bond offering on November 5th to bolster its financing framework and sustainability initiatives.

- Click here and access our complete valuation analysis report to understand the dynamics of Nivika Fastigheter.

Assess Nivika Fastigheter's past performance with our detailed historical performance reports.

Daiwa House Logistics Trust (SGX:DHLU)

Simply Wall St Value Rating: ★★★★★☆

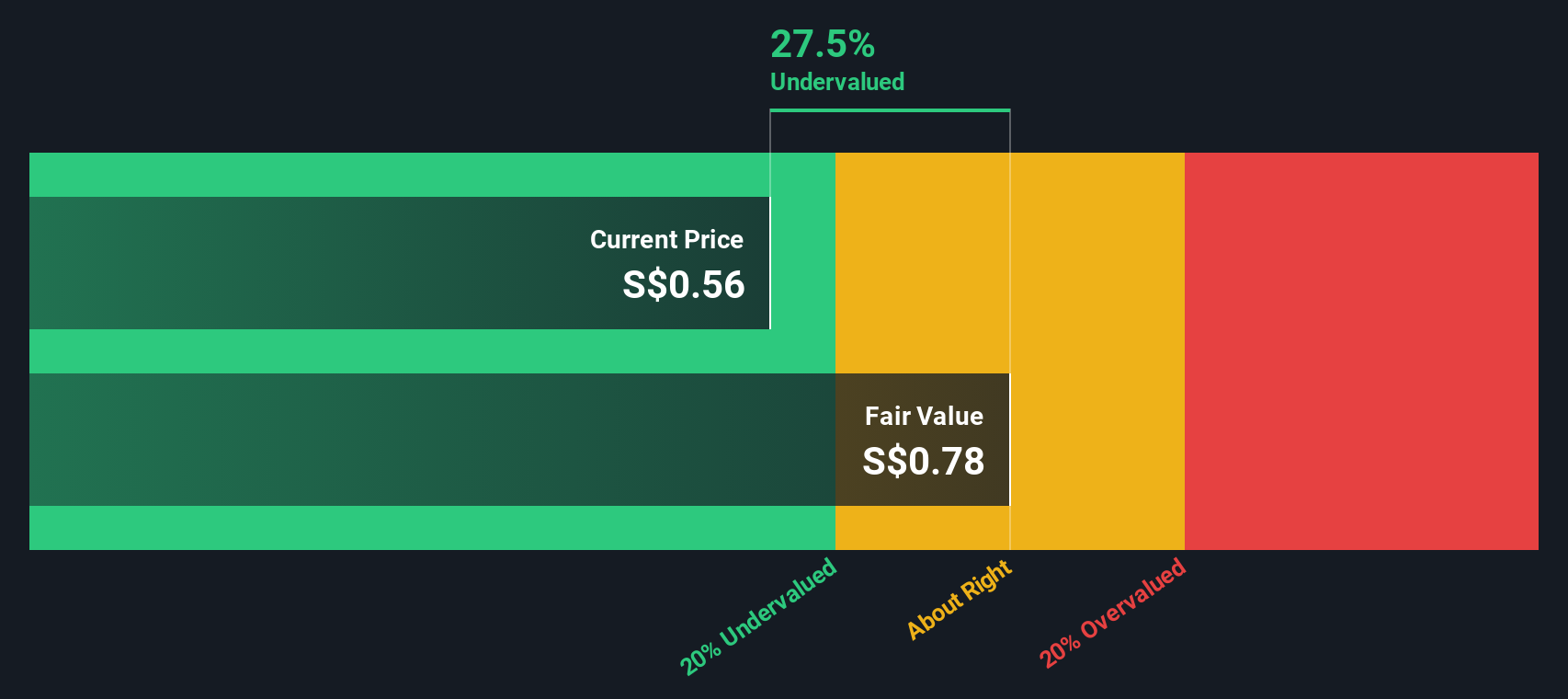

Overview: Daiwa House Logistics Trust operates as a real estate investment trust focusing on commercial properties, with a market capitalization of approximately SGD 0.56 billion.

Operations: Daiwa House Logistics Trust generates revenue primarily from its commercial REIT segment, with recent figures showing SGD 56.53 million. The company has seen fluctuations in its net income margin, reaching as high as 2.06% in 2022 and stabilizing around 0.73% by mid-2024. Operating expenses have varied over time but generally remain under SGD 6 million, impacting overall profitability alongside non-operating expenses that have occasionally been negative, contributing positively to net income.

PE: 9.7x

Daiwa House Logistics Trust, a company known for its logistics-focused real estate investments, is currently trading at prices that may not fully reflect its potential. Despite facing challenges with external borrowing as its sole funding source and a forecasted 10.5% annual decline in earnings over the next three years, insider confidence is evident through recent share purchases in September 2024. This suggests optimism from those closely involved with the company. Revenue growth of 3.79% annually offers some positive outlook amidst these hurdles.

- Click to explore a detailed breakdown of our findings in Daiwa House Logistics Trust's valuation report.

Gain insights into Daiwa House Logistics Trust's past trends and performance with our Past report.

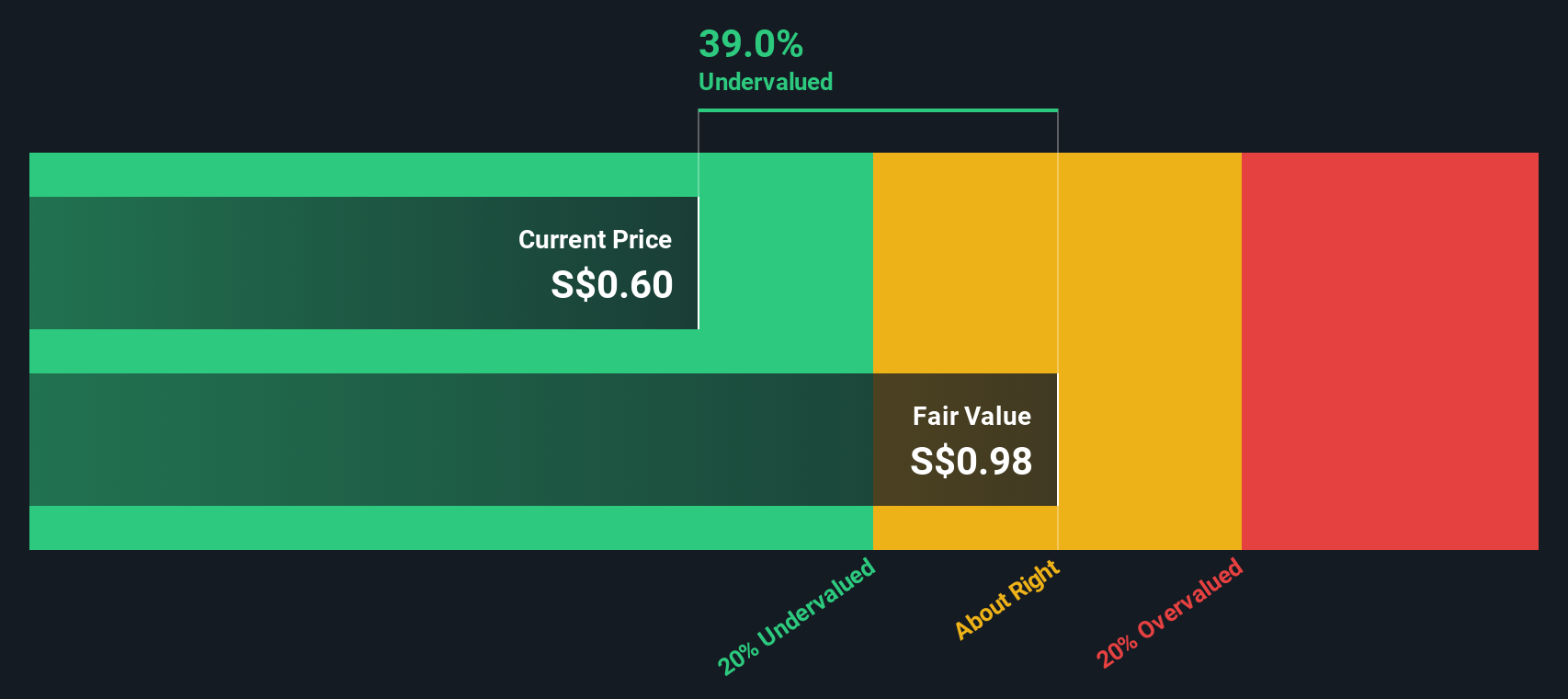

ValueMax Group (SGX:T6I)

Simply Wall St Value Rating: ★★★★☆☆

Overview: ValueMax Group operates in the pawnbroking, moneylending, and retail and trading of jewellery and gold sectors with a focus on providing financial services and products.

Operations: The company's primary revenue streams are from retail and trading of jewellery and gold, followed by pawnbroking and moneylending. Over recent periods, the gross profit margin has shown an upward trend, reaching 30.28% in the latest period. Operating expenses have been consistently increasing alongside revenue growth, with general and administrative expenses being a significant component.

PE: 6.0x

ValueMax Group, a small company in the financial services sector, has recently seen insider confidence with significant share purchases by insiders over the past six months. Despite facing challenges with debt coverage by operating cash flow, its funding primarily relies on higher-risk external borrowing. This structure might suggest potential for growth if managed well. The lack of shareholder dilution over the past year indicates stability in share value, offering an intriguing prospect for investors seeking opportunities in smaller companies.

- Take a closer look at ValueMax Group's potential here in our valuation report.

Review our historical performance report to gain insights into ValueMax Group's's past performance.

Make It Happen

- Unlock more gems! Our Undervalued Small Caps With Insider Buying screener has unearthed 168 more companies for you to explore.Click here to unveil our expertly curated list of 171 Undervalued Small Caps With Insider Buying.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nivika Fastigheter might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:NIVI B

Nivika Fastigheter

Owns, manages, and develops residential and commercial properties in Sweden.

Reasonable growth potential with questionable track record.

Market Insights

Community Narratives