Top SGX Dividend Stocks Including DBS Group Holdings And 2 Others

Reviewed by Simply Wall St

The Singapore stock market has been navigating a period of steady performance, with investors keeping a close eye on economic indicators and corporate earnings. Amid this backdrop, dividend stocks have garnered attention for their potential to offer stable returns and income in uncertain times. When considering what makes a good dividend stock, factors such as consistent payout history, strong financial health, and resilience in various market conditions are key. In this article, we will explore three top SGX dividend stocks: DBS Group Holdings and two others that stand out for their robust dividends and solid fundamentals.

Top 10 Dividend Stocks In Singapore

| Name | Dividend Yield | Dividend Rating |

| BRC Asia (SGX:BEC) | 7.02% | ★★★★★☆ |

| Bumitama Agri (SGX:P8Z) | 6.66% | ★★★★★☆ |

| YHI International (SGX:BPF) | 6.56% | ★★★★★☆ |

| Singapore Exchange (SGX:S68) | 3.29% | ★★★★★☆ |

| Singapore Airlines (SGX:C6L) | 7.62% | ★★★★★☆ |

| Civmec Singapore (SGX:P9D) | 5.77% | ★★★★★☆ |

| UOB-Kay Hian Holdings (SGX:U10) | 6.39% | ★★★★☆☆ |

| Oversea-Chinese Banking (SGX:O39) | 6.01% | ★★★★☆☆ |

| Delfi (SGX:P34) | 6.94% | ★★★★☆☆ |

| Nordic Group (SGX:MR7) | 4.82% | ★★★★☆☆ |

Click here to see the full list of 20 stocks from our Top SGX Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

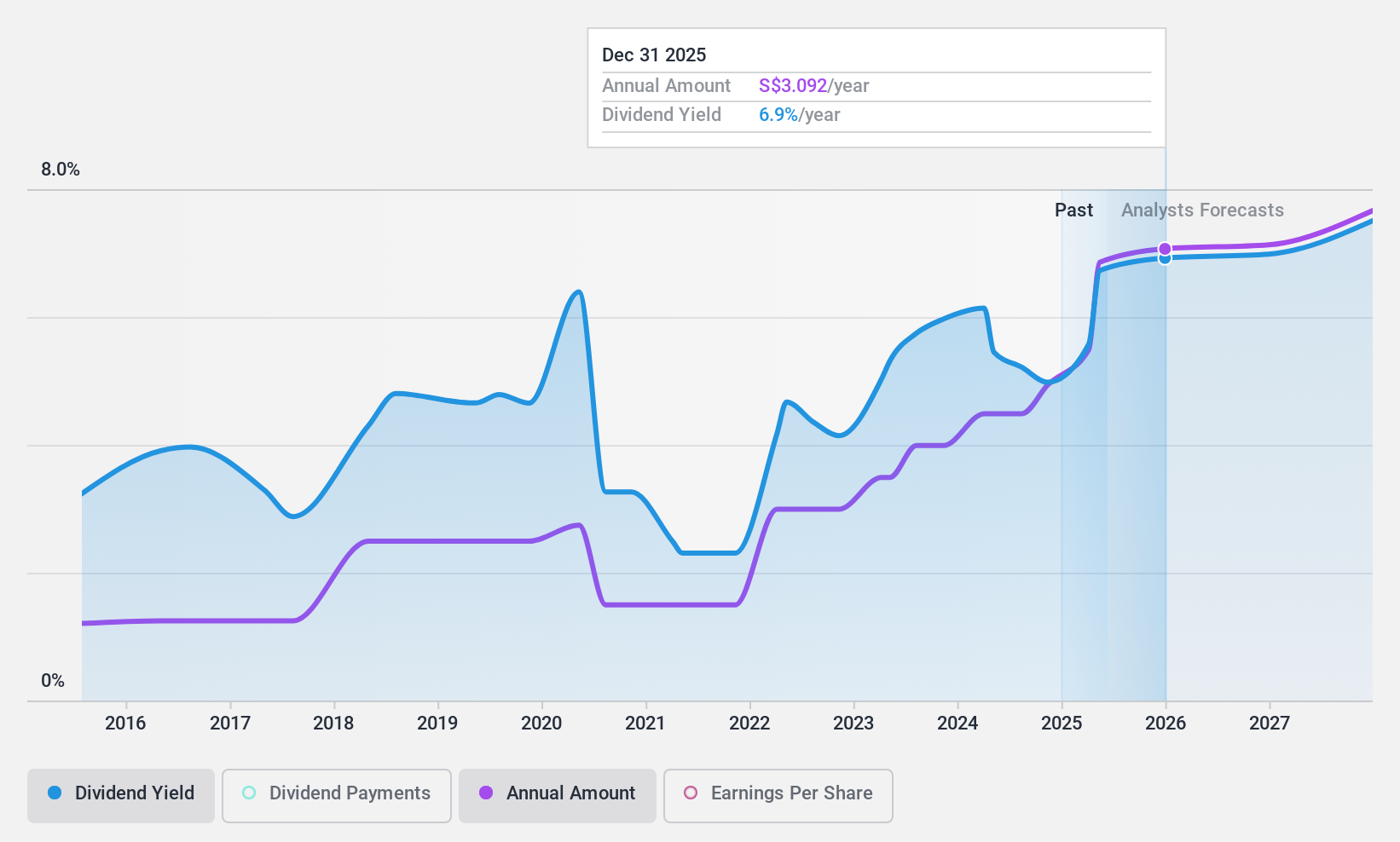

DBS Group Holdings (SGX:D05)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: DBS Group Holdings Ltd offers commercial banking and financial services across Singapore, Hong Kong, Greater China, South and Southeast Asia, and internationally with a market cap of SGD104.10 billion.

Operations: DBS Group Holdings Ltd generates revenue from Institutional Banking (SGD9.18 billion), Consumer Banking/Wealth Management (SGD9.34 billion), and Treasury Markets (SGD695 million).

Dividend Yield: 5.9%

DBS Group Holdings has demonstrated a mixed track record with dividends, showing volatility over the past decade. However, its dividend payments have increased during this period and are currently covered by earnings with a payout ratio of 54.1%. Recent financials indicate strong performance, with net interest income rising to S$7.10 billion for H1 2024. Leadership changes include the appointment of Tan Su Shan as Deputy CEO, which may influence future strategies and stability.

- Delve into the full analysis dividend report here for a deeper understanding of DBS Group Holdings.

- According our valuation report, there's an indication that DBS Group Holdings' share price might be on the cheaper side.

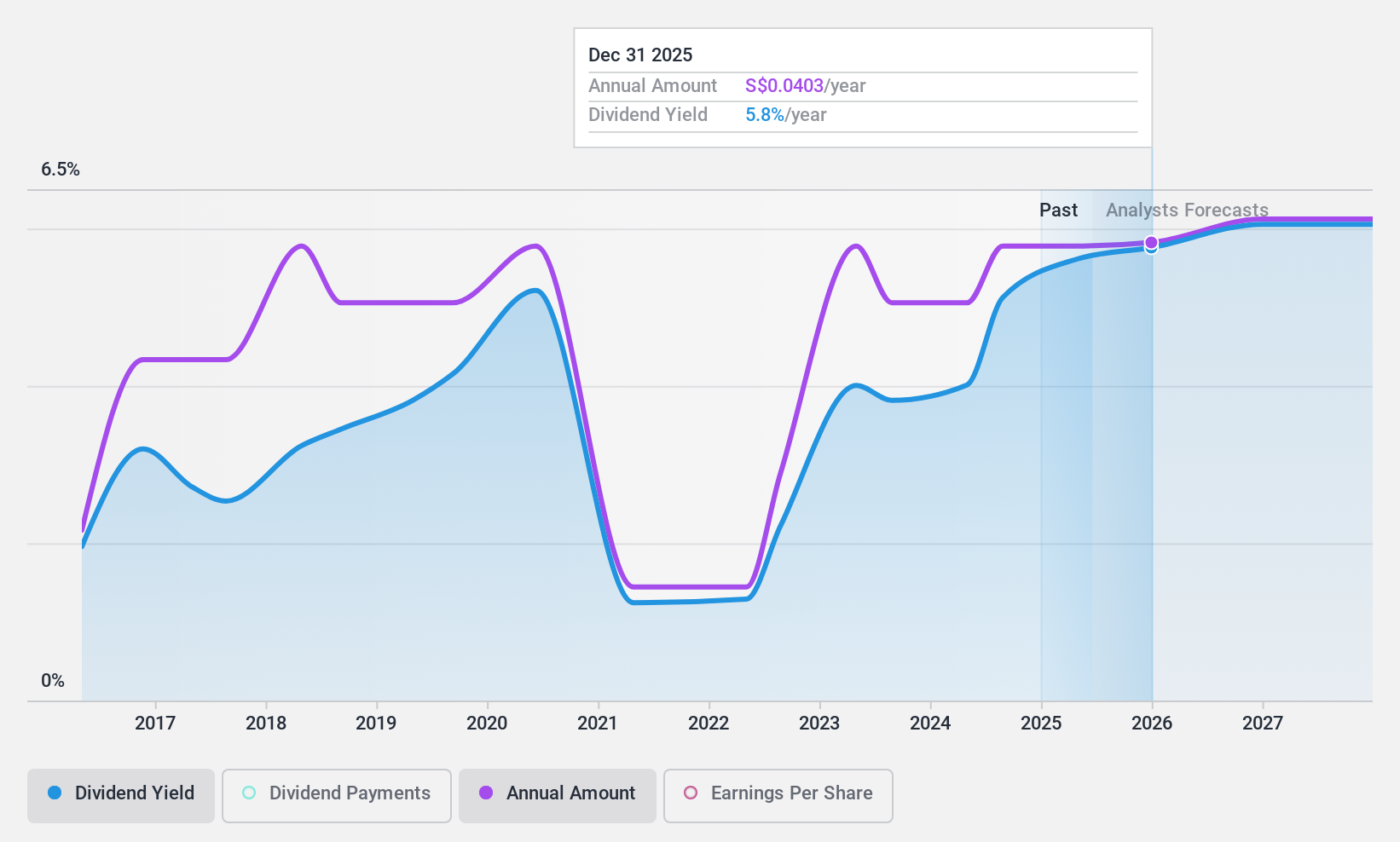

Genting Singapore (SGX:G13)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Genting Singapore Limited is an investment holding company that focuses on the construction, development, and operation of integrated resort destinations in Asia, with a market cap of SGD9.90 billion.

Operations: Genting Singapore Limited generates revenue primarily from its integrated resort destinations in Asia.

Dividend Yield: 4.9%

Genting Singapore's dividend payments have been volatile over the past decade, though they remain covered by earnings (69.8% payout ratio) and cash flows (72.3%). The company proposed an interim dividend of 2 Singapore cents per share for 2024. Recent financials show strong growth, with H1 sales rising to S$1.36 billion from S$1.08 billion a year ago, and net income increasing to S$356.91 million from S$276.68 million in the same period.

- Unlock comprehensive insights into our analysis of Genting Singapore stock in this dividend report.

- Our valuation report unveils the possibility Genting Singapore's shares may be trading at a discount.

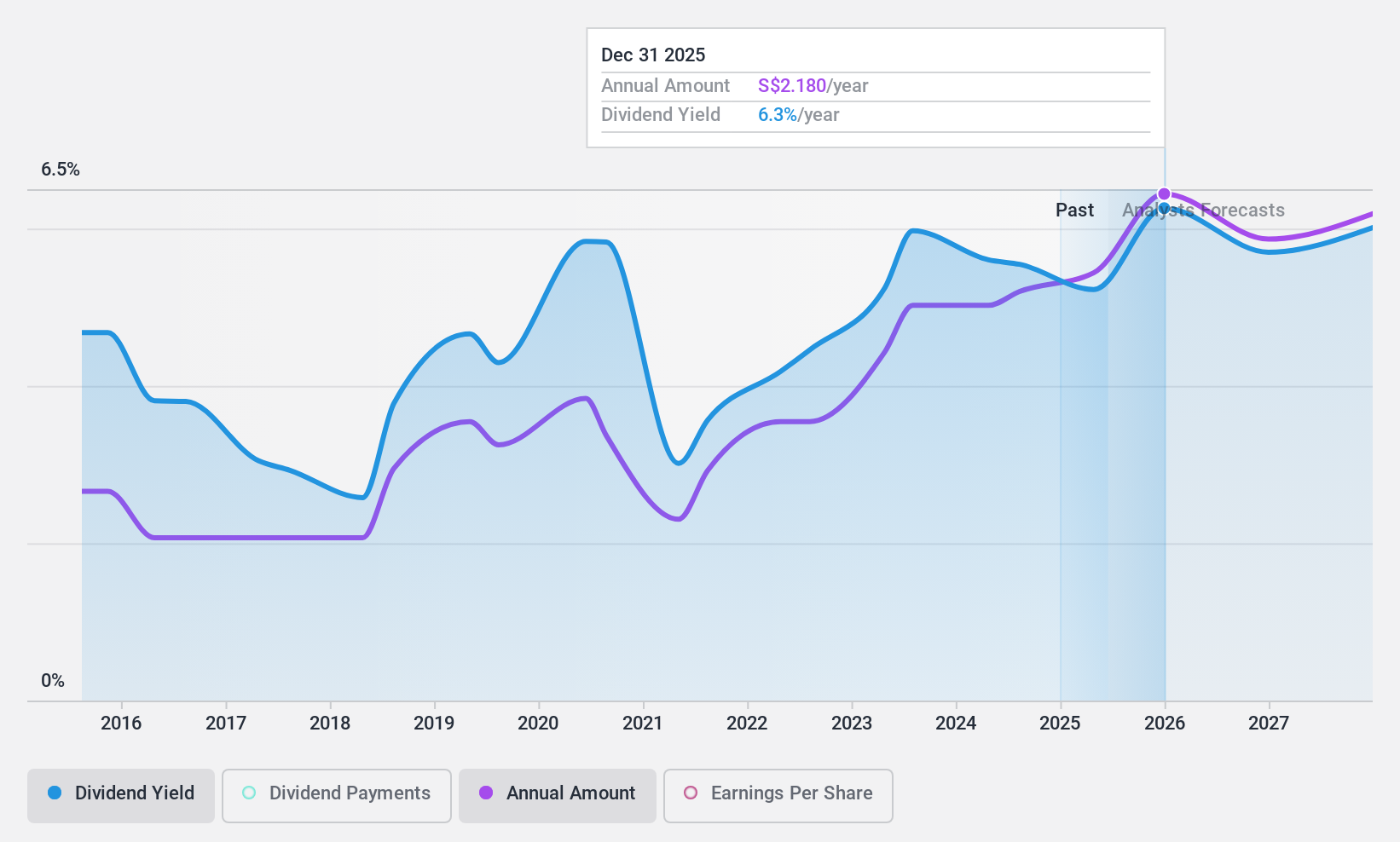

United Overseas Bank (SGX:U11)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: United Overseas Bank Limited, along with its subsidiaries, offers a range of banking products and services globally and has a market cap of SGD53.08 billion.

Operations: United Overseas Bank Limited generates revenue from Group Retail (SGD5.11 billion), Global Markets (SGD400 million), and Group Wholesale Banking (SGD6.69 billion).

Dividend Yield: 5.5%

United Overseas Bank's dividend payments have been volatile over the past decade, though they remain covered by earnings (51.9% payout ratio) and are forecast to be sustainable in three years (50.1%). The interim dividend increased to 88 cents per share. Recent financials show stable performance, with H1 net income at S$2.91 billion compared to S$2.93 billion a year ago, despite trading below its estimated fair value by 54.7%.

- Navigate through the intricacies of United Overseas Bank with our comprehensive dividend report here.

- The analysis detailed in our United Overseas Bank valuation report hints at an deflated share price compared to its estimated value.

Taking Advantage

- Take a closer look at our Top SGX Dividend Stocks list of 20 companies by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:D05

DBS Group Holdings

Provides commercial banking and financial services in Singapore, Hong Kong, rest of Greater China, South and Southeast Asia, and internationally.

Flawless balance sheet average dividend payer.