As Asian markets navigate a complex landscape marked by evolving trade ties and fluctuating interest rates, investors are increasingly looking towards dividend stocks as a potential source of steady income. In this environment, selecting robust dividend-paying companies can offer stability and income generation, appealing to those seeking to balance growth with reliable returns.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.04% | ★★★★★★ |

| Torigoe (TSE:2009) | 4.60% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 3.70% | ★★★★★★ |

| NCD (TSE:4783) | 4.65% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 3.95% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.26% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.03% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.48% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.79% | ★★★★★★ |

| Daicel (TSE:4202) | 4.39% | ★★★★★★ |

Click here to see the full list of 1055 stocks from our Top Asian Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

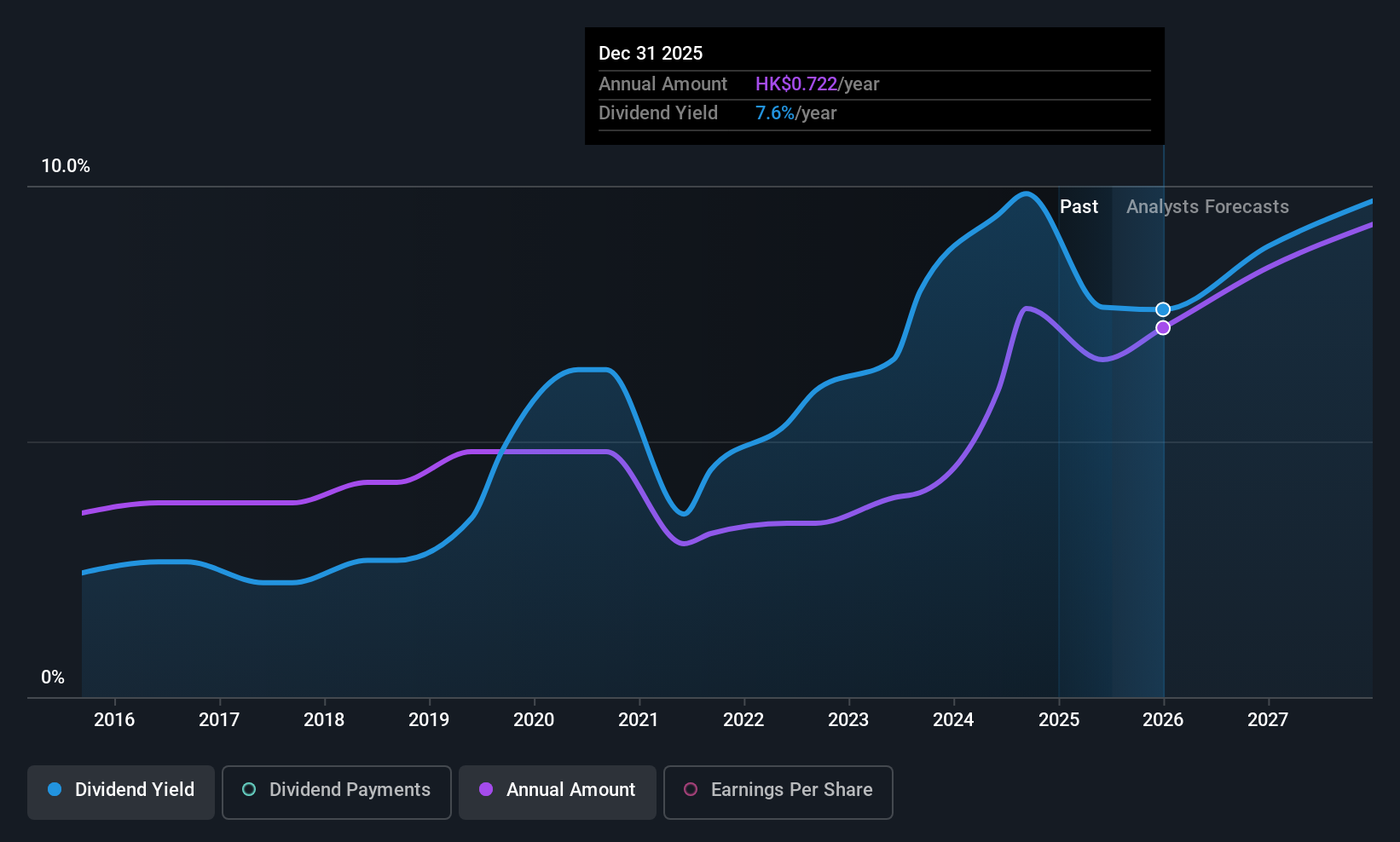

Dah Sing Banking Group (SEHK:2356)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dah Sing Banking Group Limited is an investment holding company that offers banking and financial services in Hong Kong, Macau, and the People's Republic of China, with a market cap of HK$14.83 billion.

Operations: Dah Sing Banking Group Limited generates revenue primarily from Personal Banking (HK$3.16 billion), Treasury and Global Markets (HK$1.91 billion), Corporate Banking (HK$161.15 million), and Mainland China and Macau Banking (HK$346.31 million).

Dividend Yield: 6.3%

Dah Sing Banking Group's dividend yield of 6.26% is slightly below the top quartile in Hong Kong, and its dividend history has been volatile despite recent increases, such as the interim dividend rising to HK$0.31 per share from HK$0.27 last year. While dividends are currently well-covered by a payout ratio of 43.9%, concerns exist over high bad loans (3.1%) and a low allowance for these loans (44%). Earnings growth is forecasted to decline slightly in the coming years, but recent earnings showed improvement with net income rising to HK$1.58 billion from HK$1.40 billion year-over-year for the half-year ending June 2025.

- Click here and access our complete dividend analysis report to understand the dynamics of Dah Sing Banking Group.

- In light of our recent valuation report, it seems possible that Dah Sing Banking Group is trading beyond its estimated value.

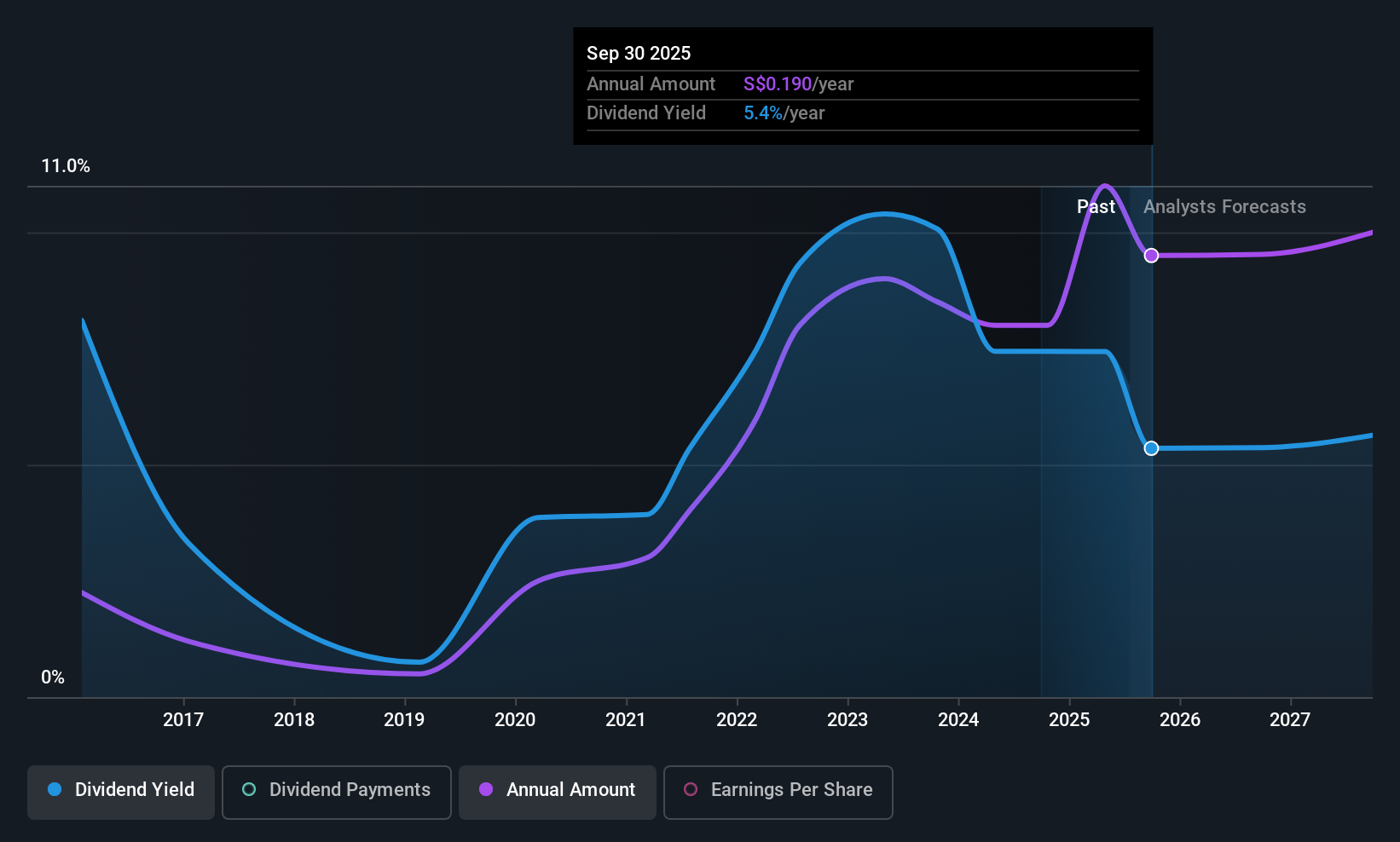

BRC Asia (SGX:BEC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: BRC Asia Limited, with a market cap of SGD1.08 billion, is involved in the prefabrication of steel reinforcement for concrete across Singapore and various international markets including Australia, Brunei, Hong Kong, Indonesia, Malaysia, Thailand, and India.

Operations: BRC Asia Limited generates revenue primarily through its Trading segment, which accounts for SGD255.23 million, and its Fabrication and Manufacturing segment, which contributes SGD1.18 billion.

Dividend Yield: 5.1%

BRC Asia's dividend payments have been volatile over the past decade, though they have increased during this period. The company's dividends are well-covered by earnings with a 39.6% payout ratio and cash flows at 68.2%. Despite trading at a significant discount to its estimated fair value, BRC's dividend yield of 5.1% is below Singapore's top quartile. Recent executive changes aim to enhance operational performance, while securing a S$570 million contract for Changi Airport Terminal 5 underscores its strategic industry position.

- Take a closer look at BRC Asia's potential here in our dividend report.

- Our valuation report here indicates BRC Asia may be undervalued.

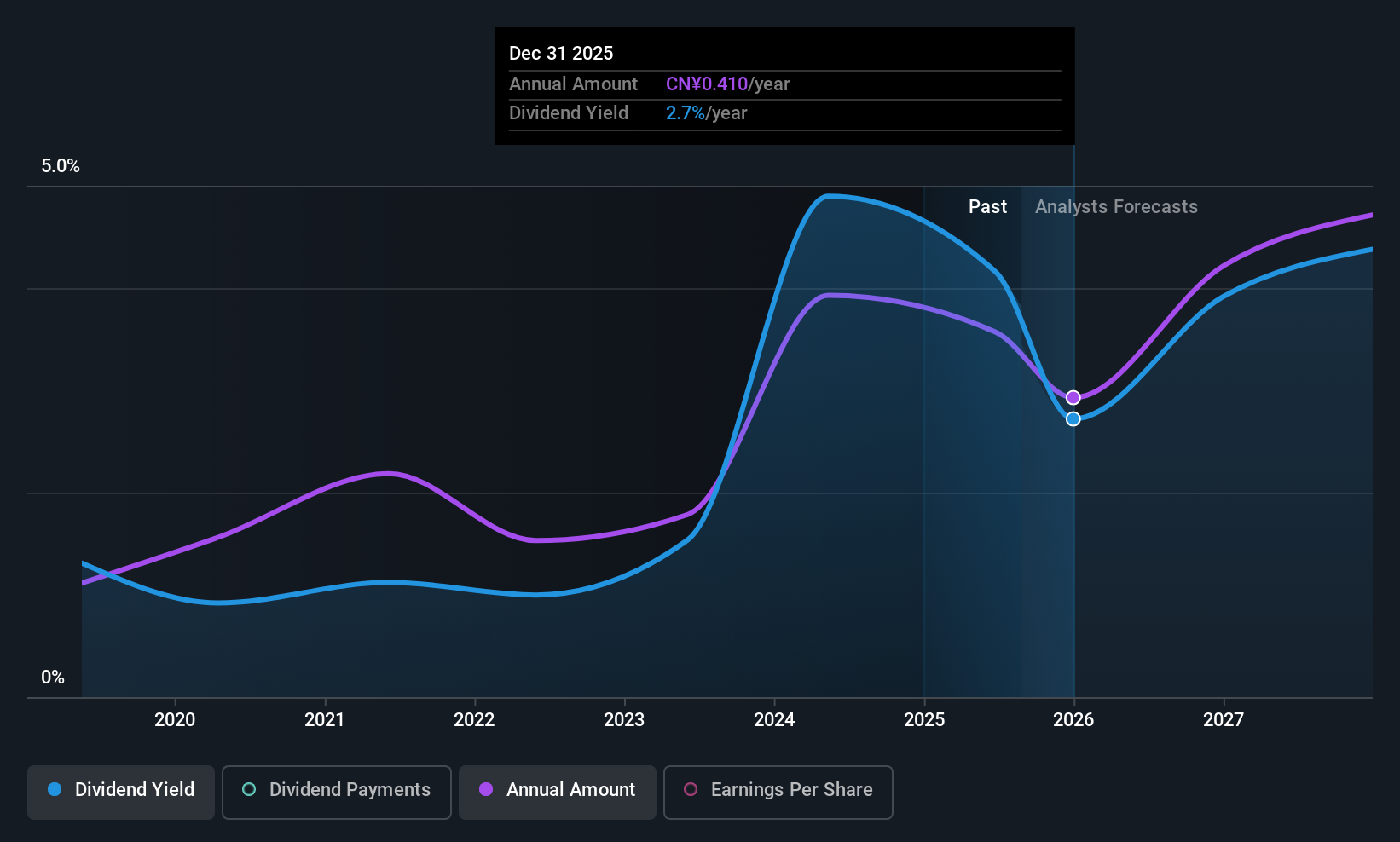

Qingdao Hiron Commercial Cold Chain (SHSE:603187)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Qingdao Hiron Commercial Cold Chain Co., Ltd. specializes in the production and distribution of commercial refrigeration equipment, with a market cap of CN¥5.68 billion.

Operations: Qingdao Hiron Commercial Cold Chain Co., Ltd. generates its revenue primarily through the production and distribution of commercial refrigeration equipment.

Dividend Yield: 3.4%

Qingdao Hiron Commercial Cold Chain's recent earnings report highlights a positive trajectory, with sales and revenue increasing to CNY 1.74 billion and CNY 1.79 billion respectively for the half year ended June 2025. Despite trading significantly below its estimated fair value, its dividend yield of 3.4% ranks in China's top quartile. However, the dividend history is unstable with volatility over six years despite being covered by earnings (51.1%) and cash flows (62%).

- Click here to discover the nuances of Qingdao Hiron Commercial Cold Chain with our detailed analytical dividend report.

- According our valuation report, there's an indication that Qingdao Hiron Commercial Cold Chain's share price might be on the cheaper side.

Make It Happen

- Click this link to deep-dive into the 1055 companies within our Top Asian Dividend Stocks screener.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BRC Asia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:BEC

BRC Asia

Engages in the prefabrication of steel reinforcement for use in concrete in Singapore, Australia, Brunei, Hong Kong, Indonesia, Malaysia, Thailand, India, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives