- Sweden

- /

- Communications

- /

- OM:WAYS

Take Care Before Jumping Onto Waystream Holding AB (publ) (STO:WAYS) Even Though It's 26% Cheaper

To the annoyance of some shareholders, Waystream Holding AB (publ) (STO:WAYS) shares are down a considerable 26% in the last month, which continues a horrid run for the company. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 42% in that time.

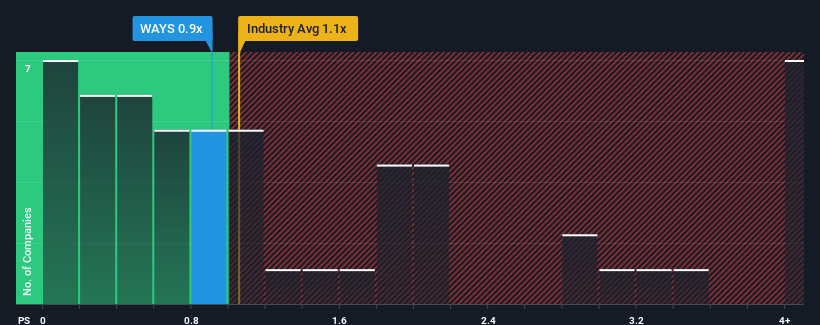

Since its price has dipped substantially, Waystream Holding may be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.9x, considering almost half of all companies in the Communications industry in Sweden have P/S ratios greater than 1.8x and even P/S higher than 5x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Waystream Holding

How Waystream Holding Has Been Performing

With revenue that's retreating more than the industry's average of late, Waystream Holding has been very sluggish. It seems that many are expecting the dismal revenue performance to persist, which has repressed the P/S. You'd much rather the company improve its revenue performance if you still believe in the business. Or at the very least, you'd be hoping the revenue slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

Keen to find out how analysts think Waystream Holding's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as low as Waystream Holding's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a frustrating 12% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 28% overall rise in revenue. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 24% during the coming year according to the two analysts following the company. That's shaping up to be materially higher than the 5.0% growth forecast for the broader industry.

With this in consideration, we find it intriguing that Waystream Holding's P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What Does Waystream Holding's P/S Mean For Investors?

Waystream Holding's P/S has taken a dip along with its share price. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

A look at Waystream Holding's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. There could be some major risk factors that are placing downward pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Waystream Holding that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Waystream Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:WAYS

Waystream Holding

Provides routers and switches that are used in the fiber markets and peripherals in Sweden.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives