- Singapore

- /

- Consumer Services

- /

- SGX:CNE

How Much Did MindChamps PreSchool's(SGX:CNE) Shareholders Earn From Share Price Movements Over The Last Year?

It's easy to match the overall market return by buying an index fund. But if you buy individual stocks, you can do both better or worse than that. For example, the MindChamps PreSchool Limited (SGX:CNE) share price is down 43% in the last year. That's well below the market decline of 14%. We wouldn't rush to judgement on MindChamps PreSchool because we don't have a long term history to look at. And the share price decline continued over the last week, dropping some 9.4%.

View our latest analysis for MindChamps PreSchool

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Even though the MindChamps PreSchool share price is down over the year, its EPS actually improved. It could be that the share price was previously over-hyped.

The divergence between the EPS and the share price is quite notable, during the year. So it's well worth checking out some other metrics, too.

MindChamps PreSchool's revenue is actually up 16% over the last year. Since the fundamental metrics don't readily explain the share price drop, there might be an opportunity if the market has overreacted.

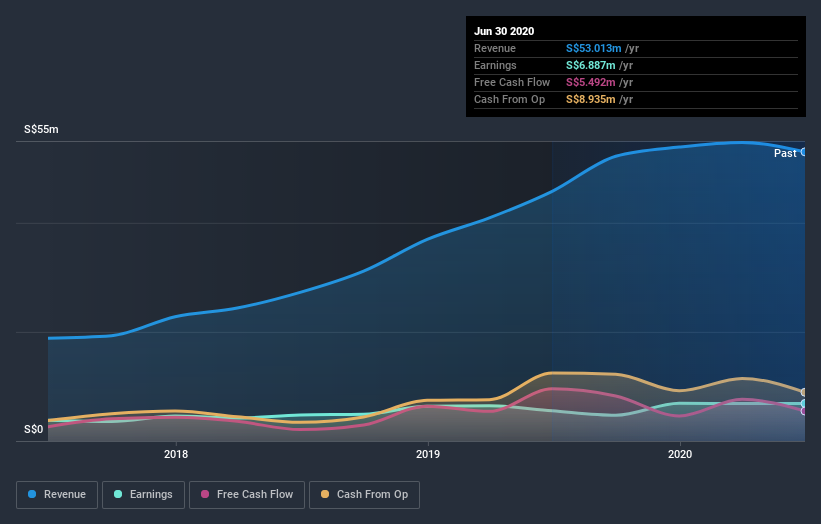

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling MindChamps PreSchool stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

We doubt MindChamps PreSchool shareholders are happy with the loss of 43% over twelve months. That falls short of the market, which lost 14%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. With the stock flat over the last three months, the market now seems fairly ambivalent about the business. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 2 warning signs for MindChamps PreSchool that you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SG exchanges.

If you’re looking to trade MindChamps PreSchool, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SGX:CNE

MindChamps PreSchool

Provides childcare services in Singapore and Australia.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives