As global markets continue to navigate through fluctuating economic conditions, the Singapore Exchange (SGX) remains a focal point for investors seeking stability and yield. In this landscape, dividend stocks stand out as particularly appealing options for those looking to generate consistent income from their investments.

Top 10 Dividend Stocks In Singapore

| Name | Dividend Yield | Dividend Rating |

| BRC Asia (SGX:BEC) | 6.69% | ★★★★★☆ |

| UOB-Kay Hian Holdings (SGX:U10) | 6.62% | ★★★★★☆ |

| China Sunsine Chemical Holdings (SGX:QES) | 6.28% | ★★★★★☆ |

| Multi-Chem (SGX:AWZ) | 8.32% | ★★★★★☆ |

| UOL Group (SGX:U14) | 3.68% | ★★★★★☆ |

| Bumitama Agri (SGX:P8Z) | 6.36% | ★★★★★☆ |

| Civmec (SGX:P9D) | 5.61% | ★★★★★☆ |

| Singapore Exchange (SGX:S68) | 3.49% | ★★★★★☆ |

| Singapore Airlines (SGX:C6L) | 6.80% | ★★★★★☆ |

| YHI International (SGX:BPF) | 6.56% | ★★★★★☆ |

Click here to see the full list of 21 stocks from our Top SGX Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

BRC Asia (SGX:BEC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: BRC Asia Limited operates in the prefabrication of steel reinforcement for concrete, serving markets in Singapore, Australia, Brunei, Hong Kong, Indonesia, Malaysia, Thailand, India and internationally; it has a market capitalization of approximately SGD 655.70 million.

Operations: BRC Asia Limited generates revenue through two primary segments: Trading, which brought in SGD 319.71 million, and Fabrication and Manufacturing, contributing SGD 1.35 billion.

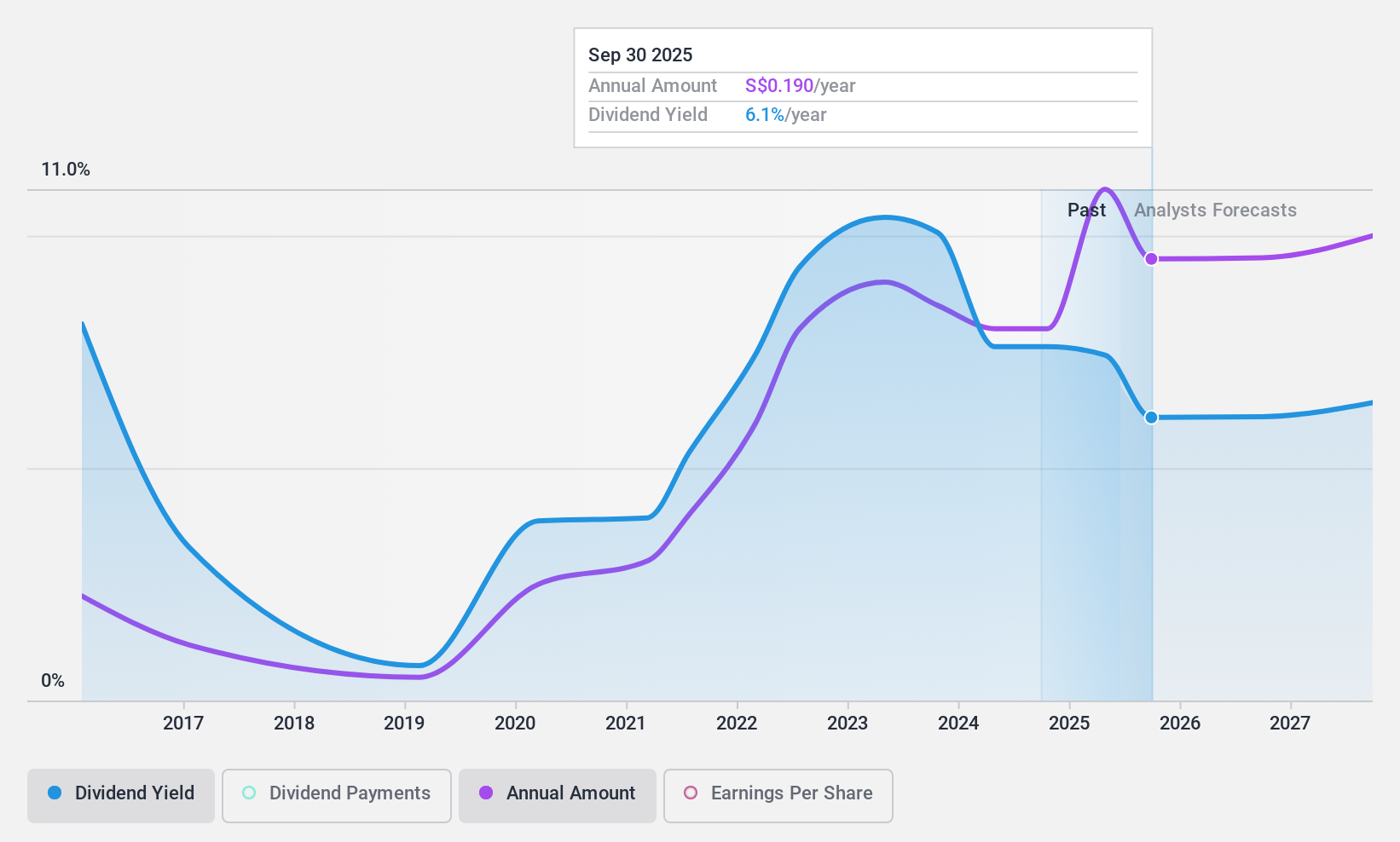

Dividend Yield: 6.7%

BRC Asia Limited, despite a history of volatile dividends, has shown promising financial growth with a 14.9% increase in earnings this past year to S$38.53 million and sales rising to S$758.29 million. The company maintains a low payout ratio at 35.9%, ensuring dividends are well-covered by earnings, though its cash payout ratio at 85.3% suggests tighter cash flow coverage. Recent actions include an interim dividend set for November payment, reflecting some level of commitment to shareholder returns amidst its unstable dividend track record.

- Delve into the full analysis dividend report here for a deeper understanding of BRC Asia.

- Our valuation report unveils the possibility BRC Asia's shares may be trading at a discount.

DBS Group Holdings (SGX:D05)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: DBS Group Holdings Ltd operates as a commercial bank offering financial services across Singapore, Hong Kong, the Greater China region, South and Southeast Asia, with a market capitalization of approximately SGD 104.95 billion.

Operations: DBS Group Holdings Ltd generates its revenue primarily from commercial banking and financial services across key regions including Singapore, Hong Kong, Greater China, South and Southeast Asia.

