Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Sunningdale Tech Ltd (SGX:BHQ) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Sunningdale Tech

What Is Sunningdale Tech's Debt?

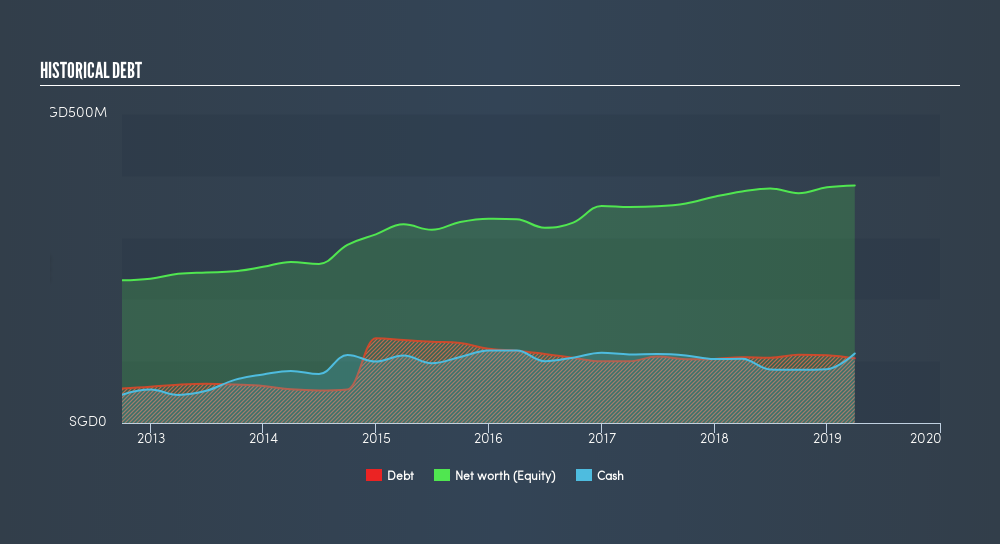

As you can see below, Sunningdale Tech had S$104.7m of debt, at March 2019, which is about the same the year before. You can click the chart for greater detail. However, it does have S$112.5m in cash offsetting this, leading to net cash of S$7.85m.

How Strong Is Sunningdale Tech's Balance Sheet?

The latest balance sheet data shows that Sunningdale Tech had liabilities of S$288.5m due within a year, and liabilities of S$48.4m falling due after that. Offsetting these obligations, it had cash of S$112.5m as well as receivables valued at S$249.1m due within 12 months. So it can boast S$24.7m more liquid assets than total liabilities.

This short term liquidity is a sign that Sunningdale Tech could probably pay off its debt with ease, as its balance sheet is far from stretched. Sunningdale Tech boasts net cash, so it's fair to say it does not have a heavy debt load!

Shareholders should be aware that Sunningdale Tech's EBIT was down 52% last year. If that earnings trend continues then paying off its debt will be about as easy as herding cats on to a roller coaster. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Sunningdale Tech can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. While Sunningdale Tech has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the last three years, Sunningdale Tech reported free cash flow worth 16% of its EBIT, which is really quite low. That limp level of cash conversion undermines its ability to manage and pay down debt.

Summing up

While we empathize with investors who find debt concerning, you should keep in mind that Sunningdale Tech has net cash of S$7.9m, as well as more liquid assets than liabilities. So while Sunningdale Tech does not have a great balance sheet, it's certainly not too bad. Given Sunningdale Tech has a strong balance sheet is profitable and pays a dividend, it would be good to know how fast its dividends are growing, if at all. You can find out instantly by clicking this link.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Market Insights

Community Narratives