- Singapore

- /

- Construction

- /

- SGX:P9D

SGX Dividend Stocks To Watch In July 2024

Reviewed by Simply Wall St

As we approach July 2024, the Singapore market continues to show resilience, with stable performance across various sectors. This stability provides a conducive environment for investors looking at dividend stocks as a potential avenue for steady income. In considering dividend stocks, it's important to focus on companies with strong fundamentals and consistent payout histories, especially in the current economic landscape.

Top 10 Dividend Stocks In Singapore

| Name | Dividend Yield | Dividend Rating |

| BRC Asia (SGX:BEC) | 6.69% | ★★★★★☆ |

| UOB-Kay Hian Holdings (SGX:U10) | 6.67% | ★★★★★☆ |

| China Sunsine Chemical Holdings (SGX:QES) | 6.29% | ★★★★★☆ |

| Multi-Chem (SGX:AWZ) | 8.29% | ★★★★★☆ |

| UOL Group (SGX:U14) | 3.72% | ★★★★★☆ |

| Bumitama Agri (SGX:P8Z) | 6.59% | ★★★★★☆ |

| Singapore Exchange (SGX:S68) | 3.48% | ★★★★★☆ |

| Civmec (SGX:P9D) | 5.40% | ★★★★★☆ |

| Singapore Airlines (SGX:C6L) | 6.82% | ★★★★★☆ |

| YHI International (SGX:BPF) | 6.56% | ★★★★★☆ |

Click here to see the full list of 21 stocks from our Top SGX Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

BRC Asia (SGX:BEC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: BRC Asia Limited operates in the prefabrication of steel reinforcement for concrete, serving markets including Singapore, Australia, Brunei, Hong Kong, Indonesia, Malaysia, Thailand, India and more globally; it has a market capitalization of approximately SGD 655.70 million.

Operations: BRC Asia Limited generates revenue primarily through two segments: Trading, which brought in SGD 319.71 million, and Fabrication and Manufacturing, which contributed SGD 1.35 billion.

Dividend Yield: 6.7%

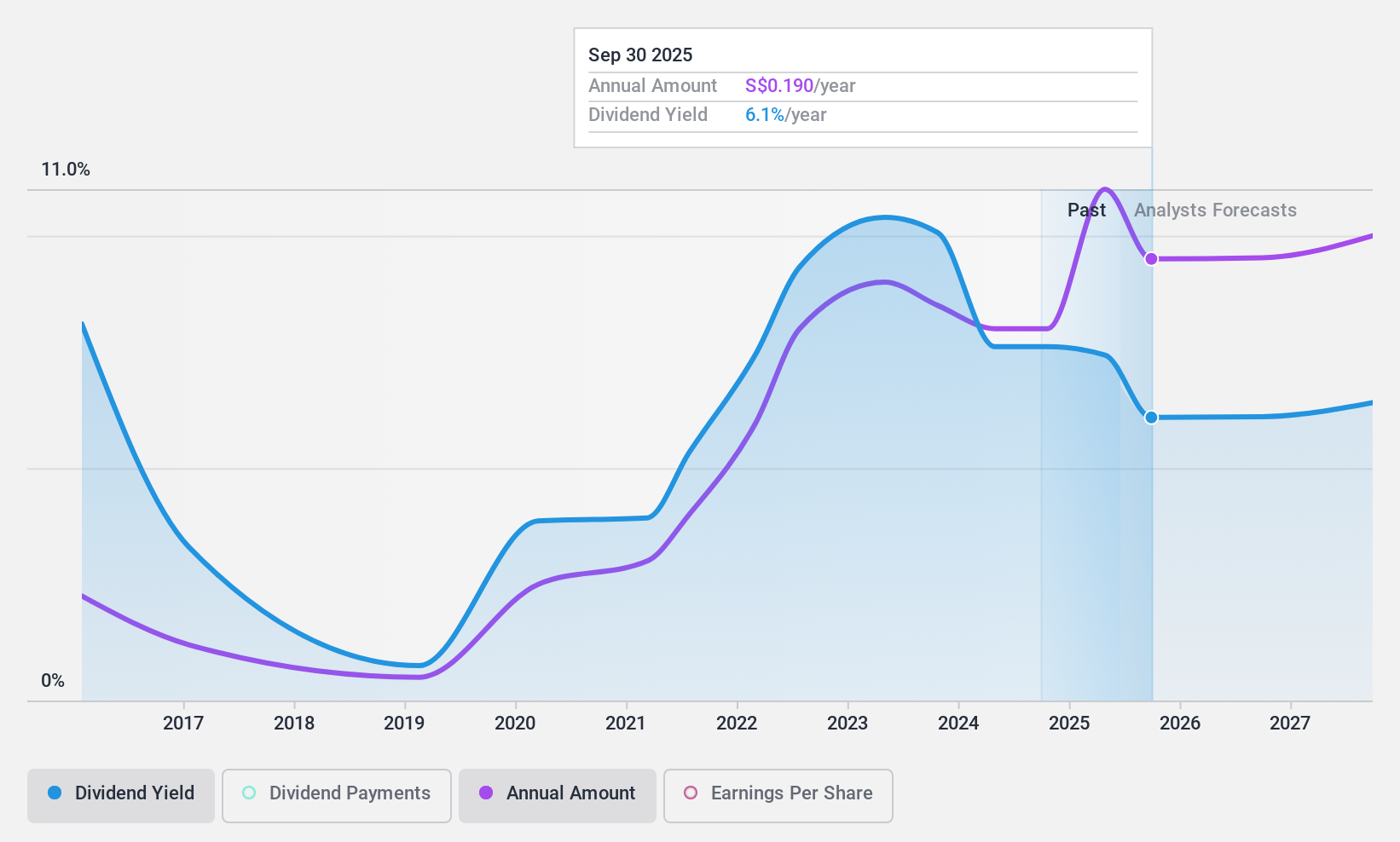

BRC Asia Limited, trading significantly below its estimated fair value, has shown a promising earnings growth of 14.9% over the past year with forecasts predicting further annual growth of around 4.03%. Despite its attractive dividend yield of 6.69%, which ranks in the top quartile in Singapore's market, the company's dividend history has been marked by volatility and unreliability over the past decade. However, dividends are currently well-supported by both earnings and cash flows, with payout ratios at 35.9% and 85.3%, respectively. Recent announcements include a planned interim dividend payment of SGD 0.06 per share to be distributed in November 2024 following a solid half-year performance with net income rising to SGD 38.53 million from SGD 26.24 million year-over-year.

- Dive into the specifics of BRC Asia here with our thorough dividend report.

- Insights from our recent valuation report point to the potential undervaluation of BRC Asia shares in the market.

Civmec (SGX:P9D)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Civmec Limited, an investment holding company based in Australia, offers construction and engineering services to sectors including energy, resources, infrastructure, and marine and defense, with a market capitalization of approximately SGD 464.45 million.

Operations: Civmec Limited generates revenue from three primary segments: Energy (A$46.02 million), Resources (A$752.82 million), and Infrastructure, Marine & Defence (A$105.52 million).

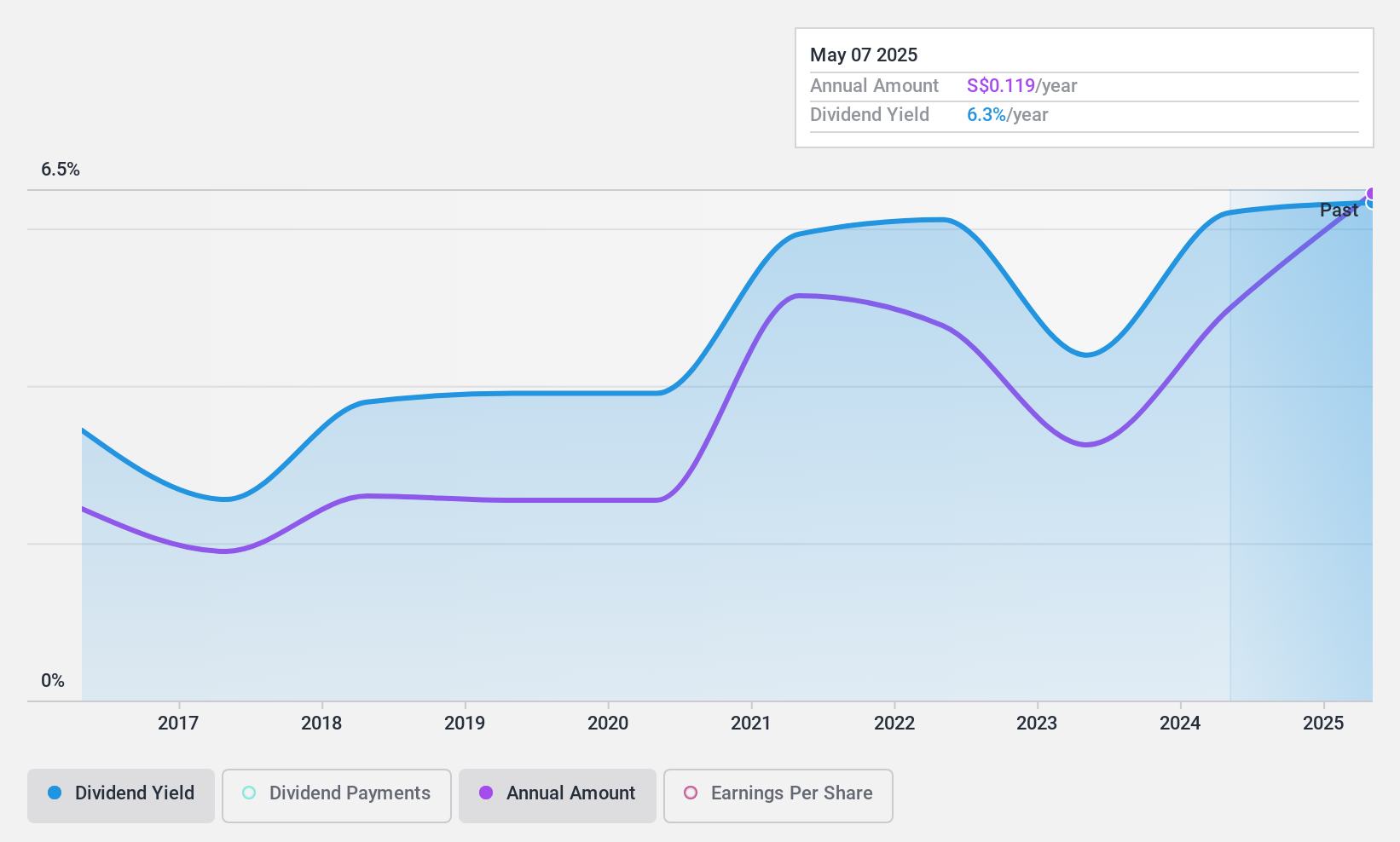

Dividend Yield: 5.4%

Civmec, while not leading in Singapore's dividend yield at 5.4%, maintains a sustainable payout with its earnings and cash flows covering dividends at 45.4% and 27% respectively. Its earnings have surged by 37.3% annually over the past five years, with a modest growth forecast of 3.88% per year ahead. Dividend reliability is underscored by a decade of stable payments and recent growth in dividends, alongside robust contract awards totaling A$174 million bolstering its operational strength.

- Take a closer look at Civmec's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that Civmec is trading behind its estimated value.

UOB-Kay Hian Holdings (SGX:U10)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: UOB-Kay Hian Holdings Limited operates as an investment holding company offering services such as stockbroking, futures broking, and more across Singapore, Hong Kong, Thailand, Malaysia, and internationally, with a market capitalization of approximately SGD 1.29 billion.

Operations: UOB-Kay Hian Holdings Limited generates revenue primarily through securities and futures broking and related services, amounting to SGD 539.01 million.

Dividend Yield: 6.7%

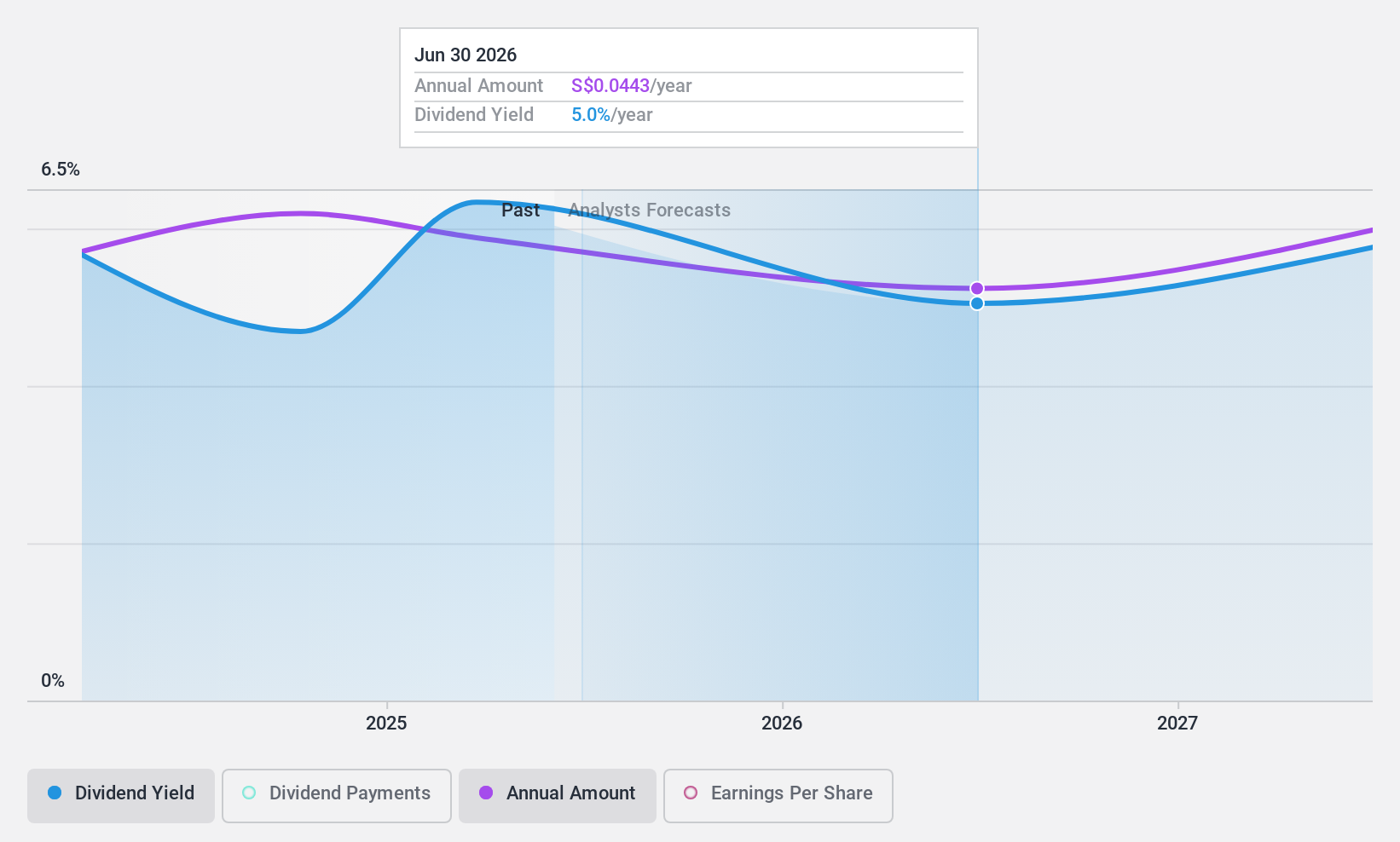

UOB-Kay Hian Holdings recently declared a dividend of S$0.092 per share, reflecting a stable payout with a low payout ratio of 48.2% and an even lower cash payout ratio of 22.7%, indicating strong coverage by both earnings and cash flows. Despite significant insider selling and historical volatility in dividend payments, the firm's recent earnings growth of 67.2% supports the sustainability of its dividends. However, shareholders have experienced dilution over the past year, which might raise concerns about future payouts.

- Click here and access our complete dividend analysis report to understand the dynamics of UOB-Kay Hian Holdings.

- Upon reviewing our latest valuation report, UOB-Kay Hian Holdings' share price might be too pessimistic.

Summing It All Up

- Access the full spectrum of 21 Top SGX Dividend Stocks by clicking on this link.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:P9D

Civmec Singapore

Civmec Limited, an investment holding company, provides construction and engineering services to the energy, resources, infrastructure, and marine and defense sectors in Australia.

Flawless balance sheet established dividend payer.