- Singapore

- /

- Food and Staples Retail

- /

- SGX:OV8

Sheng Siong (SGX:OV8) Net Margin Miss Reinforces Investor Focus on Value Over Growth

Reviewed by Simply Wall St

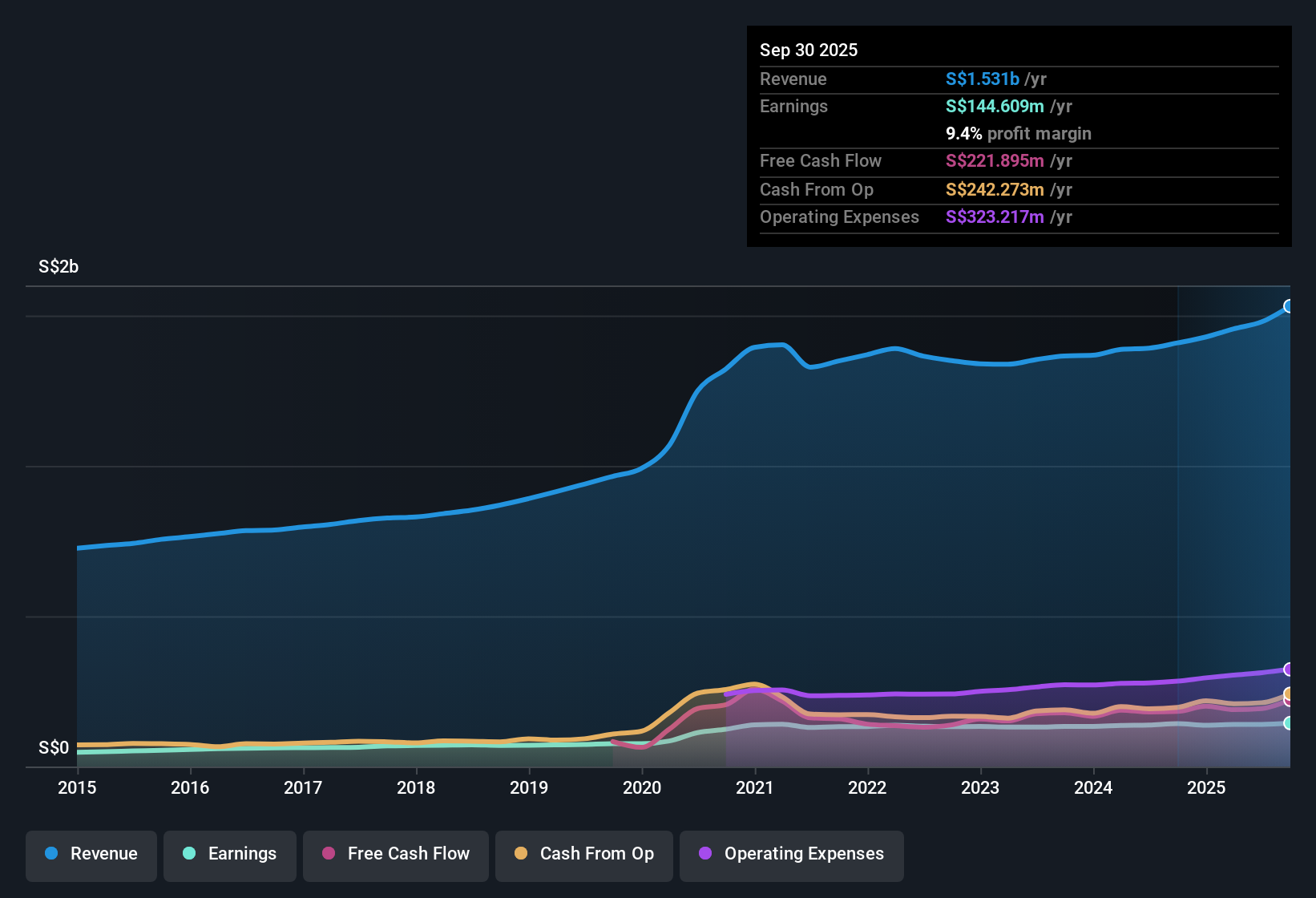

Sheng Siong Group (SGX:OV8) posted earnings growth of 1.4% over the past year, edging out its five-year average of 1.3% annually. Looking ahead, analysts expect revenues to rise 5.3% per year, which is well above the Singapore market average of 3.8%. Earnings are forecast to grow 6.6% each year, just shy of the broader market's 6.7% pace. Net profit margin dipped to 9.4% from last year's 10.1%, but the stock trades at a Price-to-Earnings ratio of 24.1x, below peers. The share price (SGD2.32) remains below an estimated fair value, suggesting investors see steady performance even as margins soften.

See our full analysis for Sheng Siong Group.Next up, we will set these latest numbers alongside the key narratives to see where they reinforce the consensus and where they shake things up.

Curious how numbers become stories that shape markets? Explore Community Narratives

Net Margin Slides to 9.4%

- Net profit margin fell from 10.1% last year to 9.4%, indicating some profitability pressure even though overall earnings growth remained steady.

- It is notable that as margins soften, the AI-generated narrative highlights Sheng Siong’s defensive appeal for investors. This is primarily due to its essential grocery segment and stable sales, which can help cushion margin dips in challenging market conditions.

- Consistent demand for basic goods helps offset some of the impact from lower margins, supporting resilience compared to non-essential retailers.

- While the margin decline may affect short-term sentiment, market observers continue to emphasize the group’s dependable cash generation and relative stability.

P/E Ratio Sits Below Peers, Above Industry

- The stock’s Price-to-Earnings ratio is 24.1 times, well below the peer average of 54 times, but notably higher than the Asian Consumer Retailing industry average of 16.3 times. This creates a nuanced valuation picture for investors.

- AI analysis notes this mid-range multiple positions Sheng Siong as a possible value opportunity for those seeking steady, quality earnings. It also points out that growth potential may already be partly reflected compared to the lower industry benchmark.

- Trading below peer multiples could attract long-term buyers looking for a discount relative to immediate competitors.

- The industry premium may deter deep value investors who expect further improvements in fundamentals or margin expansion.

Share Price Lags DCF Fair Value

- With shares at SGD2.32 and a DCF fair value estimate of SGD3.56, Sheng Siong is trading at a substantial discount, which suggests the market is cautious despite continued revenue growth and strong profitability metrics.

- The AI-generated perspective notes that this price gap may reflect concerns about margin pressure or dividend sustainability. It also indicates that patient investors could benefit if operational execution stays on track as projected.

- This price-to-fair value gap is uncommon among stable, cash-generative businesses. A market re-rating could follow if margin pressures stabilize.

- Dividend sustainability is identified as the only minor risk, so significant downside surprises appear limited given the group’s current financial position.

See how community views and fresh financials intersect by diving deeper into the full narrative review. See what the community is saying about Sheng Siong Group

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Sheng Siong Group's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Sheng Siong’s margin compression and only modest earnings growth highlight concerns about long-term dividend sustainability and resilience if profitability drops further.

Seeking more reliable income streams? Discover these 2000 dividend stocks with yields > 3% to find companies with solid yields and financial strength built to withstand changing market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:OV8

Sheng Siong Group

An investment holding company, operates a chain of supermarket retail stores in Singapore.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives