- Singapore

- /

- Construction

- /

- SGX:E3B

Wee Hur Holdings Ltd. (SGX:E3B) Stock Rockets 26% But Many Are Still Ignoring The Company

Wee Hur Holdings Ltd. (SGX:E3B) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. The last month tops off a massive increase of 146% in the last year.

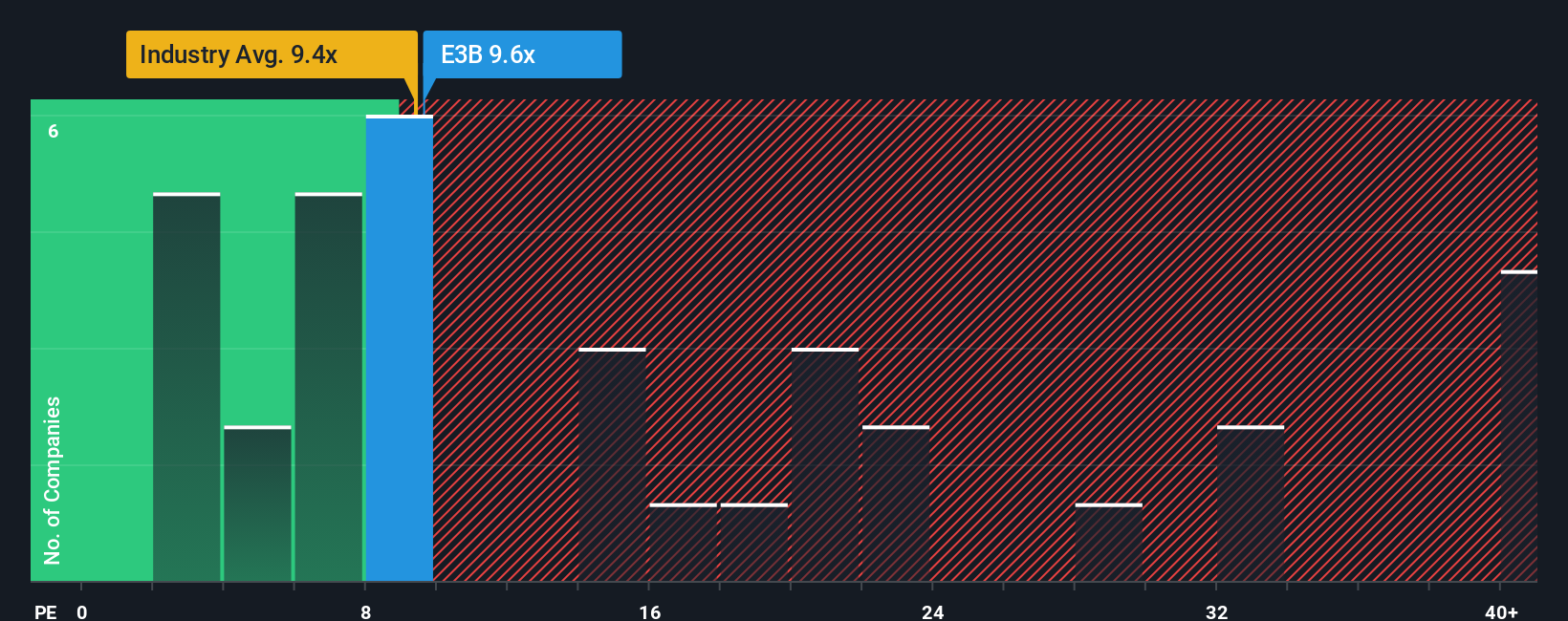

In spite of the firm bounce in price, Wee Hur Holdings may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 9.6x, since almost half of all companies in Singapore have P/E ratios greater than 13x and even P/E's higher than 24x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

While the market has experienced earnings growth lately, Wee Hur Holdings' earnings have gone into reverse gear, which is not great. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Check out our latest analysis for Wee Hur Holdings

Does Growth Match The Low P/E?

Wee Hur Holdings' P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 60%. Unfortunately, that's brought it right back to where it started three years ago with EPS growth being virtually non-existent overall during that time. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Turning to the outlook, the next year should generate growth of 58% as estimated by the one analyst watching the company. Meanwhile, the rest of the market is forecast to only expand by 13%, which is noticeably less attractive.

With this information, we find it odd that Wee Hur Holdings is trading at a P/E lower than the market. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Final Word

Despite Wee Hur Holdings' shares building up a head of steam, its P/E still lags most other companies. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Wee Hur Holdings currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Before you settle on your opinion, we've discovered 3 warning signs for Wee Hur Holdings that you should be aware of.

If you're unsure about the strength of Wee Hur Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Wee Hur Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:E3B

Wee Hur Holdings

An investment holding company, engages in general building and civil engineering construction business in Singapore and Australia.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives