- Singapore

- /

- Capital Markets

- /

- SGX:U10

SGX Dividend Stocks BRC Asia And 2 More Top Picks

Reviewed by Simply Wall St

The Singapore market has shown resilience amidst global economic uncertainties, with key indices reflecting steady performance. In this environment, dividend stocks like BRC Asia and others stand out as attractive options for investors seeking stable income and potential growth.

Top 10 Dividend Stocks In Singapore

| Name | Dividend Yield | Dividend Rating |

| BRC Asia (SGX:BEC) | 7.51% | ★★★★★☆ |

| UOB-Kay Hian Holdings (SGX:U10) | 6.92% | ★★★★★☆ |

| China Sunsine Chemical Holdings (SGX:QES) | 6.73% | ★★★★★☆ |

| Multi-Chem (SGX:AWZ) | 8.93% | ★★★★★☆ |

| UOL Group (SGX:U14) | 3.81% | ★★★★★☆ |

| Bumitama Agri (SGX:P8Z) | 6.76% | ★★★★★☆ |

| Singapore Exchange (SGX:S68) | 3.47% | ★★★★★☆ |

| Civmec (SGX:P9D) | 5.33% | ★★★★★☆ |

| Singapore Airlines (SGX:C6L) | 8.14% | ★★★★★☆ |

| YHI International (SGX:BPF) | 6.56% | ★★★★★☆ |

Click here to see the full list of 20 stocks from our Top SGX Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

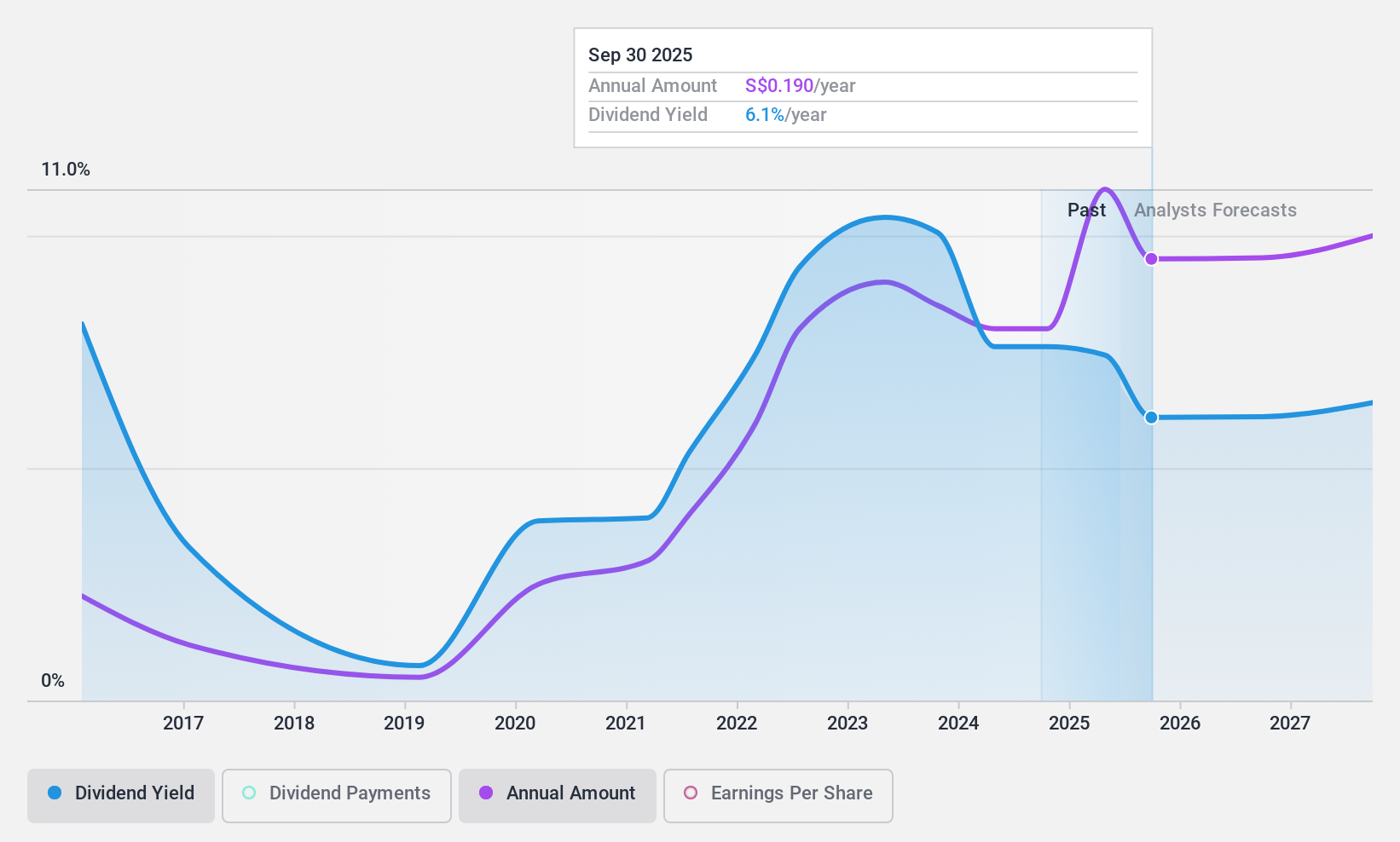

BRC Asia (SGX:BEC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: BRC Asia Limited, with a market cap of SGD584.37 million, specializes in the prefabrication of steel reinforcement for concrete across several countries including Singapore, Australia, and others.

Operations: BRC Asia Limited generates revenue primarily from two segments: Trading (SGD319.71 million) and Fabrication and Manufacturing (SGD1.35 billion).

Dividend Yield: 7.5%

BRC Asia's dividend payments are well-covered by both earnings and cash flows, with a payout ratio of 35.9% and a cash payout ratio of 85.3%. Despite an unstable dividend track record over the past decade, recent increases suggest improvement. Earnings grew by 14.9% last year, with sales reaching S$758.29 million for the half-year ending March 2024, up from S$717.06 million the previous year. The interim dividend is set at S$0.06 per share, payable on November 15, 2024.

- Take a closer look at BRC Asia's potential here in our dividend report.

- The analysis detailed in our BRC Asia valuation report hints at an deflated share price compared to its estimated value.

