Hoe Leong Corporation Ltd.'s (SGX:H20) 50% Dip Still Leaving Some Shareholders Feeling Restless Over Its P/SRatio

Hoe Leong Corporation Ltd. (SGX:H20) shares have had a horrible month, losing 50% after a relatively good period beforehand. Longer-term shareholders will rue the drop in the share price, since it's now virtually flat for the year after a promising few quarters.

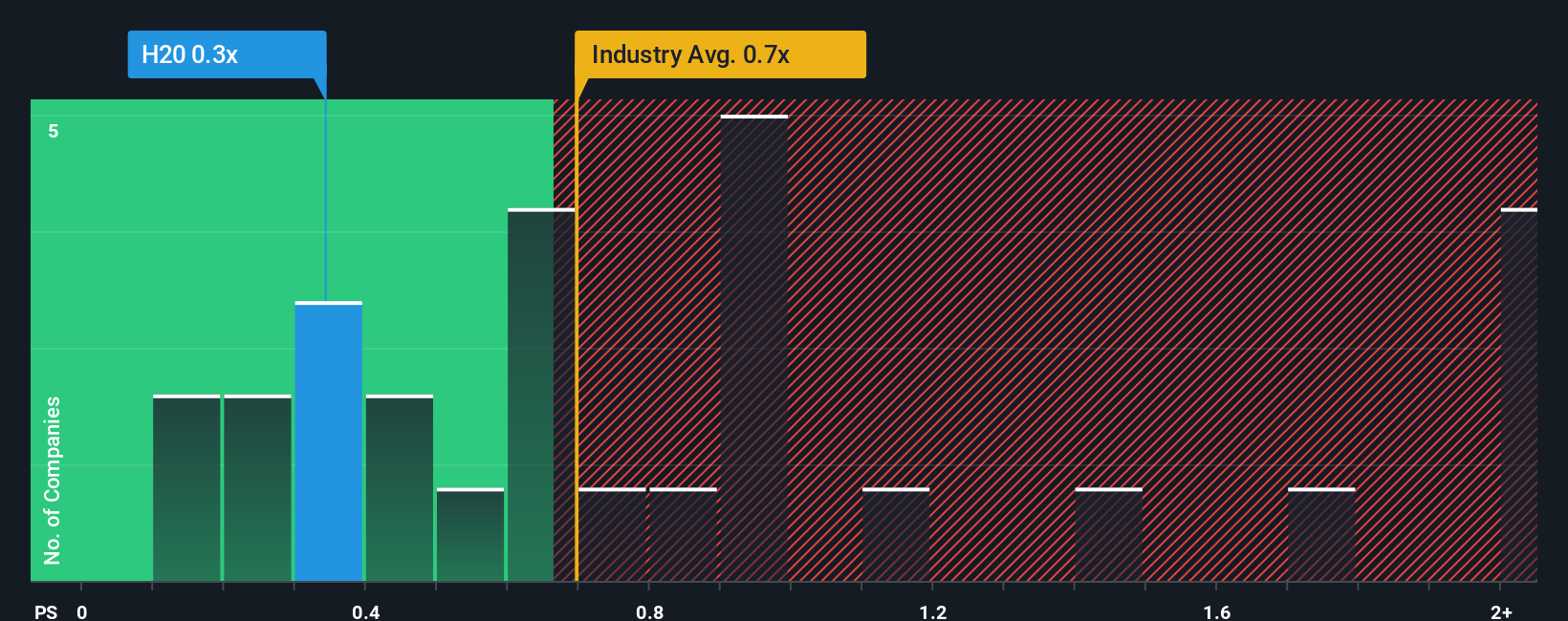

In spite of the heavy fall in price, there still wouldn't be many who think Hoe Leong's price-to-sales (or "P/S") ratio of 0.3x is worth a mention when the median P/S in Singapore's Machinery industry is similar at about 0.7x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Hoe Leong

What Does Hoe Leong's P/S Mean For Shareholders?

The recent revenue growth at Hoe Leong would have to be considered satisfactory if not spectacular. One possibility is that the P/S is moderate because investors think this good revenue growth might only be parallel to the broader industry in the near future. Those who are bullish on Hoe Leong will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Hoe Leong will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Hoe Leong's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 5.6%. However, this wasn't enough as the latest three year period has seen an unpleasant 1.4% overall drop in revenue. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

In contrast to the company, the rest of the industry is expected to grow by 17% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this information, we find it concerning that Hoe Leong is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh on the share price eventually.

The Key Takeaway

Hoe Leong's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We find it unexpected that Hoe Leong trades at a P/S ratio that is comparable to the rest of the industry, despite experiencing declining revenues during the medium-term, while the industry as a whole is expected to grow. Even though it matches the industry, we're uncomfortable with the current P/S ratio, as this dismal revenue performance is unlikely to support a more positive sentiment for long. If recent medium-term revenue trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Having said that, be aware Hoe Leong is showing 3 warning signs in our investment analysis, and 2 of those shouldn't be ignored.

If you're unsure about the strength of Hoe Leong's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Hoe Leong might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:H20

Hoe Leong

An investment holding company, designs, manufactures, and distributes heavy equipment parts in Australia, North America, Asia, Europe, the Middle East, and internationally.

Flawless balance sheet and good value.

Market Insights

Community Narratives