- Singapore

- /

- Industrials

- /

- SGX:J36

Jardine Matheson (SGX:J36) Share Buyback Sparks Fresh Look at Company Valuation

Reviewed by Simply Wall St

Jardine Matheson Holdings (SGX:J36) just repurchased and cancelled 194,000 of its ordinary shares. This move typically points to active capital management and may hint at the company’s confidence in its future prospects.

See our latest analysis for Jardine Matheson Holdings.

That buyback comes on the heels of a remarkable run for Jardine Matheson’s investors, with the share price climbing 50.95% year-to-date and the 1-year total shareholder return sitting at an impressive 59.83%. Momentum has clearly been building, reflecting both renewed confidence and improving fundamentals. The company is showing strength over the short and long term.

If you’re interested in what other companies are showing signs of accelerating growth and insider conviction, now is a perfect moment to broaden your perspective and discover fast growing stocks with high insider ownership

With such a strong rally behind it, the big question now is whether Jardine Matheson shares still represent good value or if all the optimism and future growth has already been priced in by the market.

Most Popular Narrative: 10% Undervalued

The leading narrative currently suggests Jardine Matheson’s fair value estimate is $70.00, which stands above its last closing price of $62.96. This sets the scene for a valuation case built on ambitious turnaround plans and bold capital deployment.

Ongoing portfolio simplification and capital recycling initiatives, exemplified by divestitures at DFI Retail and Hongkong Land, are redirecting resources into higher-margin, faster-growing business areas. This is likely to drive improved group net margins and return on equity over the medium term.

Want the real story behind this verdict? The narrative is tied to aggressive profit margin expansion and major shifts in group strategy. Curious which growth levers and financial assumptions could underpin that premium fair value? Find out what the narrative projects next.

Result: Fair Value of $70.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in Greater China’s property market or continued headwinds in Astra’s automotive segment could present challenges to Jardine Matheson’s growth narrative.

Find out about the key risks to this Jardine Matheson Holdings narrative.

Another View: A Contrasting Take on Fair Value

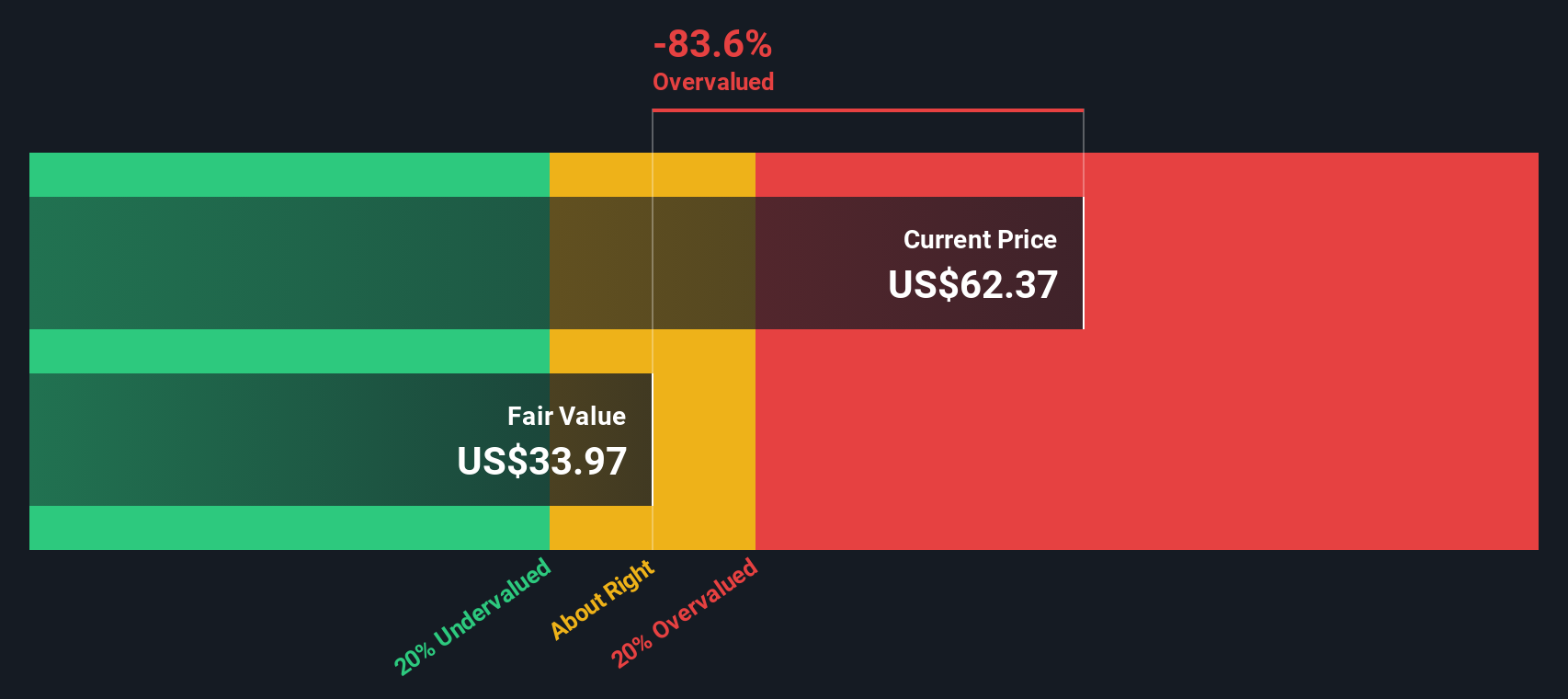

Not all valuation models agree. Our DCF model, which focuses on future cash flow potential, actually suggests Jardine Matheson may be overvalued at its current share price. This calls some of the optimism around the projected fair value into question. Can cash flow realities keep pace with market expectations?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Jardine Matheson Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 841 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Jardine Matheson Holdings Narrative

If you have a different perspective or want to dig into the numbers yourself, it's quick and easy to build your own view of Jardine Matheson’s story. Do it your way

A great starting point for your Jardine Matheson Holdings research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

The smartest investors are always one step ahead. Don’t limit yourself; there are standout opportunities waiting, tailored to your interests and strategy, right now on Simply Wall Street.

- Capture impressive yields and steady financial growth by targeting these 19 dividend stocks with yields > 3%, supported by robust balance sheets and reliable payouts.

- Ride the next wave of technological transformation as you tap into the explosive momentum of these 25 AI penny stocks, shaping tomorrow’s industries today.

- Future-proof your portfolio by tracking the breakthroughs fueled by these 27 quantum computing stocks, at the forefront of advanced computing and innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:J36

Jardine Matheson Holdings

Operates in motor vehicles and related operations, property investment and development, food retailing, health and beauty, home furnishings, engineering and construction, and transport businesses in China, Southeast Asia, and internationally.

Excellent balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives