- Singapore

- /

- Capital Markets

- /

- SGX:AIY

iFAST Corporation Ltd.'s (SGX:AIY) Popularity With Investors Is Clear

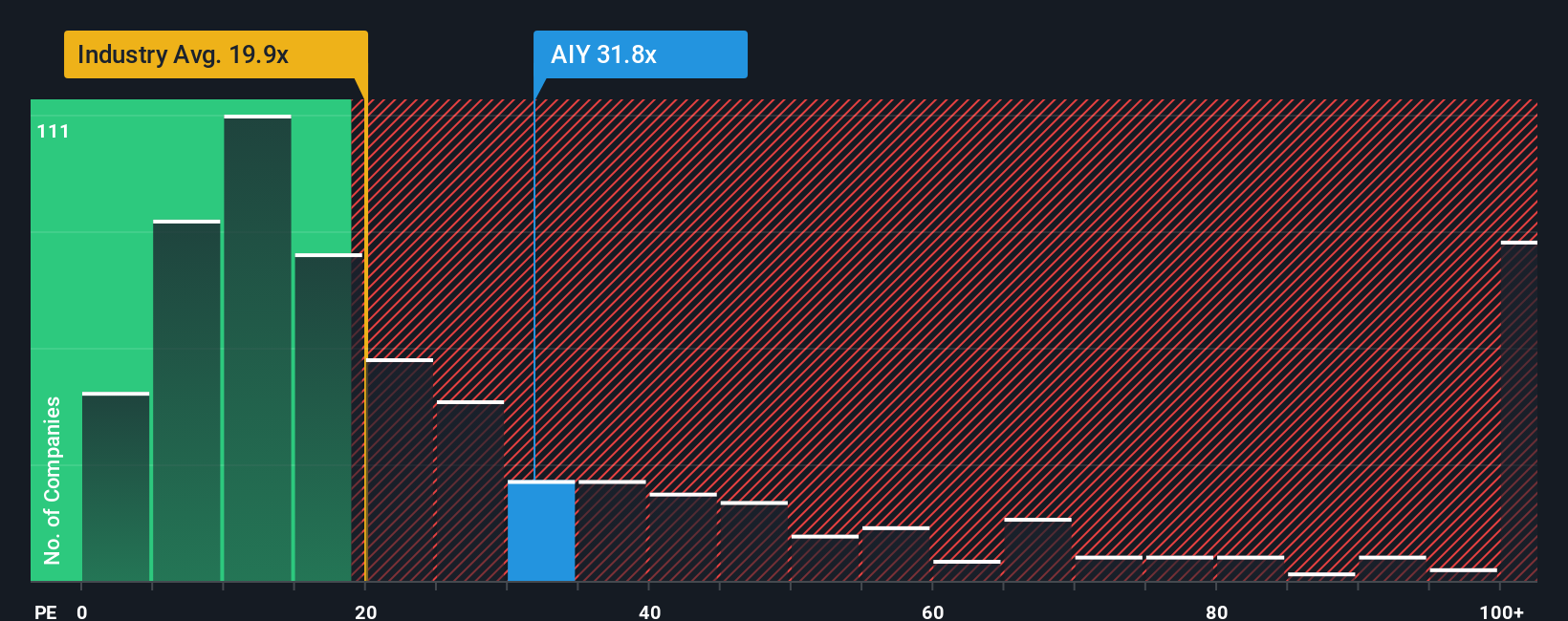

With a price-to-earnings (or "P/E") ratio of 31.8x iFAST Corporation Ltd. (SGX:AIY) may be sending very bearish signals at the moment, given that almost half of all companies in Singapore have P/E ratios under 13x and even P/E's lower than 8x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

Recent times have been advantageous for iFAST as its earnings have been rising faster than most other companies. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. If not, then existing shareholders might be a little nervous about the viability of the share price.

Check out our latest analysis for iFAST

Does Growth Match The High P/E?

The only time you'd be truly comfortable seeing a P/E as steep as iFAST's is when the company's growth is on track to outshine the market decidedly.

Retrospectively, the last year delivered an exceptional 77% gain to the company's bottom line. The strong recent performance means it was also able to grow EPS by 139% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Looking ahead now, EPS is anticipated to climb by 21% each year during the coming three years according to the five analysts following the company. Meanwhile, the rest of the market is forecast to only expand by 8.7% per year, which is noticeably less attractive.

In light of this, it's understandable that iFAST's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that iFAST maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for iFAST with six simple checks will allow you to discover any risks that could be an issue.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if iFAST might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:AIY

iFAST

Operates as a digital banking and wealth management platform in Singapore, Hong Kong, Malaysia, China, and the United Kingdom.

Outstanding track record with high growth potential.

Market Insights

Community Narratives