- Sweden

- /

- Telecom Services and Carriers

- /

- OM:BAHN B

Bahnhof's (NGM:BAHN B) Upcoming Dividend Will Be Larger Than Last Year's

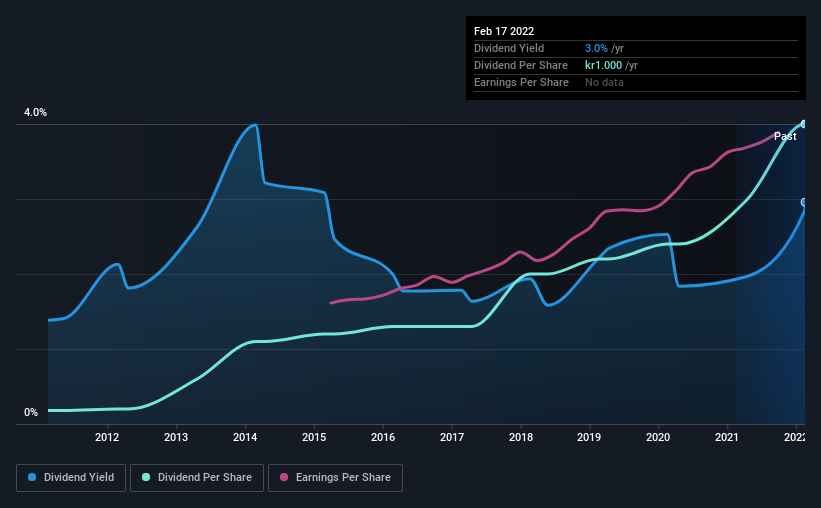

Bahnhof AB (publ) (NGM:BAHN B) will increase its dividend on the 18th of May to kr1.00. Although the dividend is now higher, the yield is only 3.0%, which is below the industry average.

View our latest analysis for Bahnhof

Bahnhof's Payment Has Solid Earnings Coverage

The dividend yield is a little bit low, but sustainability of the payments is also an important part of evaluating an income stock. Based on the last payment, Bahnhof was quite comfortably earning enough to cover the dividend. This indicates that quite a large proportion of earnings is being invested back into the business.

Looking forward, earnings per share could rise by 14.6% over the next year if the trend from the last few years continues. Assuming the dividend continues along recent trends, we think the payout ratio could be 74% by next year, which is in a pretty sustainable range.

Bahnhof Has A Solid Track Record

The company has an extended history of paying stable dividends. Since 2012, the first annual payment was kr0.045, compared to the most recent full-year payment of kr1.00. This implies that the company grew its distributions at a yearly rate of about 36% over that duration. It is good to see that there has been strong dividend growth, and that there haven't been any cuts for a long time.

The Dividend Looks Likely To Grow

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. We are encouraged to see that Bahnhof has grown earnings per share at 15% per year over the past five years. Earnings are on the uptrend, and it is only paying a small portion of those earnings to shareholders.

Bahnhof Looks Like A Great Dividend Stock

In summary, it is always positive to see the dividend being increased, and we are particularly pleased with its overall sustainability. Distributions are quite easily covered by earnings, which are also being converted to cash flows. All of these factors considered, we think this has solid potential as a dividend stock.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. See if management have their own wealth at stake, by checking insider shareholdings in Bahnhof stock. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Valuation is complex, but we're here to simplify it.

Discover if Bahnhof might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:BAHN B

Bahnhof

Engages in the Internet and telecommunications business in Sweden and rest of Europe.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success