- Sweden

- /

- Telecom Services and Carriers

- /

- OM:TRANS

Is It Time To Consider Buying Transtema Group AB (STO:TRANS)?

Transtema Group AB (STO:TRANS), is not the largest company out there, but it saw a significant share price rise of over 20% in the past couple of months on the OM. As a small cap stock, hardly covered by any analysts, there is generally more of an opportunity for mispricing as there is less activity to push the stock closer to fair value. Is there still an opportunity here to buy? Let’s examine Transtema Group’s valuation and outlook in more detail to determine if there’s still a bargain opportunity.

See our latest analysis for Transtema Group

Is Transtema Group still cheap?

The share price seems sensible at the moment according to my price multiple model, where I compare the company's price-to-earnings ratio to the industry average. In this instance, I’ve used the price-to-earnings (PE) ratio given that there is not enough information to reliably forecast the stock’s cash flows. I find that Transtema Group’s ratio of 23.55x is trading slightly above its industry peers’ ratio of 22.57x, which means if you buy Transtema Group today, you’d be paying a relatively reasonable price for it. And if you believe that Transtema Group should be trading at this level in the long run, then there should only be a fairly immaterial downside vs other industry peers. Furthermore, Transtema Group’s share price also seems relatively stable compared to the rest of the market, as indicated by its low beta. This may mean it is less likely for the stock to fall lower from natural market volatility, which suggests less opportunities to buy moving forward.

What does the future of Transtema Group look like?

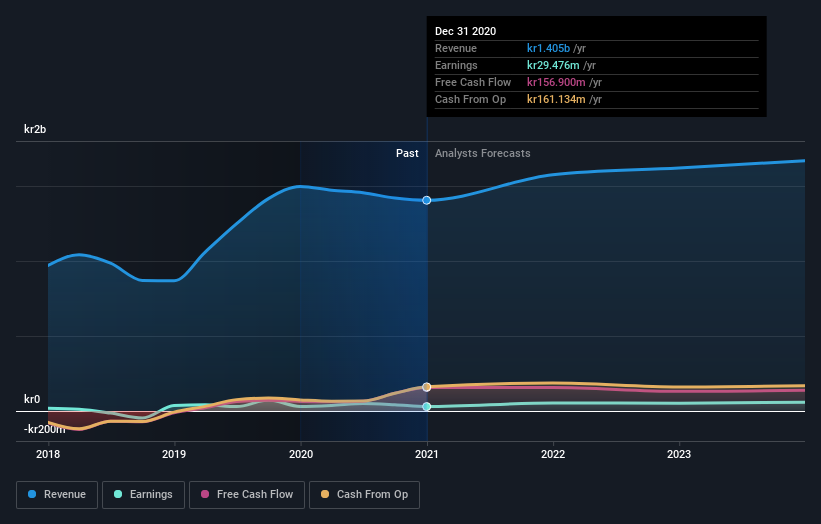

Future outlook is an important aspect when you’re looking at buying a stock, especially if you are an investor looking for growth in your portfolio. Buying a great company with a robust outlook at a cheap price is always a good investment, so let’s also take a look at the company's future expectations. With profit expected to grow by 96% over the next couple of years, the future seems bright for Transtema Group. It looks like higher cash flow is on the cards for the stock, which should feed into a higher share valuation.

What this means for you:

Are you a shareholder? TRANS’s optimistic future growth appears to have been factored into the current share price, with shares trading around industry price multiples. However, there are also other important factors which we haven’t considered today, such as the financial strength of the company. Have these factors changed since the last time you looked at TRANS? Will you have enough confidence to invest in the company should the price drop below the industry PE ratio?

Are you a potential investor? If you’ve been keeping tabs on TRANS, now may not be the most optimal time to buy, given it is trading around industry price multiples. However, the positive outlook is encouraging for TRANS, which means it’s worth further examining other factors such as the strength of its balance sheet, in order to take advantage of the next price drop.

So while earnings quality is important, it's equally important to consider the risks facing Transtema Group at this point in time. Every company has risks, and we've spotted 4 warning signs for Transtema Group you should know about.

If you are no longer interested in Transtema Group, you can use our free platform to see our list of over 50 other stocks with a high growth potential.

If you’re looking to trade Transtema Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Transtema Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OM:TRANS

Transtema Group

Transtema Group AB installs, maintains, and manages the operation of various communication networks in the Nordic region.

Undervalued with slight risk.

Similar Companies

Market Insights

Community Narratives