- Singapore

- /

- Consumer Services

- /

- SGX:NR7

These 4 Measures Indicate That Raffles Education (SGX:NR7) Is Using Debt In A Risky Way

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Raffles Education Corporation Limited (SGX:NR7) does use debt in its business. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Raffles Education

What Is Raffles Education's Debt?

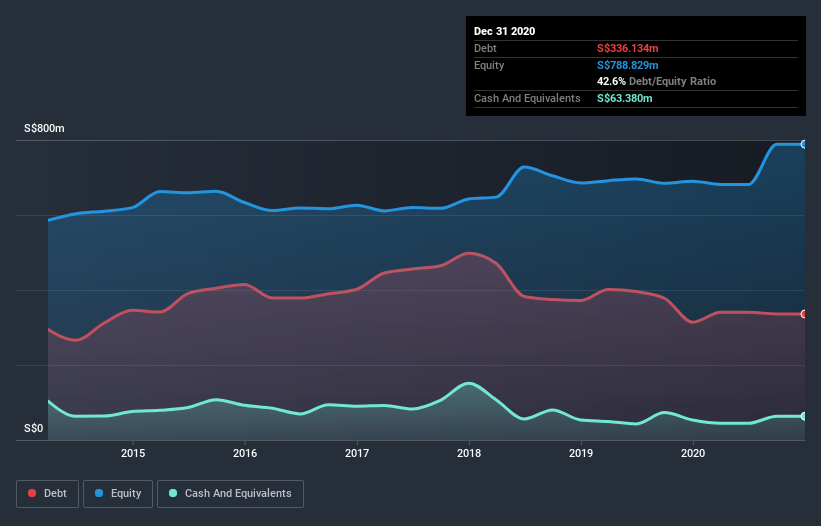

As you can see below, at the end of December 2020, Raffles Education had S$336.1m of debt, up from S$313.9m a year ago. Click the image for more detail. However, because it has a cash reserve of S$63.4m, its net debt is less, at about S$272.8m.

A Look At Raffles Education's Liabilities

We can see from the most recent balance sheet that Raffles Education had liabilities of S$293.9m falling due within a year, and liabilities of S$260.6m due beyond that. Offsetting this, it had S$63.4m in cash and S$101.1m in receivables that were due within 12 months. So its liabilities total S$390.0m more than the combination of its cash and short-term receivables.

This deficit casts a shadow over the S$208.2m company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. At the end of the day, Raffles Education would probably need a major re-capitalization if its creditors were to demand repayment.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Weak interest cover of 0.015 times and a disturbingly high net debt to EBITDA ratio of 18.7 hit our confidence in Raffles Education like a one-two punch to the gut. This means we'd consider it to have a heavy debt load. Even worse, Raffles Education saw its EBIT tank 93% over the last 12 months. If earnings keep going like that over the long term, it has a snowball's chance in hell of paying off that debt. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Raffles Education will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we always check how much of that EBIT is translated into free cash flow. During the last two years, Raffles Education burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

To be frank both Raffles Education's EBIT growth rate and its track record of staying on top of its total liabilities make us rather uncomfortable with its debt levels. And even its interest cover fails to inspire much confidence. It looks to us like Raffles Education carries a significant balance sheet burden. If you play with fire you risk getting burnt, so we'd probably give this stock a wide berth. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. These risks can be hard to spot. Every company has them, and we've spotted 3 warning signs for Raffles Education (of which 1 is potentially serious!) you should know about.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you decide to trade Raffles Education, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SGX:NR7

Raffles Education

An investment holding company, provides education and related services in the regions of ASEAN, North Asia, South Asia, Australasia, and Europe.

Questionable track record with imperfect balance sheet.

Market Insights

Community Narratives