- Sweden

- /

- Telecom Services and Carriers

- /

- OM:TELIA

Telia Company (OM:TELIA): Is the Market Undervaluing the Ongoing Turnaround?

Reviewed by Simply Wall St

If you’ve been watching Telia Company (OM:TELIA) lately, you might have noticed some interesting moves under the surface. There was no single event that sent shockwaves through the market this week. However, a steady climb over the past month has started to catch the eye of investors. With no major headlines to attribute the change to, the price action might indicate that investors are reassessing the stock or anticipating a shift in future growth.

Telia Company’s journey this year has been a story of gradual recovery. The stock has increased nearly 14% since January, with an upswing of almost 3% in the past month, while three-year returns have reached 22%. There is a sense that momentum is slow but positive, even as the company’s revenue shrank slightly in the last twelve months. The picture is further complicated by a significant rise in net income during the period, suggesting that cost control or shifting operations may be driving improvement beneath the top line.

With the share price reflecting these signals and the company showing mixed growth metrics, the question remains whether Telia Company is trading at a bargain or if the market has already priced in any future upside.

Most Popular Narrative: 0.7% Undervalued

The most widely followed narrative suggests that Telia Company is trading slightly below its estimated fair value. The current market price does not fully reflect the company’s future earnings potential and operational improvements.

Ongoing transformation and portfolio restructuring, such as the exit from non-core markets (Latvia) and targeted acquisitions (Bredband2), enable more focused capital allocation in core Nordic/Baltic operations. This is improving earnings quality and enhancing ROE and long-term earnings growth.

Want to uncover why analysts see Telia Company as almost perfectly valued, with just a sliver of upside left? The critical driver behind this fair value rests on a bold transformation narrative and key financial projections that Wall Street is betting on. Wondering which assumptions could tip the balance for Telia’s stock over the coming years? The answers might surprise you if you read on.

Result: Fair Value of $35.82 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent digital disruption and fierce competition from new entrants could quickly erode Telia’s pricing power. This casts doubt on these optimistic projections.

Find out about the key risks to this Telia Company narrative.Another Perspective: What Do Market Ratios Suggest?

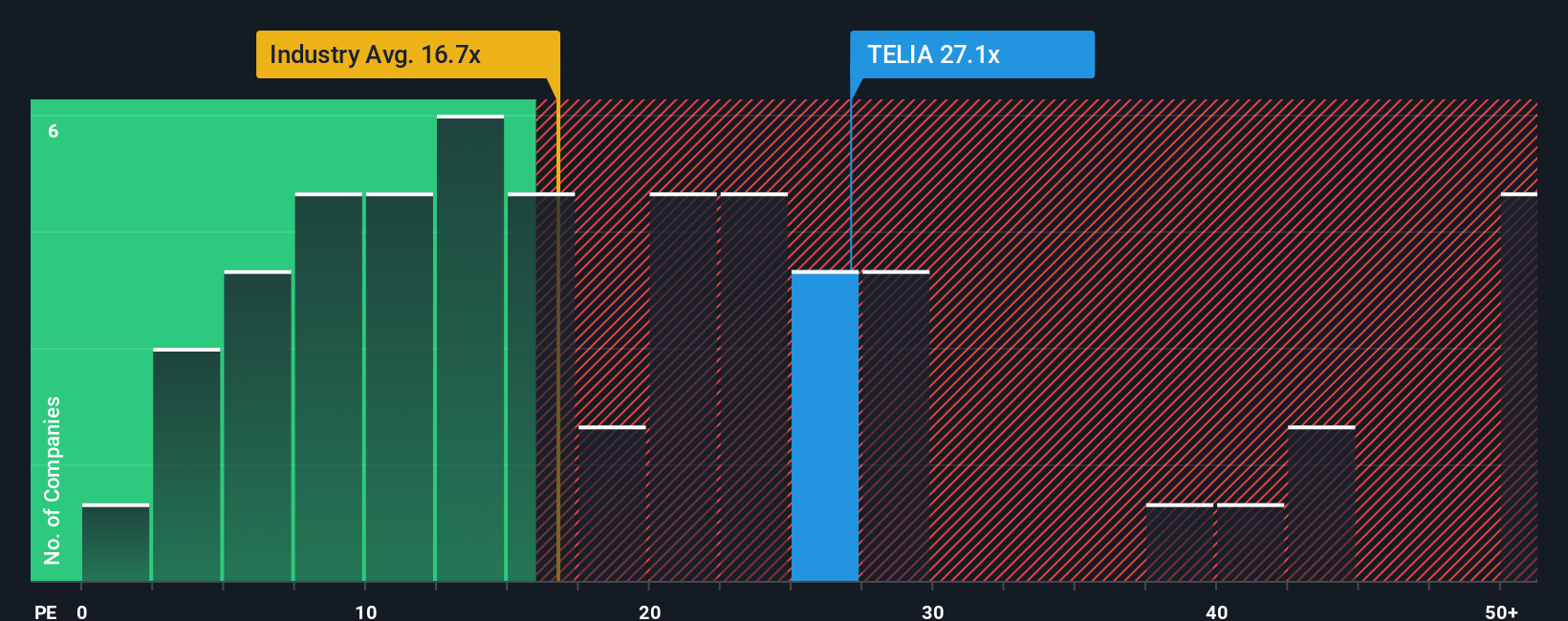

Looking at it from a market multiples lens, Telia appears more expensive relative to the European industry average, despite earlier hints at value. This raises the question: Has the market overestimated Telia's strengths?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Telia Company to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Telia Company Narrative

If you see things differently or want to dig into the numbers yourself, you can easily piece together your perspective in just a few minutes. Do it your way

A great starting point for your Telia Company research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t limit your opportunities. There are plenty of compelling stocks making waves right now. Let the Simply Wall Street Screener help you spot your next big winner before everyone else does.

- Spot under-the-radar companies trading at a fraction of their true value with our selection of undervalued stocks based on cash flows.

- Capitalize on explosive breakthroughs ushering in the future of health with leaders in artificial intelligence for medicine: healthcare AI stocks.

- Catch exciting up-and-comers with rock-solid financials using our hub for penny stocks with strong financials.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Telia Company might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About OM:TELIA

Telia Company

Provides communication services to businesses, individuals, families, and communities in Sweden, Finland, Norway, Denmark, Lithuania, Estonia, and Latvia.

Solid track record second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives