What underlying fundamental trends can indicate that a company might be in decline? When we see a declining return on capital employed (ROCE) in conjunction with a declining base of capital employed, that's often how a mature business shows signs of aging. This indicates the company is producing less profit from its investments and its total assets are decreasing. In light of that, from a first glance at Keppel (SGX:BN4), we've spotted some signs that it could be struggling, so let's investigate.

Return On Capital Employed (ROCE): What Is It?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. Analysts use this formula to calculate it for Keppel:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

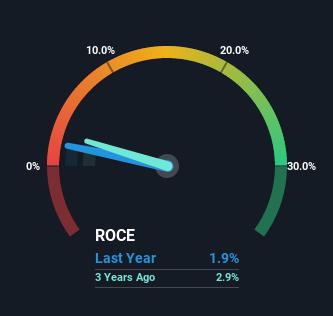

0.019 = S$377m ÷ (S$31b - S$11b) (Based on the trailing twelve months to December 2022).

Therefore, Keppel has an ROCE of 1.9%. In absolute terms, that's a low return and it also under-performs the Industrials industry average of 7.0%.

View our latest analysis for Keppel

In the above chart we have measured Keppel's prior ROCE against its prior performance, but the future is arguably more important. If you'd like to see what analysts are forecasting going forward, you should check out our free report for Keppel.

SWOT Analysis for Keppel

- Debt is well covered by earnings.

- Earnings declined over the past year.

- Dividend is low compared to the top 25% of dividend payers in the Industrials market.

- Annual earnings are forecast to grow for the next 3 years.

- Good value based on P/E ratio and estimated fair value.

- Significant insider buying over the past 3 months.

- Debt is not well covered by operating cash flow.

- Paying a dividend but company has no free cash flows.

- Annual earnings are forecast to grow slower than the Singaporean market.

What Can We Tell From Keppel's ROCE Trend?

In terms of Keppel's historical ROCE movements, the trend doesn't inspire confidence. To be more specific, the ROCE was 2.8% five years ago, but since then it has dropped noticeably. Meanwhile, capital employed in the business has stayed roughly the flat over the period. Since returns are falling and the business has the same amount of assets employed, this can suggest it's a mature business that hasn't had much growth in the last five years. So because these trends aren't typically conducive to creating a multi-bagger, we wouldn't hold our breath on Keppel becoming one if things continue as they have.

The Bottom Line

In summary, it's unfortunate that Keppel is generating lower returns from the same amount of capital. However the stock has delivered a 53% return to shareholders over the last five years, so investors might be expecting the trends to turn around. Regardless, we don't feel too comfortable with the fundamentals so we'd be steering clear of this stock for now.

Since virtually every company faces some risks, it's worth knowing what they are, and we've spotted 5 warning signs for Keppel (of which 1 is a bit concerning!) that you should know about.

While Keppel isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

Valuation is complex, but we're here to simplify it.

Discover if Keppel might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:BN4

Keppel

An investment holding company, engages in the infrastructure, real estate, and connectivity business in Singapore, China, Hong Kong, other far East and ASEAN countries, and internationally.

Slight with moderate growth potential.