- Sweden

- /

- Telecom Services and Carriers

- /

- OM:TELIA

Telia Company (OM:TELIA) Valuation in Focus After Mixed Earnings and Recent Share Price Gain

Reviewed by Simply Wall St

Telia Company (OM:TELIA) released its third quarter earnings, highlighting stable sales and a slight increase in quarterly net income. However, nine-month results reflected lower net income and earnings per share compared to last year.

See our latest analysis for Telia Company.

Despite Telia's mixed earnings, the stock has maintained upward momentum, with a 5.2% one-month share price return and a strong 19.5% year-to-date increase. Looking to the long term, total shareholder return stands at an impressive 54.5% over three years, reflecting resilient investor confidence.

Curious to see what else the market is rewarding right now? It’s a great moment to widen your perspective and discover fast growing stocks with high insider ownership

The question now is whether Telia's rally still has room to run, or if the optimism is already reflected in the stock price. Could investors be overlooking a potential bargain, or is the market already factoring in all the growth ahead?

Most Popular Narrative: 10% Undervalued

Telia's current fair value in the most widely followed narrative stands approximately SEK 2 higher than the last close, suggesting an attractive entry point for investors. The margin between price and narrative value is narrow but meaningful, setting the stage for the key drivers behind this valuation.

Advancing convergence across connectivity, TV, media, and cloud services allows Telia to deepen customer relationships and reduce churn. This drives up household ARPU and supports stable, recurring revenue streams along with higher EBITDA margins over time.

Want to know why Telia’s business model is commanding extra value? The secret lies in how it turns service convergence into sticky, high-margin growth. See how the narrative’s quantitative roadmap adds up.

Result: Fair Value of $37.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained digital disruption or tougher competition could weaken Telia’s pricing power, making long-term revenue growth more challenging than forecasted.

Find out about the key risks to this Telia Company narrative.

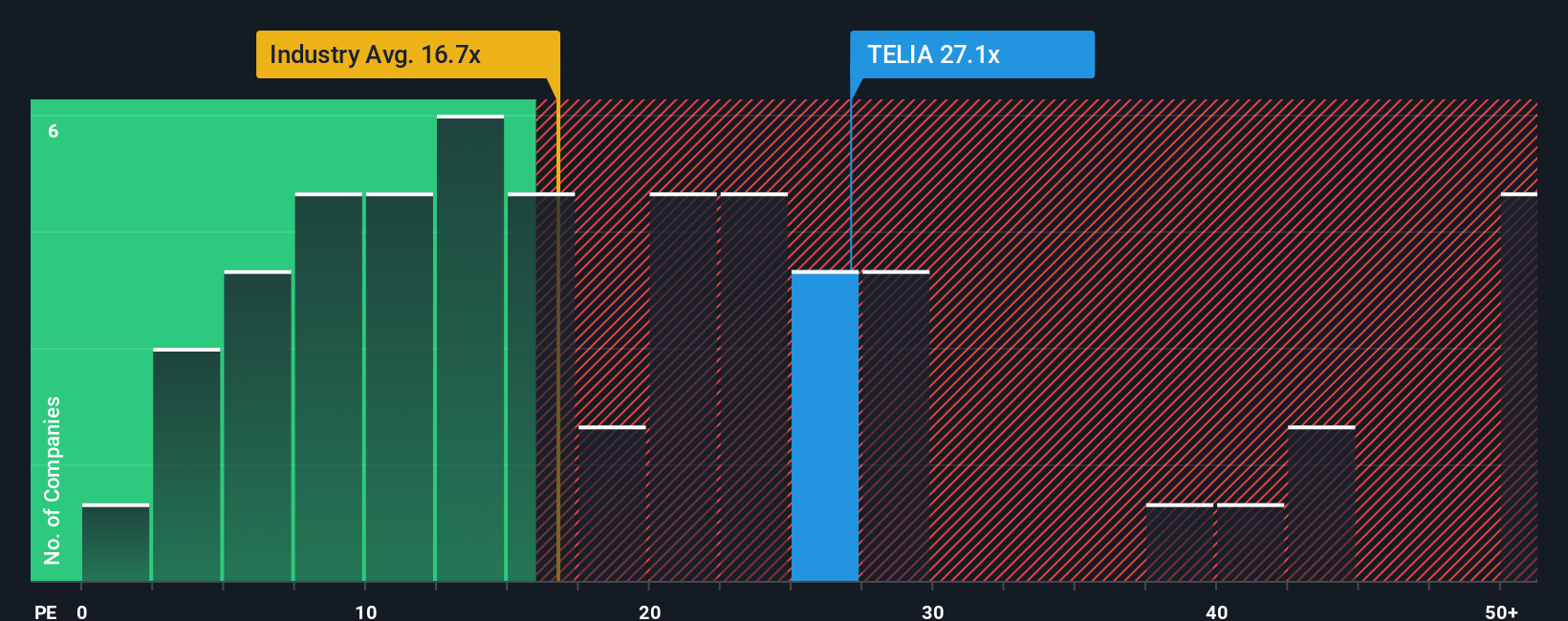

Another View: Multiples Show a Different Story

Looking at Telia’s valuation through the lens of the price-to-earnings ratio paints a more cautious picture. The company trades at 27.1 times earnings, making it pricier than the European telecom sector average of 17.3x and its peers at 21.7x. Even compared to its fair ratio of 26.4x, Telia remains on the expensive side, suggesting investors may be paying up for stability while accepting less margin for error. Does this signal over-optimism, or is reliable performance worth the premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Telia Company Narrative

If you have a different view or want to dig into the numbers yourself, crafting your own Telia Company story is quick and insightful. Get started and Do it your way.

A great starting point for your Telia Company research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don't limit your potential by staying in one lane. Find tomorrow’s winners, income standouts, and sector leaders by using Simply Wall Street’s powerful screeners today.

- Capture the upside by targeting high-yield income with these 20 dividend stocks with yields > 3%, and see which companies are generating strong returns through robust dividends.

- Seize the AI boom and get ahead of the curve by following these 27 AI penny stocks at the forefront of artificial intelligence innovation.

- Boost your portfolio’s value by zeroing in on these 840 undervalued stocks based on cash flows, which the market may be mispricing right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Telia Company might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:TELIA

Telia Company

Provides communication services to businesses, individuals, families, and communities in Sweden, Finland, Norway, Denmark, Lithuania, Estonia, and Latvia.

Solid track record second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives