Stock Analysis

Yangzijiang Shipbuilding Holdings Leads Three SGX Dividend Stocks To Consider

Reviewed by Simply Wall St

As the Singapore market continues to navigate through evolving global economic conditions, investors are keenly observing how local companies adapt and thrive. Amidst these dynamics, dividend stocks remain a focal point for those seeking potential stability and consistent returns. In this context, understanding the fundamental qualities that contribute to a strong dividend stock is crucial, especially in an environment where efficiency and innovation are increasingly valued.

Top 10 Dividend Stocks In Singapore

| Name | Dividend Yield | Dividend Rating |

| Civmec (SGX:P9D) | 6.20% | ★★★★★★ |

| Singapore Exchange (SGX:S68) | 3.59% | ★★★★★☆ |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | 3.47% | ★★★★★☆ |

| BRC Asia (SGX:BEC) | 7.66% | ★★★★★☆ |

| UOB-Kay Hian Holdings (SGX:U10) | 6.92% | ★★★★★☆ |

| UOL Group (SGX:U14) | 3.62% | ★★★★★☆ |

| Bumitama Agri (SGX:P8Z) | 6.88% | ★★★★★☆ |

| Singapore Airlines (SGX:C6L) | 7.15% | ★★★★★☆ |

| YHI International (SGX:BPF) | 6.63% | ★★★★★☆ |

| Sing Investments & Finance (SGX:S35) | 6.09% | ★★★★☆☆ |

Click here to see the full list of 20 stocks from our Top SGX Dividend Stocks screener.

Let's dive into some prime choices out of from the screener.

Yangzijiang Shipbuilding (Holdings) (SGX:BS6)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Yangzijiang Shipbuilding (Holdings) Ltd. is an investment holding company that specializes in shipbuilding, operating across Greater China, Canada, Japan, Italy, Greece, other European countries and internationally, with a market capitalization of SGD 7.31 billion.

Operations: Yangzijiang Shipbuilding (Holdings) Ltd. generates revenue primarily through its shipbuilding segment, which contributed CN¥22.79 billion, and its shipping operations, which added CN¥1.02 billion.

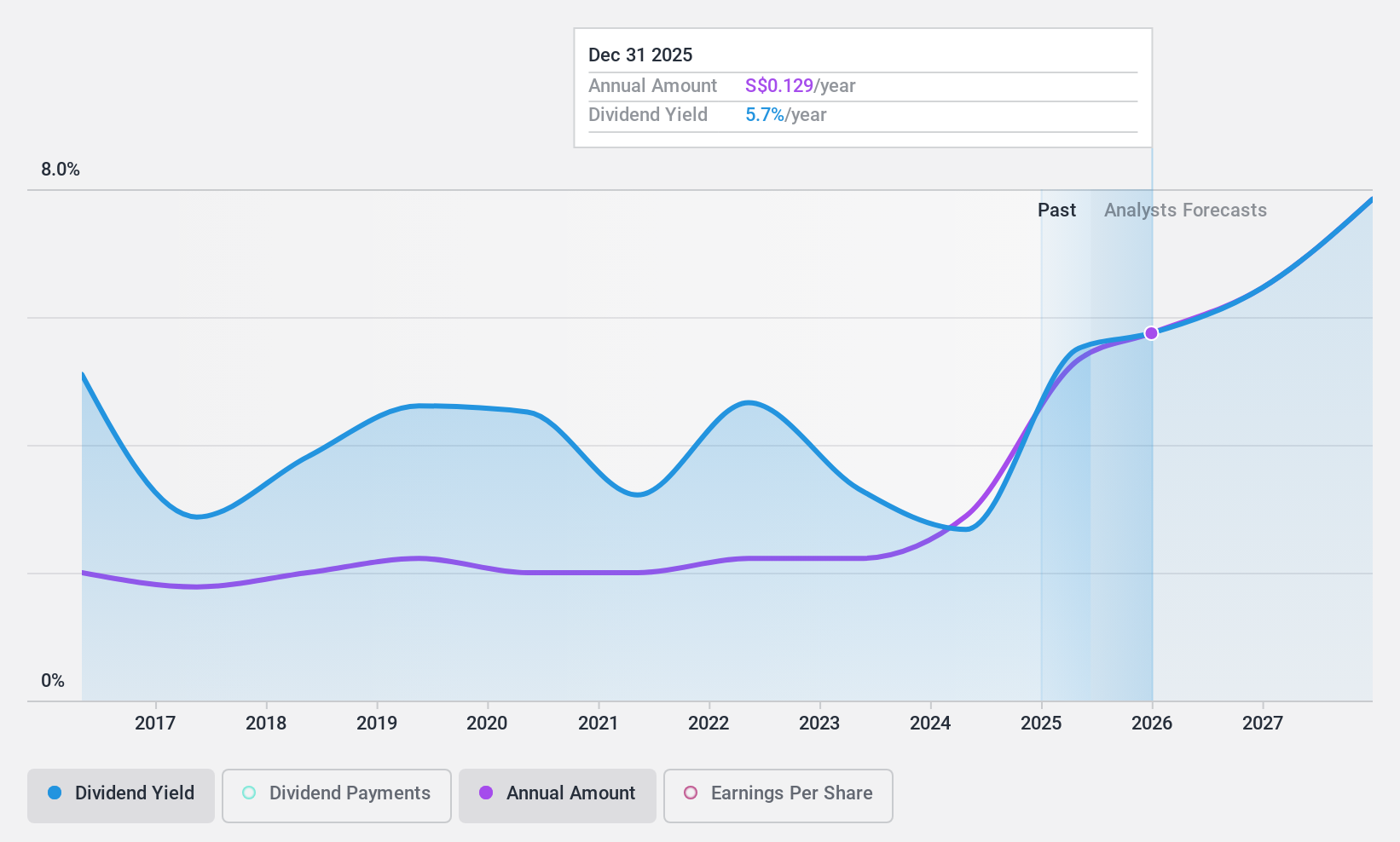

Dividend Yield: 3.5%

Yangzijiang Shipbuilding (Holdings) Ltd. recently declared a tax-exempt final dividend of SGD 0.065 per share for FY 2023, reflecting its commitment to returning value to shareholders. Financially, the company reported a significant increase in net income to CNY 4.1 billion from CNY 2.81 billion the previous year, with earnings per share also rising sharply. The dividends are well-supported by both earnings and cash flows, with payout ratios of 33.6% and cash payout ratio at 19.1%, indicating sustainability in its dividend payments amidst financial growth.

- Click here to discover the nuances of Yangzijiang Shipbuilding (Holdings) with our detailed analytical dividend report.

- Our expertly prepared valuation report Yangzijiang Shipbuilding (Holdings) implies its share price may be too high.

Bumitama Agri (SGX:P8Z)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bumitama Agri Ltd. is an investment holding company focused on the production and trade of crude palm oil and palm kernel in Indonesia, with a market capitalization of approximately SGD 1.21 billion.

Operations: Bumitama Agri Ltd. generates revenue primarily from its plantations and palm oil mills, totaling IDR 15.44 billion.