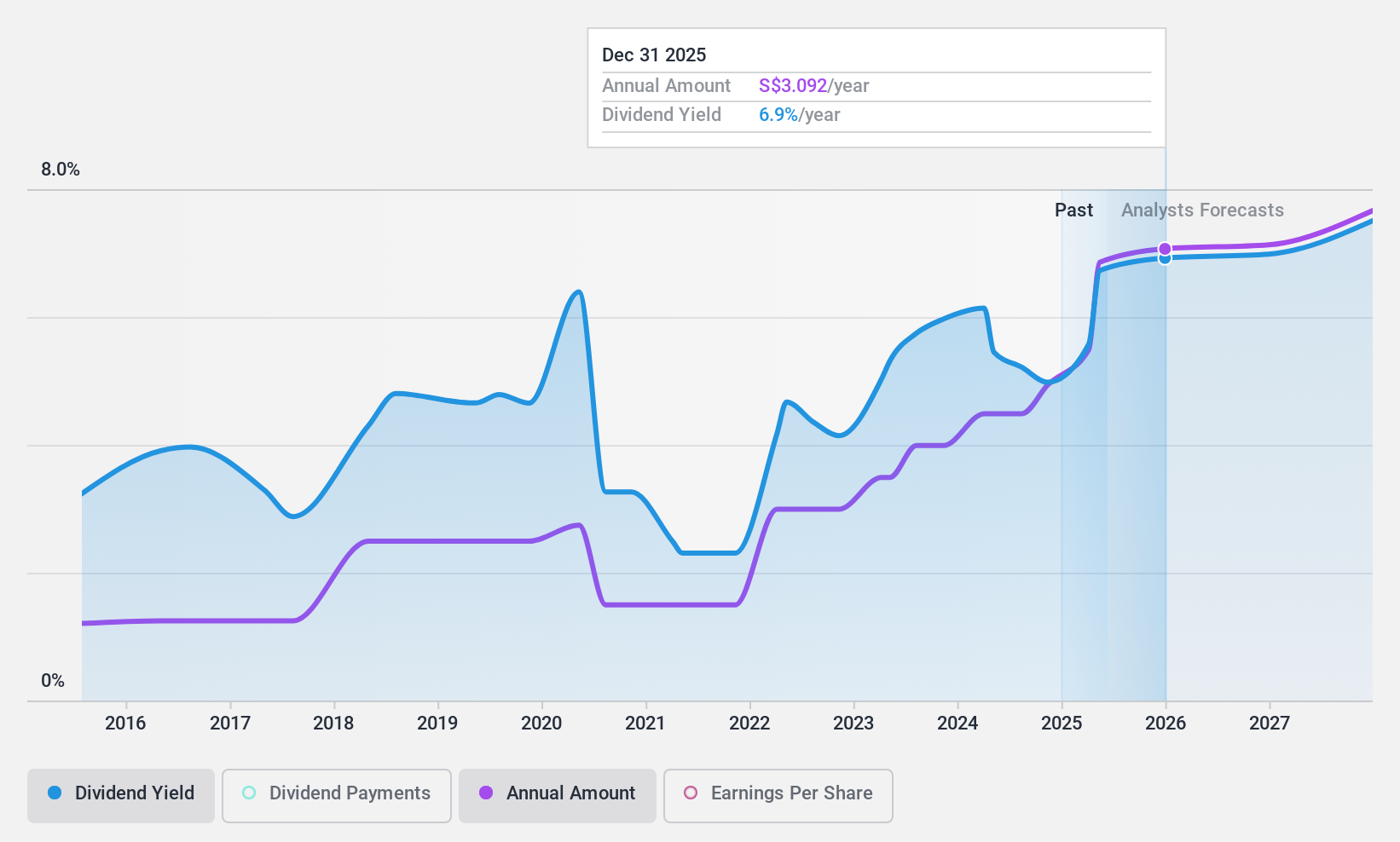

Dividend Yield: 5.3%

DBS Group Holdings has experienced fluctuating dividend payments over the past decade, with a recent interim dividend increase to S$0.54 per share. Despite this volatility, dividends are currently supported by a payout ratio of 50.8%, with projections showing improved coverage in three years at 67.1%. However, its dividend yield of 5.32% remains below the top quartile in Singapore's market at 6.18%. Recent earnings growth and executive changes aim to enhance operational stability and address past service disruptions.

- Click here and access our complete dividend analysis report to understand the dynamics of DBS Group Holdings.

- The analysis detailed in our DBS Group Holdings valuation report hints at an deflated share price compared to its estimated value.

Bumitama Agri (SGX:P8Z)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bumitama Agri Ltd. is an investment holding company based in Indonesia, specializing in the production and trade of crude palm oil and palm kernel, with a market capitalization of approximately SGD 1.28 billion.

Operations: Bumitama Agri Ltd. generates IDR 15.44 billion primarily from its plantations and palm oil mills segment.

