- Sweden

- /

- Telecom Services and Carriers

- /

- OM:BAHN B

Swedish Undiscovered Gems Backed By Strong Fundamentals

Reviewed by Simply Wall St

As European markets continue to rally, bolstered by slower inflation and potential interest rate cuts from the ECB, investors are increasingly looking for opportunities in lesser-known regions. Sweden's small-cap sector, often overshadowed by its larger counterparts, presents a fertile ground for finding undiscovered gems backed by strong fundamentals. In the current market environment where value stocks are outperforming growth shares and economic indicators show resilience despite global uncertainties, identifying stocks with robust financial health and promising growth prospects becomes crucial.

Top 10 Undiscovered Gems With Strong Fundamentals In Sweden

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Softronic | NA | 3.58% | 7.41% | ★★★★★★ |

| Duni | 29.33% | 10.78% | 22.98% | ★★★★★★ |

| Bahnhof | NA | 9.02% | 15.02% | ★★★★★★ |

| AB Traction | NA | 5.38% | 5.19% | ★★★★★★ |

| Firefly | NA | 16.04% | 32.29% | ★★★★★★ |

| Creades | NA | -28.54% | -27.09% | ★★★★★★ |

| AQ Group | 7.30% | 14.89% | 22.26% | ★★★★★★ |

| Byggmästare Anders J Ahlström Holding | NA | 30.31% | -9.00% | ★★★★★★ |

| Linc | NA | 56.01% | 0.54% | ★★★★★★ |

| Solid Försäkringsaktiebolag | NA | 7.64% | 28.44% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Bahnhof (OM:BAHN B)

Simply Wall St Value Rating: ★★★★★★

Overview: Bahnhof AB (publ) operates in the Internet and telecommunications sector across Sweden and Europe, with a market cap of SEK5.78 billion.

Operations: Bahnhof AB (publ) generates revenue primarily from its Internet and telecommunications services in Sweden and Europe. The company has a market cap of SEK5.78 billion.

