A Look at DBS (SGX:D05) Valuation Following Third Quarter 2025 Earnings Results

Reviewed by Simply Wall St

DBS Group Holdings (SGX:D05) just released its third quarter 2025 earnings, drawing attention from investors who are closely watching shifts in the bank’s net interest income and profits compared to last year.

See our latest analysis for DBS Group Holdings.

The timely release of DBS Group Holdings’ Q3 results has come on the back of an impressive run for shareholders. Despite some fluctuations after recent earnings news, the stock’s momentum has stayed strong. The year-to-date share price return stands at 21.7%, and the 1-year total shareholder return is nearly 45%. This suggests that investors continue to see long-term potential even after short-term earnings dips.

Curious what other opportunities are out there? Now could be a great moment to broaden your search and discover fast growing stocks with high insider ownership

But after these strong returns and a recent dip in profits, investors have to wonder if DBS shares are still trading at a discount or if the market has already baked in all the expected future growth.

Most Popular Narrative: 4.6% Overvalued

DBS Group Holdings closed at SGD53.5, slightly above the most widely followed fair value estimate of SGD51.16. This small price gap hints at a market consensus that aligns closely with analyst projections, but nuanced factors set the current market apart. Let’s look at one of the major growth themes driving this narrative.

Digital asset and payments ecosystem initiatives, leveraging early investments and regulatory engagement, position DBS to benefit from accelerated digital adoption and mobile penetration across Southeast Asia, supporting scalable high-margin business lines and enhancing non-interest income streams.

Unlock the strategy behind this valuation. Why is digital transformation such a dealmaker for DBS’s future earnings? One bold profit forecast and a premium multiple sit at the heart of this narrative’s optimistic fair value. The kicker is not what most investors expect. Curious? The full narrative exposes the playbook analysts believe will keep DBS priced above the crowd.

Result: Fair Value of $51.16 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as prolonged low interest rates or stricter regulatory measures could challenge DBS’s growth optimism and put pressure on profit margins.

Find out about the key risks to this DBS Group Holdings narrative.

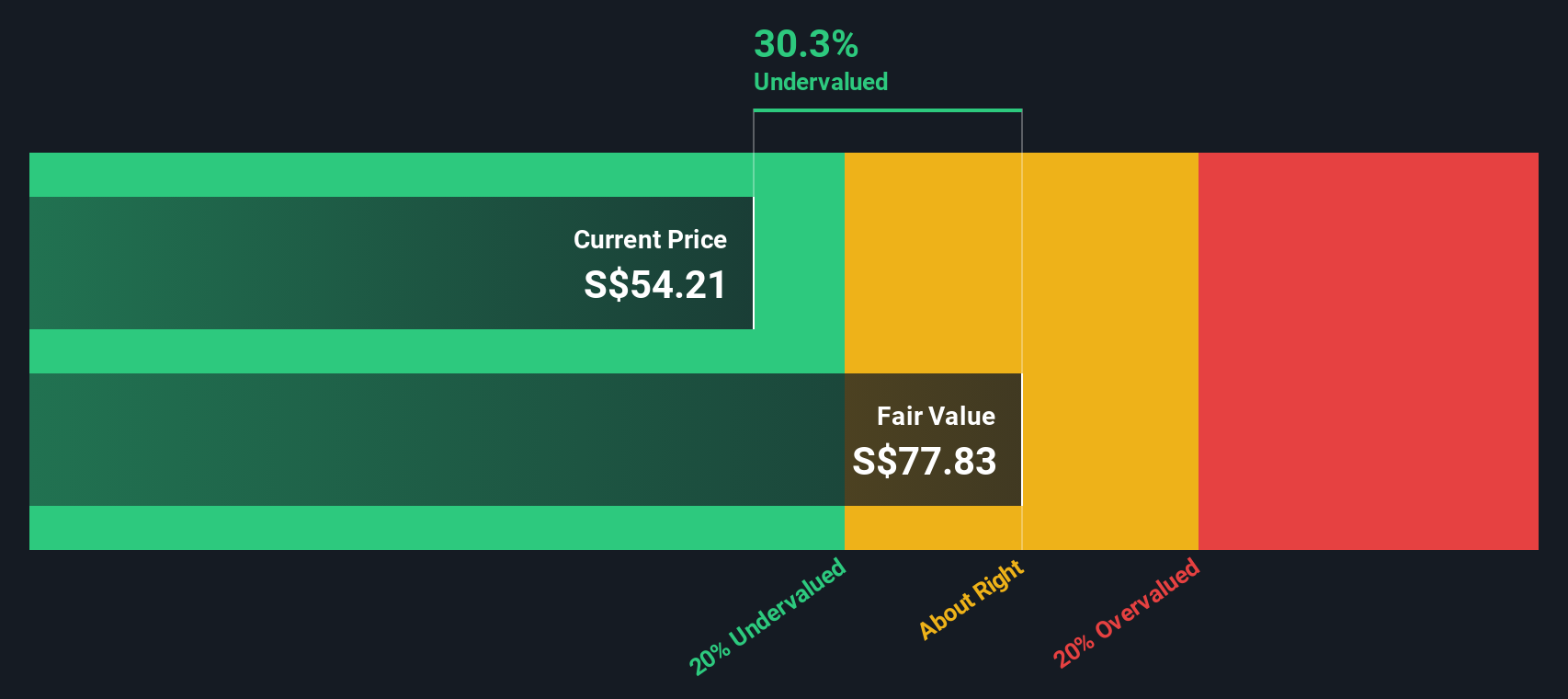

Another View: Discounted Cash Flow Model Shows Opportunity

While the analyst consensus suggests DBS shares are slightly overvalued, our SWS DCF model presents a contrasting view. It estimates the fair value at SGD77.14, which is significantly higher than the current price. This prompts the question: is the market underestimating DBS’s long-term cash flow strength?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out DBS Group Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 838 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own DBS Group Holdings Narrative

If you see the story differently or want to dive into the numbers yourself, it’s easy to build your own DBS narrative in just a few minutes. Why not Do it your way?

A great starting point for your DBS Group Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investing means not sticking to just one story. Give yourself an edge by targeting new themes with our most exciting stock strategies below. You’ll want to be ahead of the next big move.

- Grab reliable income and stability by checking out these 20 dividend stocks with yields > 3%, with yields that stand out even when the market gets choppy.

- Uncover high-potential innovators, as these 26 AI penny stocks are reimagining industries and setting the pace for tomorrow’s breakthroughs.

- Tap into ever-evolving finance trends through these 81 cryptocurrency and blockchain stocks, where blockchain powerhouses and new tech trailblazers are rapidly transforming how value is exchanged worldwide.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:D05

DBS Group Holdings

Provides commercial banking and financial services in Singapore, Hong Kong, rest of Greater China, South and Southeast Asia, and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives