- Singapore

- /

- Industrials

- /

- SGX:BN4

These 4 Measures Indicate That Keppel (SGX:BN4) Is Using Debt Extensively

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Keppel Corporation Limited (SGX:BN4) makes use of debt. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Keppel

How Much Debt Does Keppel Carry?

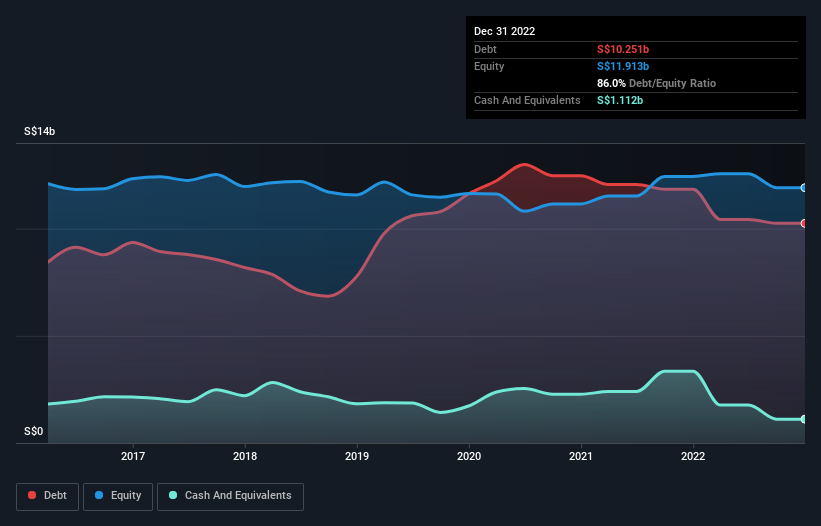

The image below, which you can click on for greater detail, shows that Keppel had debt of S$10.3b at the end of December 2022, a reduction from S$11.8b over a year. However, it also had S$1.11b in cash, and so its net debt is S$9.14b.

How Strong Is Keppel's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Keppel had liabilities of S$11.4b due within 12 months and liabilities of S$7.66b due beyond that. Offsetting this, it had S$1.11b in cash and S$1.76b in receivables that were due within 12 months. So its liabilities total S$16.2b more than the combination of its cash and short-term receivables.

Given this deficit is actually higher than the company's market capitalization of S$12.4b, we think shareholders really should watch Keppel's debt levels, like a parent watching their child ride a bike for the first time. Hypothetically, extremely heavy dilution would be required if the company were forced to pay down its liabilities by raising capital at the current share price.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Strangely Keppel has a sky high EBITDA ratio of 14.8, implying high debt, but a strong interest coverage of 59.9. So either it has access to very cheap long term debt or that interest expense is going to grow! Notably, Keppel made a loss at the EBIT level, last year, but improved that to positive EBIT of S$377m in the last twelve months. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Keppel can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of the earnings before interest and tax (EBIT) is backed by free cash flow. Over the last year, Keppel saw substantial negative free cash flow, in total. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

To be frank both Keppel's net debt to EBITDA and its track record of converting EBIT to free cash flow make us rather uncomfortable with its debt levels. But at least it's pretty decent at covering its interest expense with its EBIT; that's encouraging. Overall, it seems to us that Keppel's balance sheet is really quite a risk to the business. For this reason we're pretty cautious about the stock, and we think shareholders should keep a close eye on its liquidity. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. To that end, you should learn about the 3 warning signs we've spotted with Keppel (including 1 which can't be ignored) .

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Valuation is complex, but we're here to simplify it.

Discover if Keppel might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:BN4

Keppel

An investment holding company, engages in the infrastructure, real estate, and connectivity business in Singapore, China, Hong Kong, other far East and ASEAN countries, and internationally.

Slight with moderate growth potential.