- Singapore

- /

- Consumer Services

- /

- SGX:CNE

The 58% return delivered to MindChamps PreSchool's (SGX:CNE) shareholders actually lagged YoY earnings growth

The simplest way to invest in stocks is to buy exchange traded funds. But investors can boost returns by picking market-beating companies to own shares in. For example, the MindChamps PreSchool Limited (SGX:CNE) share price is up 58% in the last 1 year, clearly besting the market decline of around 7.3% (not including dividends). That's a solid performance by our standards! The longer term returns have not been as good, with the stock price only 1.8% higher than it was three years ago.

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

View our latest analysis for MindChamps PreSchool

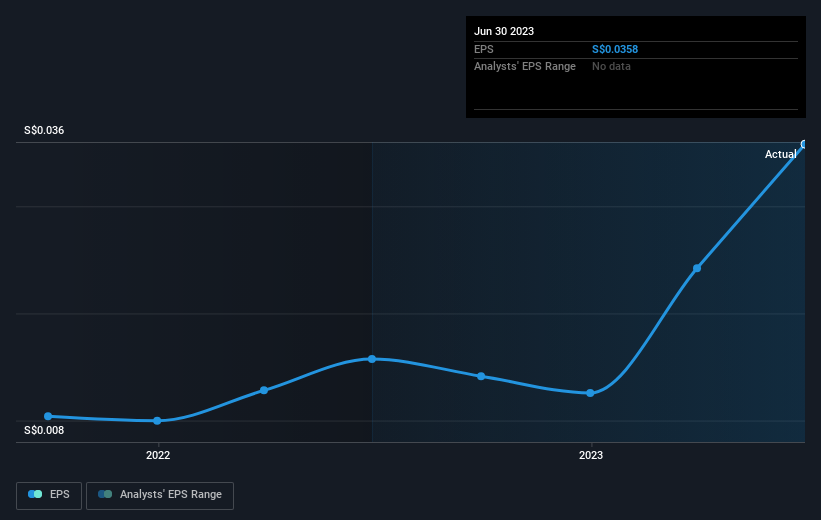

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

MindChamps PreSchool was able to grow EPS by 127% in the last twelve months. This EPS growth is significantly higher than the 58% increase in the share price. Therefore, it seems the market isn't as excited about MindChamps PreSchool as it was before. This could be an opportunity. The caution is also evident in the lowish P/E ratio of 7.96.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

This free interactive report on MindChamps PreSchool's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

We're pleased to report that MindChamps PreSchool shareholders have received a total shareholder return of 58% over one year. Notably the five-year annualised TSR loss of 8% per year compares very unfavourably with the recent share price performance. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. It's always interesting to track share price performance over the longer term. But to understand MindChamps PreSchool better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 4 warning signs for MindChamps PreSchool (of which 1 is significant!) you should know about.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Singaporean exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:CNE

MindChamps PreSchool

Owns and operates preschools and enrichment centers in Singapore and Australia.

Good value with mediocre balance sheet.