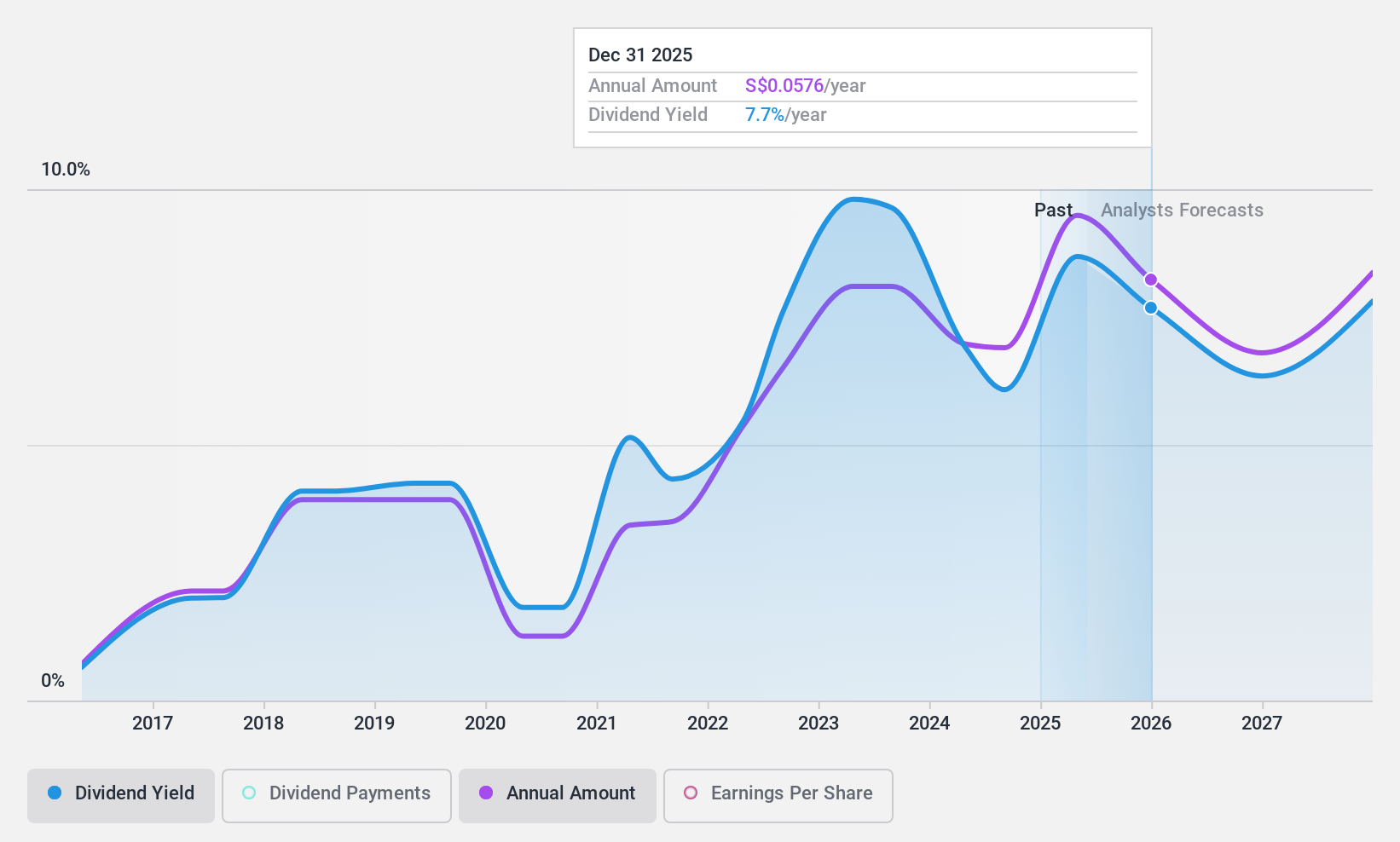

Dividend Yield: 6.9%

Bumitama Agri Ltd. has recently enhanced its board with the appointment of Ms Ng Yi Wayn, aiming to strengthen governance and risk management. The company declared a final dividend of 3.63 SGD cents and a special dividend of 1.92 SGD cents for FY 2023, payable in May 2024, showcasing a commitment to shareholder returns despite an unstable dividend history over the past decade. Financially, dividends are supported by a low payout ratio of 40.4% and cash flows with a cash payout ratio of 60.8%, although earnings are expected to decline annually by 5.5% over the next three years.

- Click to explore a detailed breakdown of our findings in Bumitama Agri's dividend report.

- Our expertly prepared valuation report Bumitama Agri implies its share price may be lower than expected.

Singapore Exchange (SGX:S68)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Singapore Exchange Limited operates as an integrated securities and derivatives exchange with related clearing houses in Singapore, boasting a market capitalization of approximately SGD 10.13 billion.

Operations: Singapore Exchange Limited generates revenue primarily from two segments: Segment Adjustment (SGD 0.84 billion) and Fixed Income, Currencies, and Commodities (SGD 0.37 billion).

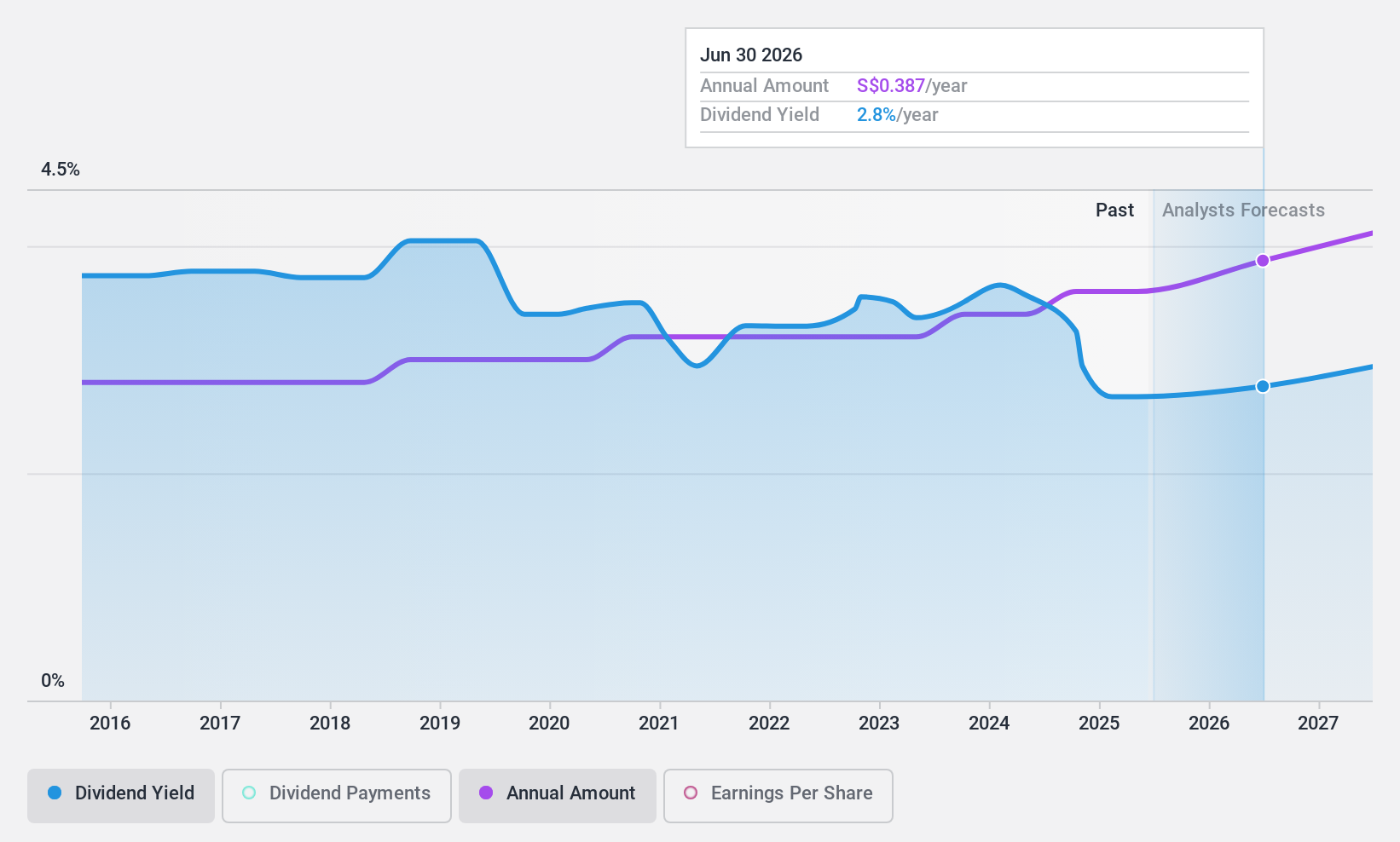

Dividend Yield: 3.6%

Singapore Exchange offers a 3.59% dividend yield, which is modest compared to the top quartile of Singapore's dividend stocks at 6.19%. Over the past decade, its dividends have shown stability and growth, supported by earnings with a payout ratio of 63% and cash flows with a cash payout ratio of 79.1%. Despite trading below estimated fair value by 7.5%, prospective earnings growth stands at a mild 3.13% per year, suggesting cautious optimism for sustained dividend performance amidst stable financial backing.

- Delve into the full analysis dividend report here for a deeper understanding of Singapore Exchange.

- The analysis detailed in our Singapore Exchange valuation report hints at an inflated share price compared to its estimated value.

Next Steps

- Delve into our full catalog of 20 Top SGX Dividend Stocks here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Bumitama Agri is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:P8Z

Bumitama Agri

An investment holding company, engages in the production and trade of crude palm oil (CPO), palm kernel (PK), and related products for refineries in Indonesia.

Flawless balance sheet, undervalued and pays a dividend.