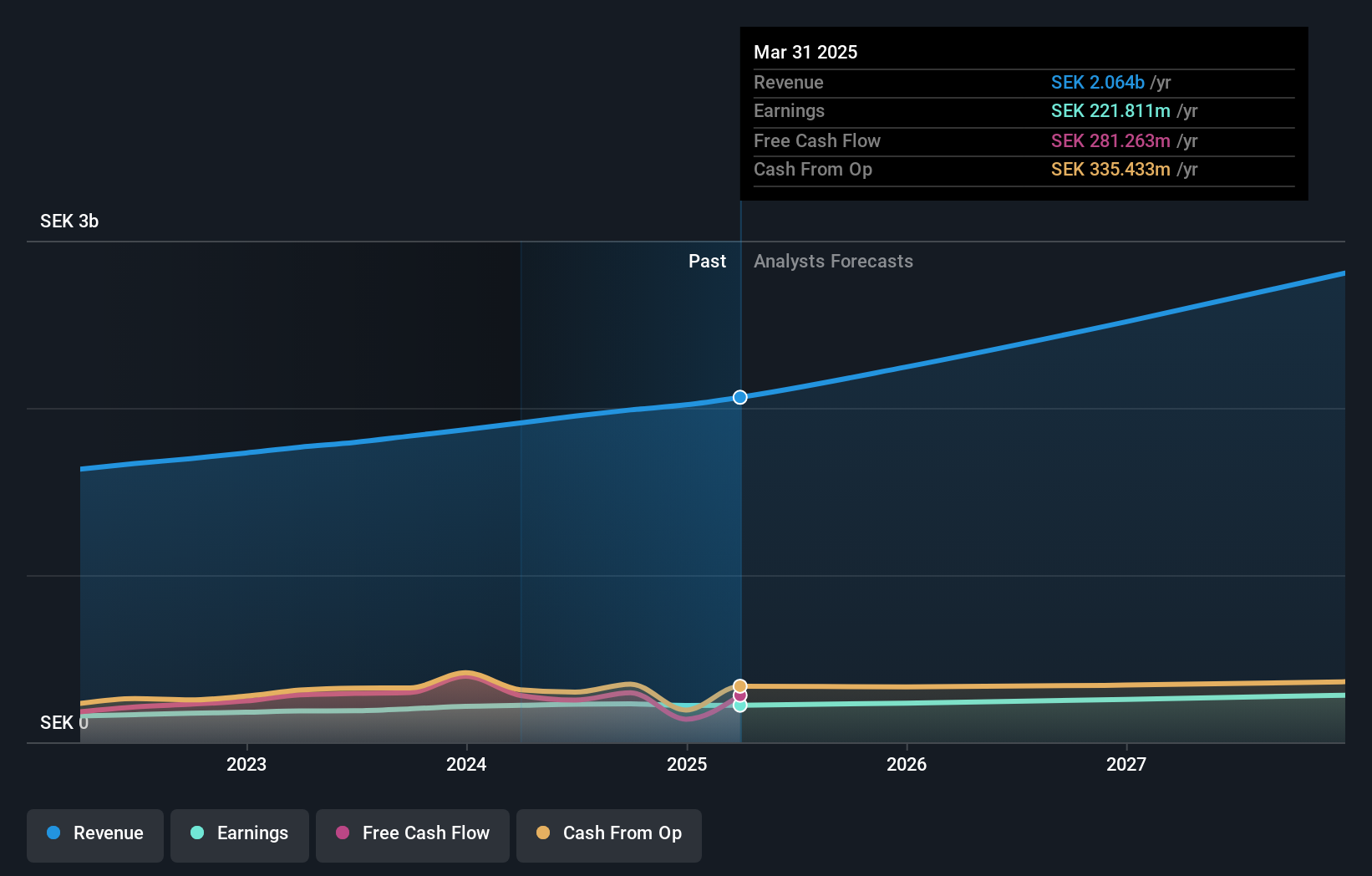

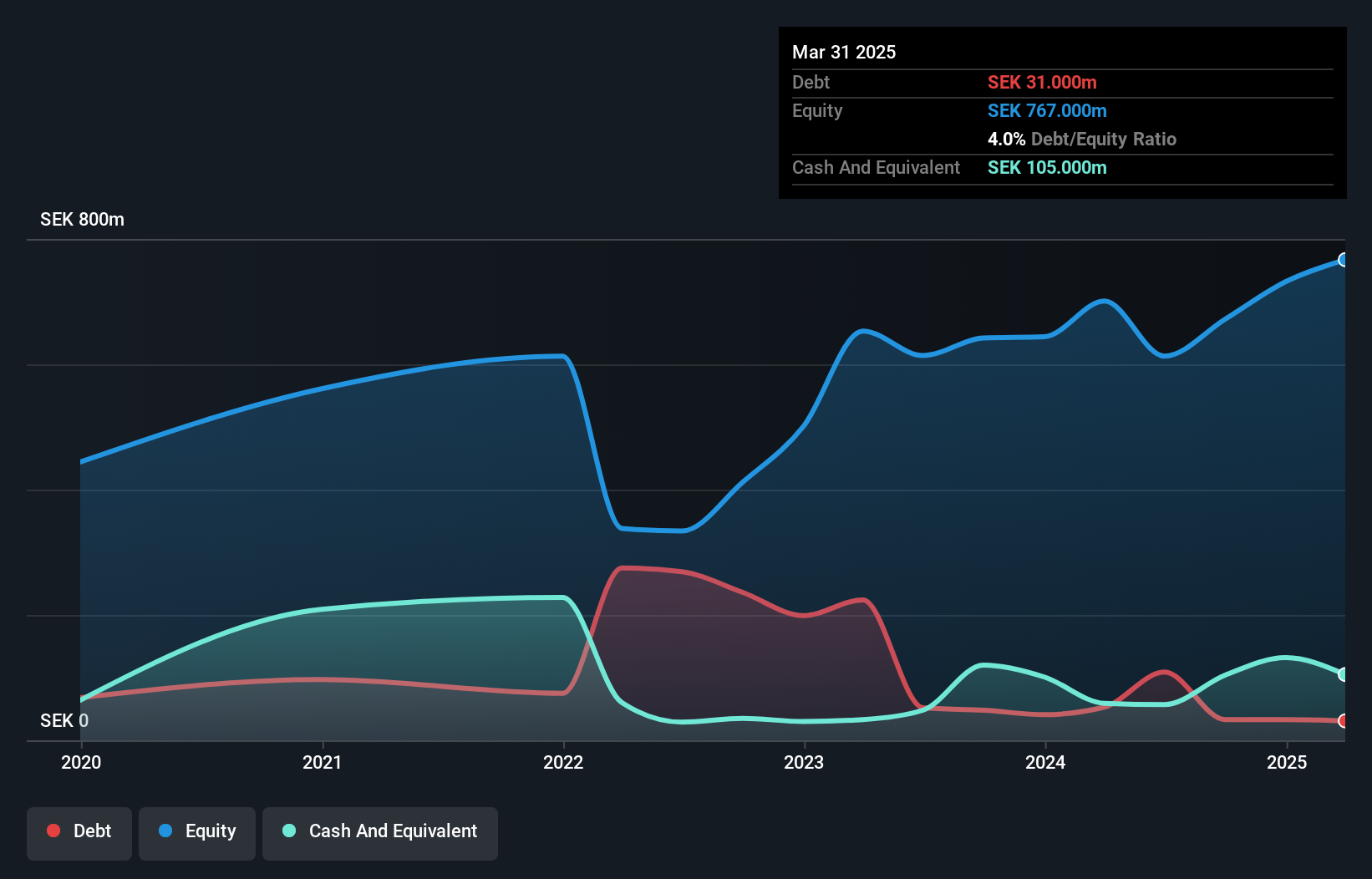

Bahnhof has shown impressive performance, with earnings growth of 21% over the past year, outpacing the Telecom industry's 5.4%. The company reported Q2 sales of SEK 500.88 million and net income of SEK 53.71 million, up from SEK 459.06 million and SEK 46.44 million respectively a year ago. Trading at about 5% below its fair value estimate, Bahnhof is debt-free now compared to a debt-to-equity ratio of 1.4 five years ago.

engcon (OM:ENGCON B)

Simply Wall St Value Rating: ★★★★★☆

Overview: Engcon AB (publ) designs, produces, and sells excavator tools across various regions including Europe, the Americas, Asia, and Oceania with a market cap of SEK18.00 billion.

Operations: Engcon AB (publ) generates revenue primarily from the sale of construction machinery and equipment, amounting to SEK1.54 billion. The company's net profit margin is %.

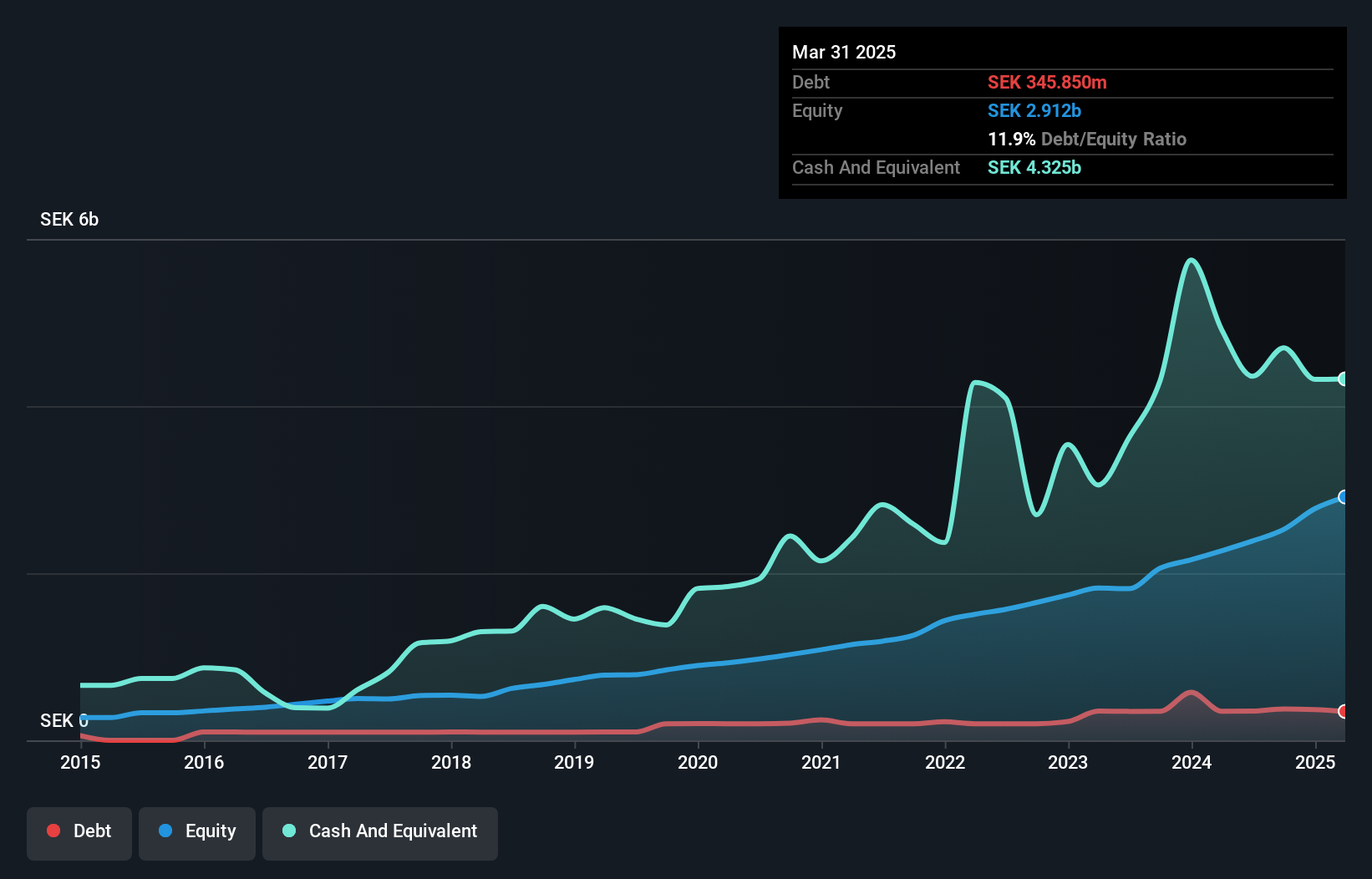

Engcon, a niche player in the machinery sector, has seen its net income drop to SEK 55 million in Q2 2024 from SEK 83 million last year. The company's debt to equity ratio stands at a satisfactory 8.5%, with interest payments well covered by EBIT at 20.4x. Despite profitability concerns, Engcon's earnings are expected to grow by nearly 44% annually. Additionally, the firm recently appointed Anders Smith as COO to bolster future expansion efforts starting January next year.

- Click here to discover the nuances of engcon with our detailed analytical health report.

Evaluate engcon's historical performance by accessing our past performance report.

TF Bank (OM:TFBANK)

Simply Wall St Value Rating: ★★★★☆☆

Overview: TF Bank AB (publ) is a digital bank offering consumer banking services and e-commerce solutions via its proprietary IT platform, with a market cap of SEK5.72 billion.

Operations: TF Bank AB (publ) generates revenue primarily from three segments: Credit Cards (SEK511.24 million), Consumer Lending (SEK607.24 million), and E-commerce Solutions excluding Credit Cards (SEK363.28 million).

TF Bank has shown impressive growth, with earnings increasing by 21.3% over the past year, outpacing the industry average of 10.4%. The bank's total assets stand at SEK24.1B, while total equity is SEK2.4B. Total deposits amount to SEK20.7B against loans of SEK19.4B, indicating robust financial health despite a high level of bad loans at 10.6%. Additionally, TF Bank trades significantly below its estimated fair value and recently established Rediem Capital AB to manage non-performing exposures effectively from January 2025 onward.

- Navigate through the intricacies of TF Bank with our comprehensive health report here.

Understand TF Bank's track record by examining our Past report.

Seize The Opportunity

- Click this link to deep-dive into the 55 companies within our Swedish Undiscovered Gems With Strong Fundamentals screener.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bahnhof might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BAHN B

Bahnhof

Engages in the Internet and telecommunications business in Sweden and rest of Europe.

Outstanding track record with flawless balance sheet and pays a dividend.