- Sweden

- /

- Communications

- /

- OM:TAGM B

Investors Still Aren't Entirely Convinced By TagMaster AB (publ)'s (STO:TAGM B) Revenues Despite 28% Price Jump

The TagMaster AB (publ) (STO:TAGM B) share price has done very well over the last month, posting an excellent gain of 28%. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 18% in the last twelve months.

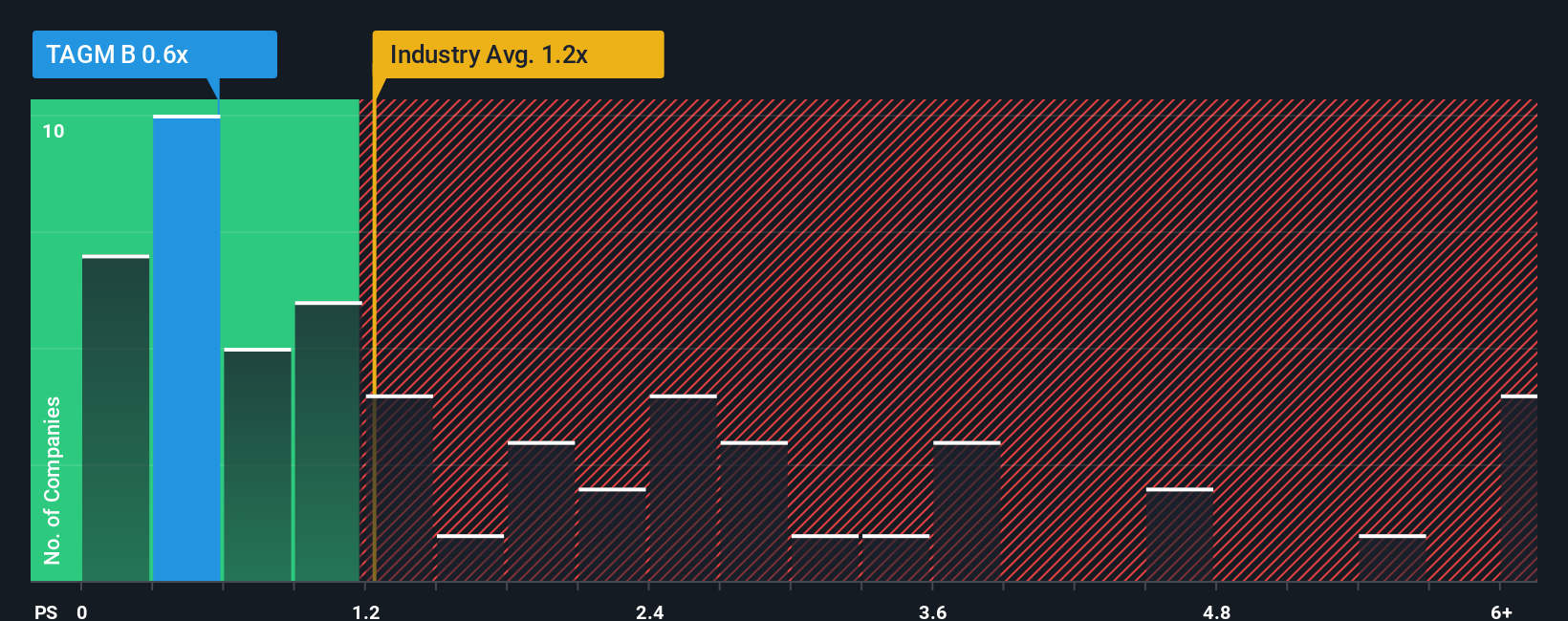

In spite of the firm bounce in price, considering around half the companies operating in Sweden's Communications industry have price-to-sales ratios (or "P/S") above 2.1x, you may still consider TagMaster as an solid investment opportunity with its 0.6x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for TagMaster

How TagMaster Has Been Performing

With its revenue growth in positive territory compared to the declining revenue of most other companies, TagMaster has been doing quite well of late. One possibility is that the P/S ratio is low because investors think the company's revenue is going to fall away like everyone else's soon. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on TagMaster will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

TagMaster's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered a decent 3.5% gain to the company's revenues. The solid recent performance means it was also able to grow revenue by 26% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Turning to the outlook, the next year should generate growth of 13% as estimated by the sole analyst watching the company. Meanwhile, the rest of the industry is forecast to only expand by 1.1%, which is noticeably less attractive.

In light of this, it's peculiar that TagMaster's P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Final Word

The latest share price surge wasn't enough to lift TagMaster's P/S close to the industry median. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

TagMaster's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

We don't want to rain on the parade too much, but we did also find 4 warning signs for TagMaster (1 is potentially serious!) that you need to be mindful of.

If you're unsure about the strength of TagMaster's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if TagMaster might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:TAGM B

TagMaster

An application oriented technical company, develops and sells advanced sensor systems and solutions based on radio, radar, magnetic and camera technologies under the TagMaster, Sensys Networks, and Citilog brand names.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives