- Sweden

- /

- Telecom Services and Carriers

- /

- OM:TRANS

Transtema Group AB (STO:TRANS) Held Back By Insufficient Growth Even After Shares Climb 29%

Despite an already strong run, Transtema Group AB (STO:TRANS) shares have been powering on, with a gain of 29% in the last thirty days. Notwithstanding the latest gain, the annual share price return of 3.7% isn't as impressive.

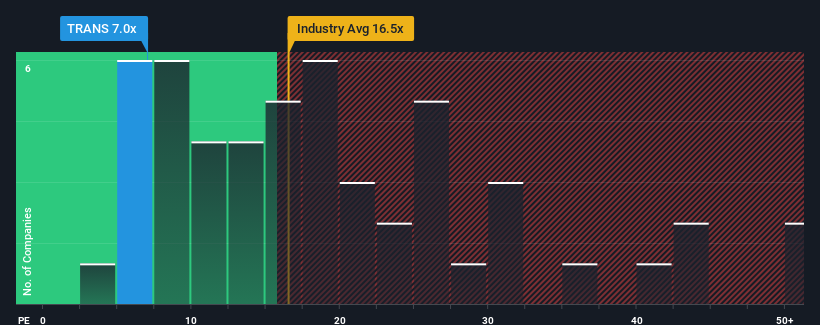

In spite of the firm bounce in price, given about half the companies in Sweden have price-to-earnings ratios (or "P/E's") above 24x, you may still consider Transtema Group as a highly attractive investment with its 7x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

Recent times haven't been advantageous for Transtema Group as its earnings have been falling quicker than most other companies. It seems that many are expecting the dismal earnings performance to persist, which has repressed the P/E. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

View our latest analysis for Transtema Group

Is There Any Growth For Transtema Group?

Transtema Group's P/E ratio would be typical for a company that's expected to deliver very poor growth or even falling earnings, and importantly, perform much worse than the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 38%. Still, the latest three year period has seen an excellent 104% overall rise in EPS, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Turning to the outlook, the next three years should bring diminished returns, with earnings decreasing 3.5% each year as estimated by the two analysts watching the company. With the market predicted to deliver 19% growth each year, that's a disappointing outcome.

In light of this, it's understandable that Transtema Group's P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

What We Can Learn From Transtema Group's P/E?

Even after such a strong price move, Transtema Group's P/E still trails the rest of the market significantly. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Transtema Group maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

It is also worth noting that we have found 2 warning signs for Transtema Group that you need to take into consideration.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if Transtema Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:TRANS

Transtema Group

Transtema Group AB installs, maintains, and manages the operation of various communication networks in the Nordic region.

Undervalued with slight risk.

Similar Companies

Market Insights

Community Narratives