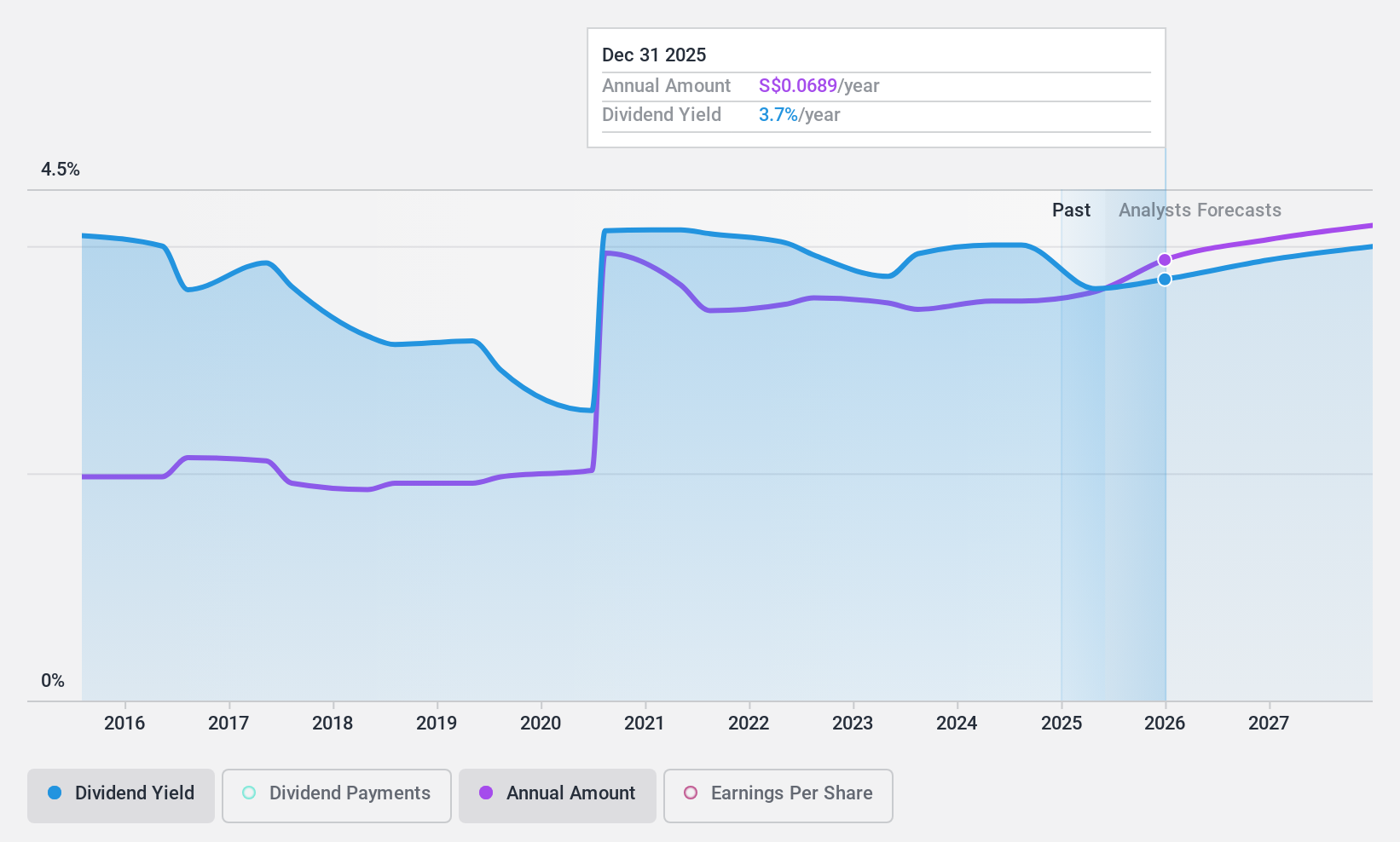

Sheng Siong Group (SGX:OV8)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sheng Siong Group Ltd, an investment holding company with a market cap of SGD2.29 billion, operates a chain of supermarket retail stores in Singapore.

Operations: Sheng Siong Group Ltd generates SGD1.39 billion in revenue from its supermarket operations selling consumer goods.

Dividend Yield: 4.1%

Sheng Siong Group's recent earnings report shows sales of S$714.2 million and net income of S$69.91 million for the half-year ending June 30, 2024, up from last year. The company has a reasonable payout ratio of 69.6%, indicating dividends are well-covered by earnings and cash flows (cash payout ratio: 51.8%). However, its dividend track record has been unstable with volatility over the past decade, and its current yield is lower than top-tier dividend payers in Singapore.

- Click here to discover the nuances of Sheng Siong Group with our detailed analytical dividend report.

- According our valuation report, there's an indication that Sheng Siong Group's share price might be on the cheaper side.

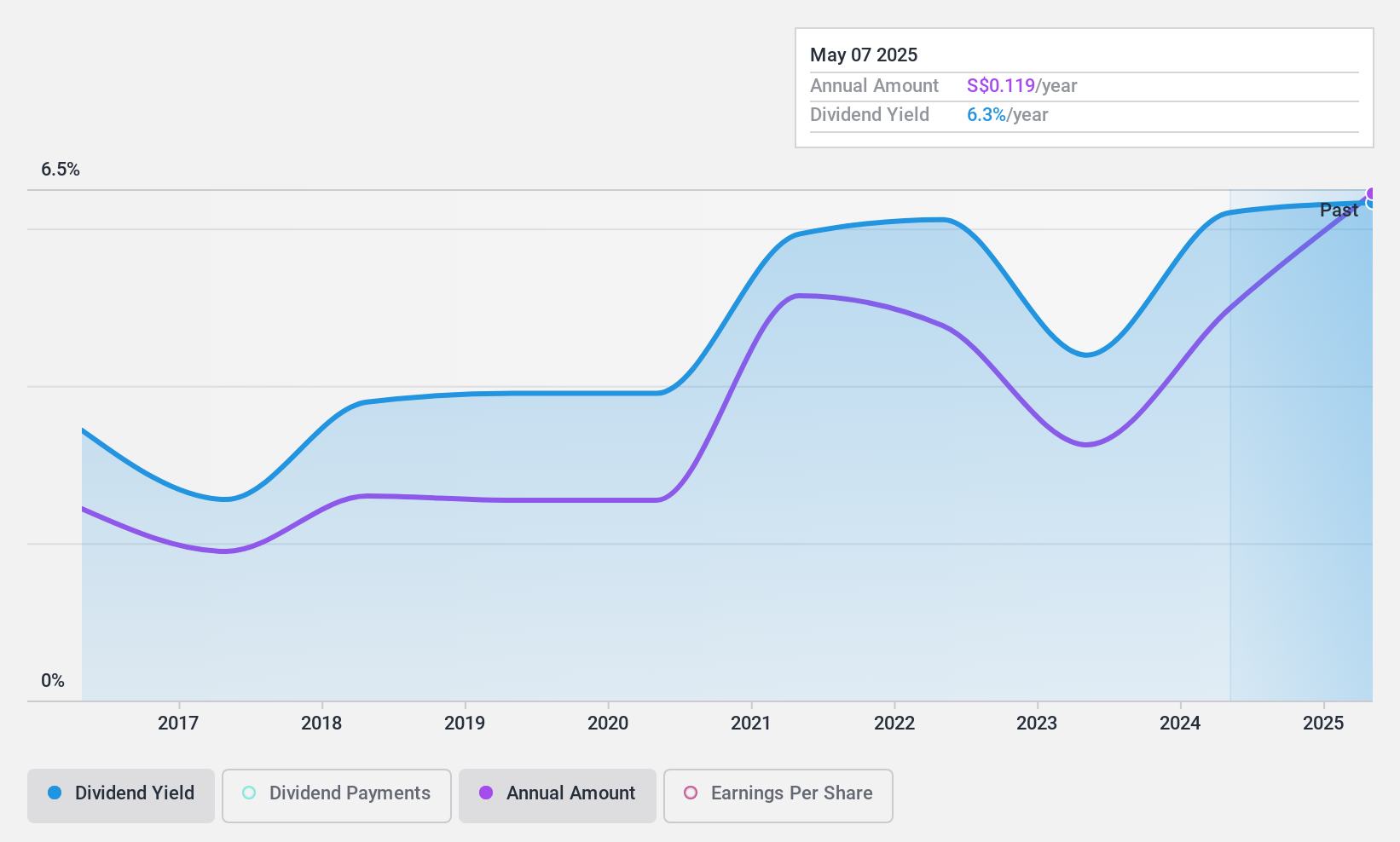

UOB-Kay Hian Holdings (SGX:U10)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: UOB-Kay Hian Holdings Limited is an investment holding company offering stockbroking, futures broking, structured lending, investment trading, margin financing, and nominee and research services across Singapore, Hong Kong, Thailand, Malaysia, and internationally with a market cap of SGD1.24 billion.

Operations: UOB-Kay Hian Holdings Limited generates revenue of SGD539.01 million from its Securities and Futures Broking and other related services.

Dividend Yield: 6.9%

UOB-Kay Hian Holdings' dividend yield is among the top 25% in Singapore, supported by a low payout ratio of 48.2% and a cash payout ratio of 22.7%, indicating strong coverage by earnings and cash flows. However, the dividend track record has been volatile over the past decade, with periods of instability. Recent insider selling and shareholder dilution raise concerns about sustainability despite recent earnings growth of 67.2%.

- Delve into the full analysis dividend report here for a deeper understanding of UOB-Kay Hian Holdings.

- Our expertly prepared valuation report UOB-Kay Hian Holdings implies its share price may be lower than expected.

Key Takeaways

- Discover the full array of 20 Top SGX Dividend Stocks right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:U10

UOB-Kay Hian Holdings

An investment holding company, provides stockbroking, futures broking, structured lending, investment trading, margin financing, and nominee and research services in Singapore, Hong Kong, Thailand, Malaysia, and internationally.

Solid track record, good value and pays a dividend.