- Singapore

- /

- Diversified Financial

- /

- SGX:P15

What Are The Total Returns Earned By Shareholders Of Pacific Century Regional Developments (SGX:P15) On Their Investment?

Ideally, your overall portfolio should beat the market average. But even in a market-beating portfolio, some stocks will lag the market. While the Pacific Century Regional Developments Limited (SGX:P15) share price is down 25% over half a decade, the total return to shareholders (which includes dividends) was 29%. And that total return actually beats the market decline of 12%. Contrary to the longer term story, the last month has been good for stockholders, with a share price gain of 8.5%. But this could be related to good market conditions, with stocks up around 3.5% during the period.

View our latest analysis for Pacific Century Regional Developments

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

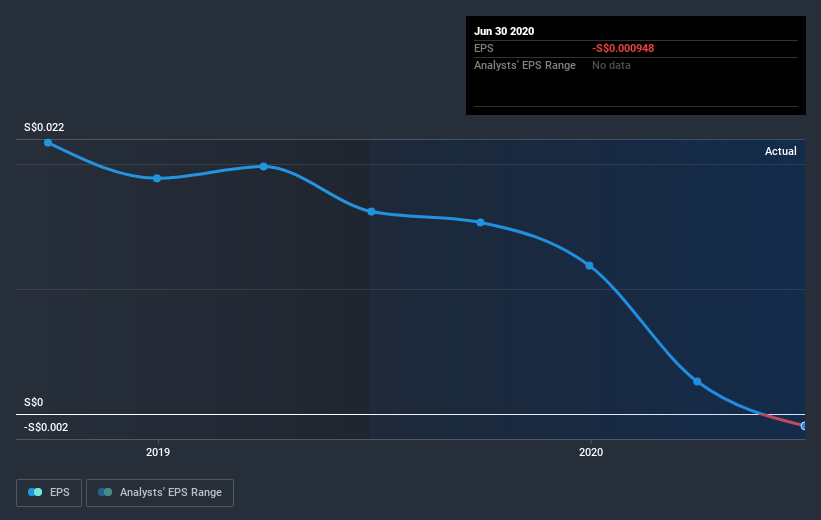

In the last half decade Pacific Century Regional Developments saw its share price fall as its EPS declined below zero. Since the company has fallen to a loss making position, it's hard to compare the change in EPS with the share price change. However, we can say we'd expect to see a falling share price in this scenario.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

This free interactive report on Pacific Century Regional Developments' earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Pacific Century Regional Developments the TSR over the last 5 years was 29%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

It's nice to see that Pacific Century Regional Developments shareholders have received a total shareholder return of 12% over the last year. That's including the dividend. That's better than the annualised return of 5% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. It's always interesting to track share price performance over the longer term. But to understand Pacific Century Regional Developments better, we need to consider many other factors. Even so, be aware that Pacific Century Regional Developments is showing 2 warning signs in our investment analysis , and 1 of those can't be ignored...

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SG exchanges.

When trading Pacific Century Regional Developments or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SGX:P15

Pacific Century Regional Developments

An investment holding company, engages in management and consultancy service businesses in Singapore, Hong Kong, and Cayman Islands.

Low risk unattractive dividend payer.

Similar Companies

Market Insights

Community Narratives