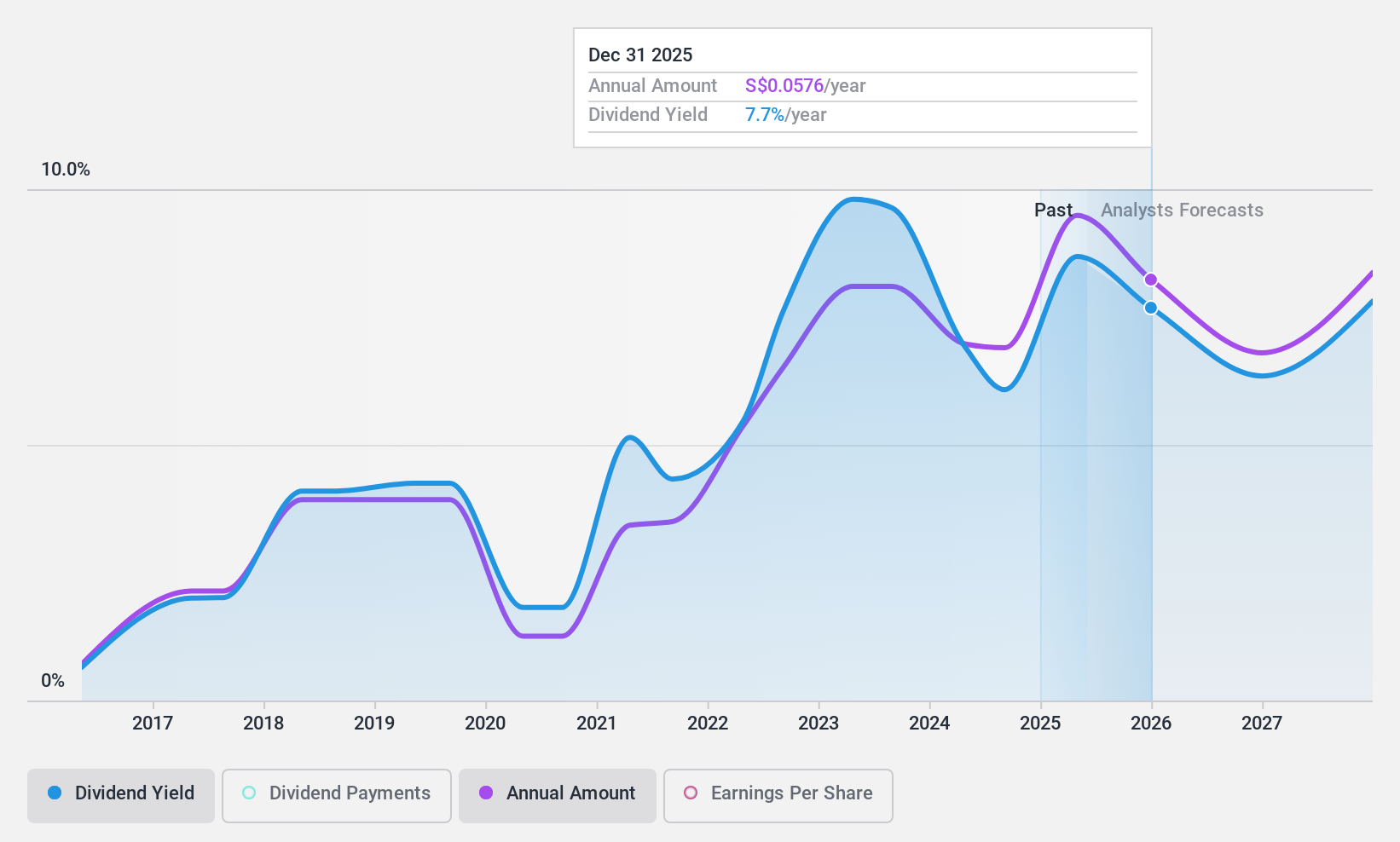

Dividend Yield: 6.4%

Bumitama Agri's dividend track record is unstable, with payments showing volatility over the last decade. Despite this, the company's dividends are reasonably covered by both earnings and cash flows, with a payout ratio of 40.4% and a cash payout ratio of 60.8%. Trading at 52.9% below its estimated fair value, it offers relative affordability in the market. However, earnings are expected to decline by an average of 5.4% annually over the next three years. Recent board enhancements could positively impact governance and strategic direction.

- Take a closer look at Bumitama Agri's potential here in our dividend report.

- Our valuation report here indicates Bumitama Agri may be undervalued.

Key Takeaways

- Click here to access our complete index of 21 Top SGX Dividend Stocks.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bumitama Agri might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:P8Z

Bumitama Agri

An investment holding company, engages in the production and trade of crude palm oil (CPO), palm kernel (PK), and related products for refineries in Indonesia.

Flawless balance sheet, undervalued and pays a dividend.