- Singapore

- /

- Construction

- /

- SGX:V5Q

A Piece Of The Puzzle Missing From Soilbuild Construction Group Ltd.'s (SGX:S7P) 178% Share Price Climb

Soilbuild Construction Group Ltd. (SGX:S7P) shares have had a really impressive month, gaining 178% after a shaky period beforehand. The annual gain comes to 154% following the latest surge, making investors sit up and take notice.

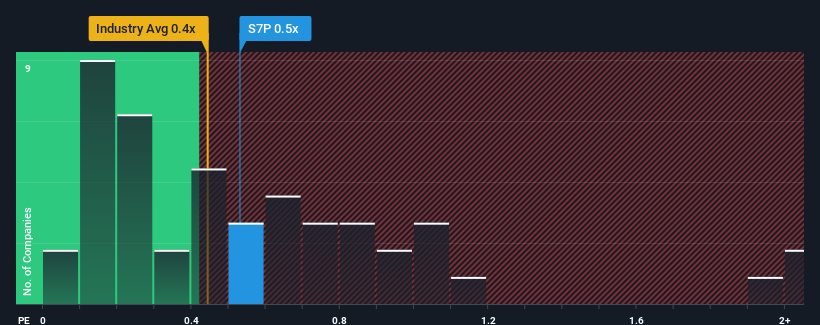

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Soilbuild Construction Group's P/S ratio of 0.5x, since the median price-to-sales (or "P/S") ratio for the Construction industry in Singapore is also close to 0.4x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Soilbuild Construction Group

How Has Soilbuild Construction Group Performed Recently?

We'd have to say that with no tangible growth over the last year, Soilbuild Construction Group's revenue has been unimpressive. It might be that many expect the uninspiring revenue performance to only match most other companies at best over the coming period, which has kept the P/S from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Soilbuild Construction Group's earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For Soilbuild Construction Group?

The only time you'd be comfortable seeing a P/S like Soilbuild Construction Group's is when the company's growth is tracking the industry closely.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. Although pleasingly revenue has lifted 66% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, shareholders will be pleased, but also have some questions to ponder about the last 12 months.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 13% shows it's noticeably more attractive.

In light of this, it's curious that Soilbuild Construction Group's P/S sits in line with the majority of other companies. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Final Word

Its shares have lifted substantially and now Soilbuild Construction Group's P/S is back within range of the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Soilbuild Construction Group currently trades on a lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see strong revenue with faster-than-industry growth, we can only assume potential risks are what might be placing pressure on the P/S ratio. At least the risk of a price drop looks to be subdued if recent medium-term revenue trends continue, but investors seem to think future revenue could see some volatility.

You should always think about risks. Case in point, we've spotted 3 warning signs for Soilbuild Construction Group you should be aware of, and 2 of them make us uncomfortable.

If these risks are making you reconsider your opinion on Soilbuild Construction Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:V5Q

Soilbuild Construction Group

An investment holding company, engages in the residential and business space properties construction in Singapore, Myanmar, Malaysia, and internationally.

Very undervalued with outstanding track record.

Market Insights

Community Narratives