- Sweden

- /

- Telecom Services and Carriers

- /

- OM:TRANS

Here's Why Transtema Group (STO:TRANS) Can Manage Its Debt Responsibly

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Transtema Group AB (STO:TRANS) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Transtema Group

How Much Debt Does Transtema Group Carry?

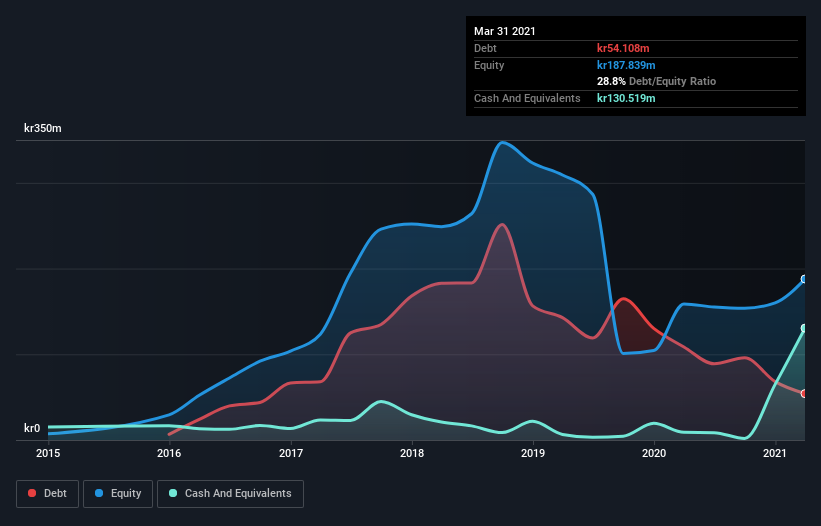

You can click the graphic below for the historical numbers, but it shows that Transtema Group had kr54.1m of debt in March 2021, down from kr108.5m, one year before. But on the other hand it also has kr130.5m in cash, leading to a kr76.4m net cash position.

How Healthy Is Transtema Group's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Transtema Group had liabilities of kr428.0m due within 12 months and liabilities of kr102.4m due beyond that. On the other hand, it had cash of kr130.5m and kr104.6m worth of receivables due within a year. So it has liabilities totalling kr295.3m more than its cash and near-term receivables, combined.

While this might seem like a lot, it is not so bad since Transtema Group has a market capitalization of kr761.1m, and so it could probably strengthen its balance sheet by raising capital if it needed to. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk. Despite its noteworthy liabilities, Transtema Group boasts net cash, so it's fair to say it does not have a heavy debt load!

Better yet, Transtema Group grew its EBIT by 146% last year, which is an impressive improvement. If maintained that growth will make the debt even more manageable in the years ahead. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Transtema Group's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. While Transtema Group has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Happily for any shareholders, Transtema Group actually produced more free cash flow than EBIT over the last two years. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Summing up

While Transtema Group does have more liabilities than liquid assets, it also has net cash of kr76.4m. And it impressed us with free cash flow of kr256m, being 342% of its EBIT. So we don't think Transtema Group's use of debt is risky. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. To that end, you should be aware of the 3 warning signs we've spotted with Transtema Group .

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you’re looking to trade Transtema Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Transtema Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OM:TRANS

Transtema Group

Transtema Group AB installs, maintains, and manages the operation of various communication networks in the Nordic region.

Undervalued with slight risk.

Similar Companies

Market Insights

Community Narratives