As global markets navigate a complex landscape marked by government shutdowns and fluctuating economic indicators, small-cap stocks have shown resilience, with the Russell 2000 Index outperforming broader indices. In this environment, identifying stocks with strong growth potential often involves looking at companies that can capitalize on unique market opportunities and demonstrate adaptability in uncertain times.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Korea Ratings | NA | 0.99% | 3.62% | ★★★★★★ |

| MSC | 29.29% | 6.15% | 15.10% | ★★★★★★ |

| CYMECHS | 8.28% | -3.30% | -18.05% | ★★★★★★ |

| Anapass | 9.88% | 18.10% | 57.00% | ★★★★★★ |

| Myung In Pharmaceutical | NA | 9.70% | 9.38% | ★★★★★★ |

| Oriental Precision & EngineeringLtd | 34.33% | 7.40% | 2.05% | ★★★★★☆ |

| ITCENGLOBAL | 73.61% | 17.53% | 18.23% | ★★★★★☆ |

| Chinyang Holdings | 31.14% | 7.30% | -20.39% | ★★★★★☆ |

| MNtech | 66.79% | 12.39% | -12.13% | ★★★★★☆ |

| TSTE | 38.15% | 4.63% | -6.91% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Soilbuild Construction Group (SGX:V5Q)

Simply Wall St Value Rating: ★★★★★★

Overview: Soilbuild Construction Group Ltd. is an investment holding company involved in constructing residential and business space properties across Singapore, Myanmar, Malaysia, and internationally, with a market cap of SGD587.40 million.

Operations: The company's revenue primarily comes from its construction activities in Singapore, contributing SGD410.03 million, and precast operations in Singapore and Malaysia, adding SGD116.34 million and SGD54.19 million respectively.

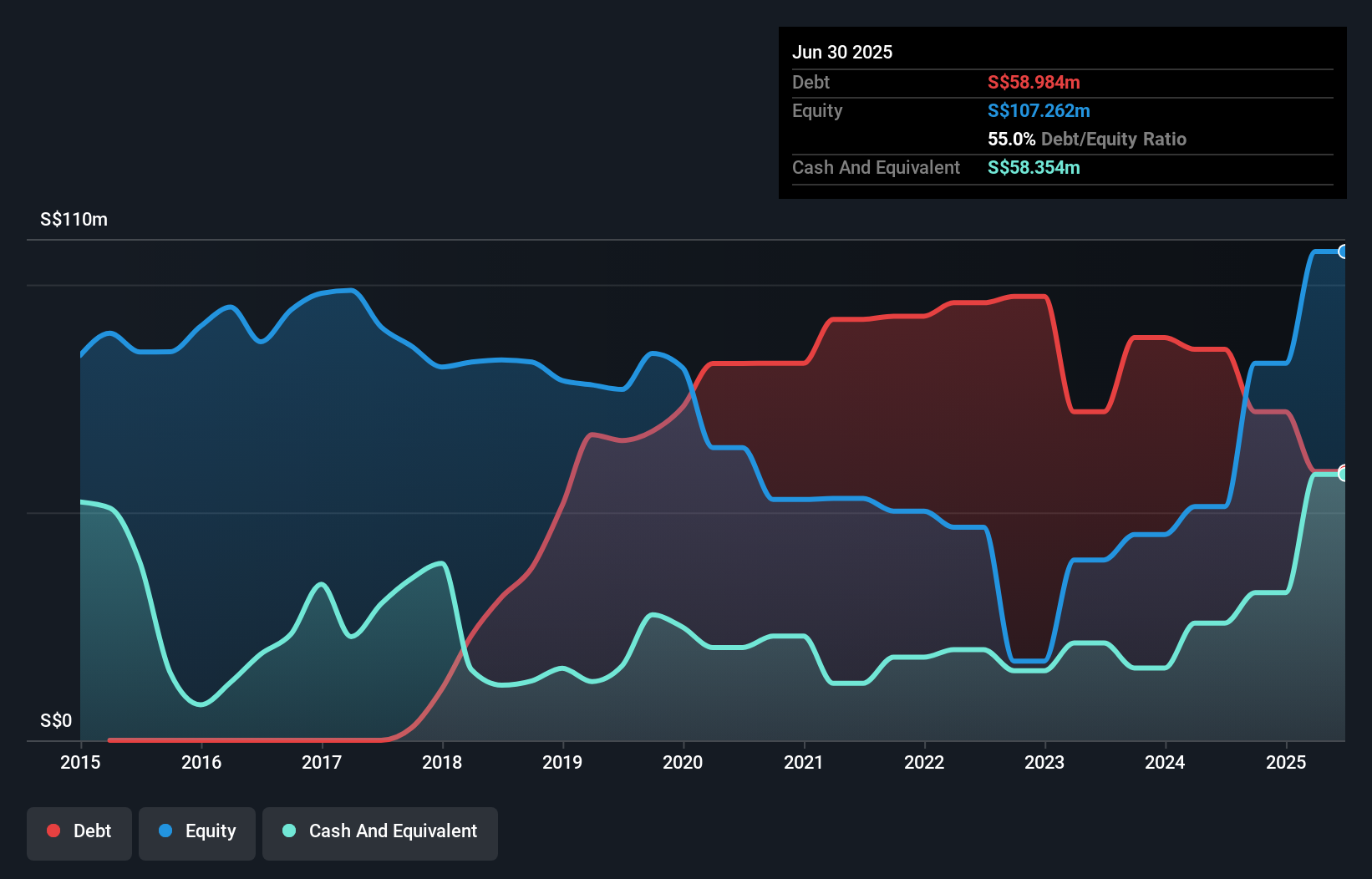

Soilbuild Construction Group, a nimble player in the construction sector, showcases impressive financial health with its net debt to equity ratio at a satisfactory 0.6%. The company reported a robust earnings growth of 255.7% over the past year, outpacing the industry average of 13.7%. Recent contract wins worth S$178.6 million bolster its order book to approximately S$1.21 billion as of May 2025, enhancing revenue visibility. Additionally, Soilbuild's interim dividend payout of SGD 0.02 per share highlights shareholder value focus while trading at an attractive valuation—71.5% below estimated fair value—suggests potential for future appreciation.

Fixstars (TSE:3687)

Simply Wall St Value Rating: ★★★★★★

Overview: Fixstars Corporation is a software company operating in Japan and internationally, with a market capitalization of ¥71.38 billion.

Operations: Fixstars generates revenue primarily through its Solution Business, which accounts for ¥8.86 billion, and its SaaS business, contributing ¥665.51 million. The company's net profit margin is a notable aspect of its financial performance, reflecting how efficiently it converts revenue into profit after expenses.

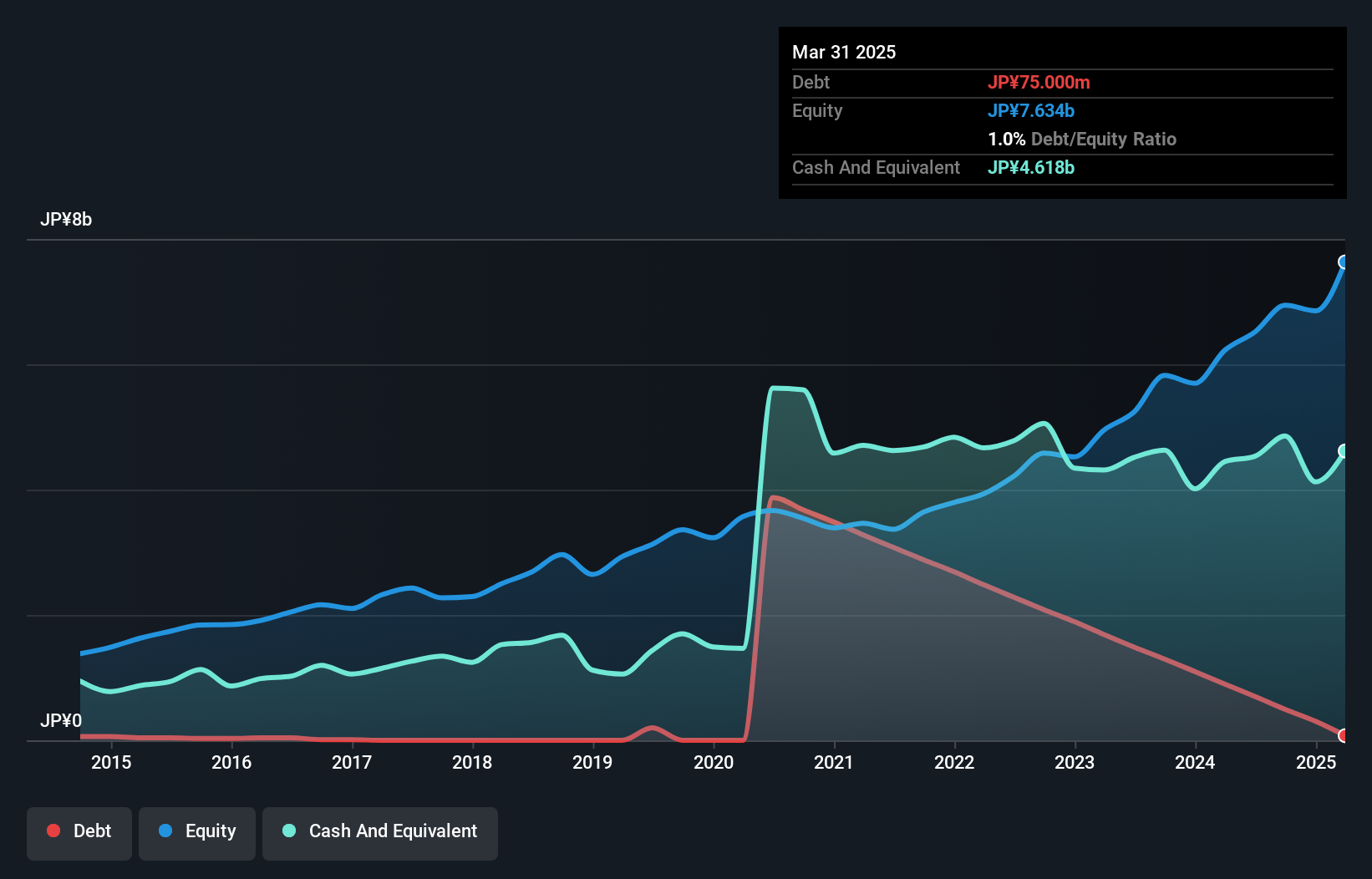

Fixstars, a nimble player in the software sector, has been making waves with its innovative AI workload optimization tool, AIBooster. The company announced this latest version in July 2025 to tackle rising GPU infrastructure costs, offering features like performance observability and enhanced GPU profiling. With no debt on its books—a significant shift from a debt to equity ratio of 105.7% five years ago—Fixstars shows financial discipline. Its earnings surged by 33% last year, outpacing industry growth of nearly 18%. Despite recent share price volatility, Fixstars' future earnings are projected to grow at an impressive rate of over 24% annually.

- Navigate through the intricacies of Fixstars with our comprehensive health report here.

Examine Fixstars' past performance report to understand how it has performed in the past.

Shiny Chemical Industrial (TWSE:1773)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shiny Chemical Industrial Co., Ltd. is involved in the manufacturing, processing, and trading of chemical solvents both in Taiwan and internationally, with a market capitalization of NT$43.05 billion.

Operations: Shiny Chemical Industrial generates revenue primarily from its Yongan Factory, contributing NT$10.54 billion, and the Zhangbin Plant, adding NT$1.72 billion. The company experiences adjustments and eliminations amounting to -NT$0.88 billion in its financial reporting.

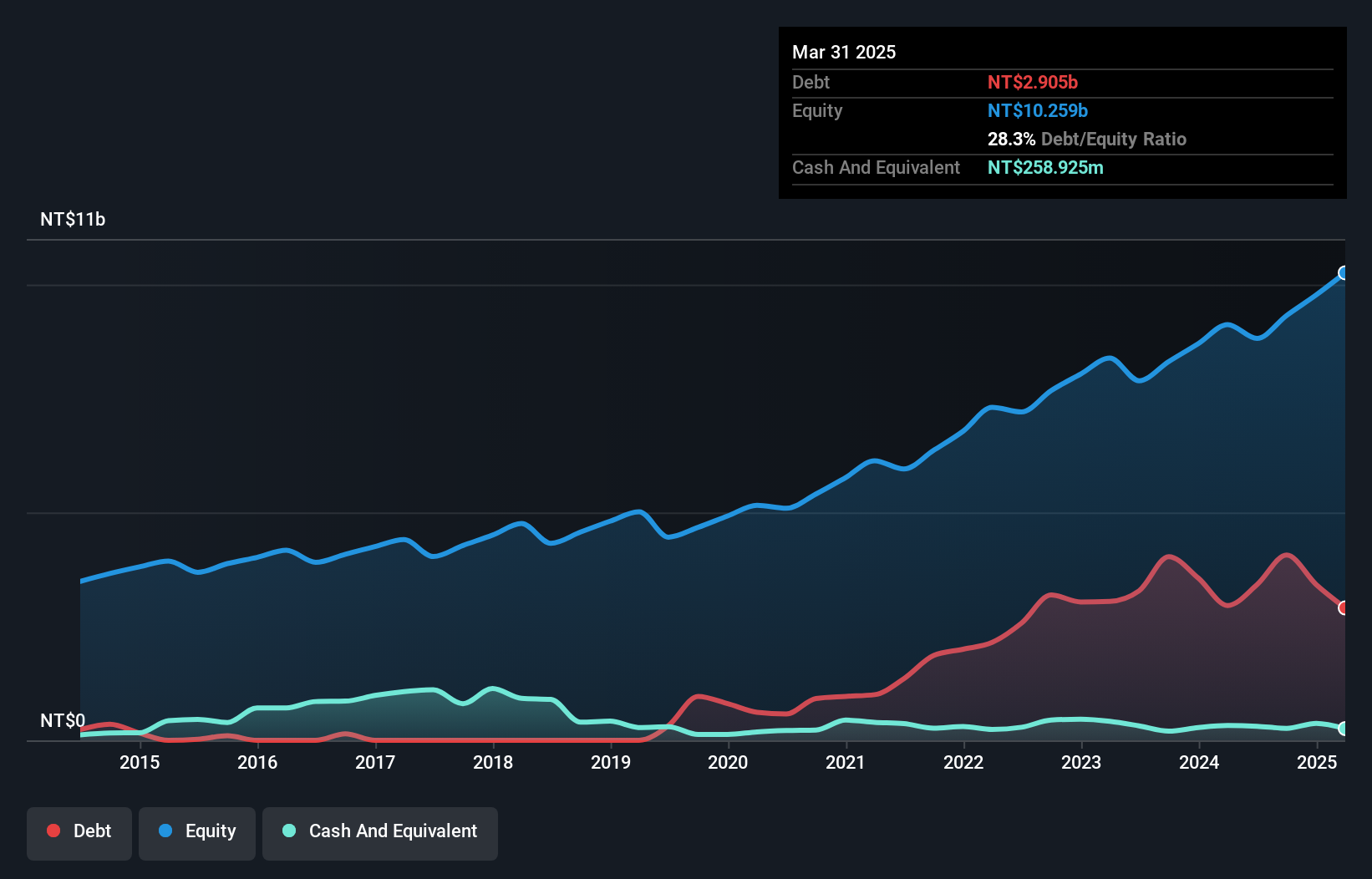

Shiny Chemical Industrial is carving a niche in the chemicals sector with notable earnings growth of 13.9% over the past year, outpacing the industry's -13.4%. Its net debt to equity ratio stands at a satisfactory 27.3%, reflecting prudent financial management, though it has risen from 11.4% five years ago to 31.4%. The company's price-to-earnings ratio of 22.7x is appealingly below the industry average of 24.7x, suggesting good value potential for investors looking for opportunities in this space. Recent reports show sales reaching TWD 2,849 million and net income at TWD 478 million for Q2, indicating steady performance amidst market challenges.

- Click here to discover the nuances of Shiny Chemical Industrial with our detailed analytical health report.

Learn about Shiny Chemical Industrial's historical performance.

Turning Ideas Into Actions

- Get an in-depth perspective on all 2374 Asian Undiscovered Gems With Strong Fundamentals by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:1773

Shiny Chemical Industrial

Engages in manufacturing, processing, and trading of chemical solvents in Taiwan and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives