Three Stocks Estimated To Be Trading Below Their Intrinsic Value In December 2024

Reviewed by Simply Wall St

As global markets continue to reach record highs, driven by strong consumer spending and geopolitical developments, investors are increasingly looking for opportunities among stocks that may be trading below their intrinsic value. In this environment of robust market activity, identifying undervalued stocks requires careful consideration of factors such as economic stability and potential tariff impacts, which can influence a stock's perceived worth relative to its actual financial health and growth prospects.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| NBT Bancorp (NasdaqGS:NBTB) | US$50.01 | US$99.93 | 50% |

| HangzhouS MedTech (SHSE:688581) | CN¥62.38 | CN¥124.04 | 49.7% |

| Sudarshan Chemical Industries (BSE:506655) | ₹1118.85 | ₹2224.27 | 49.7% |

| Bank BTPN Syariah (IDX:BTPS) | IDR900.00 | IDR1786.71 | 49.6% |

| Iguatemi (BOVESPA:IGTI3) | R$2.26 | R$4.49 | 49.7% |

| Pluk Phak Praw Rak Mae (SET:OKJ) | THB15.50 | THB30.86 | 49.8% |

| AirBoss of America (TSX:BOS) | CA$4.05 | CA$8.05 | 49.7% |

| Shanghai INT Medical Instruments (SEHK:1501) | HK$27.25 | HK$54.11 | 49.6% |

| Genesis Minerals (ASX:GMD) | A$2.41 | A$4.82 | 50% |

| Akeso (SEHK:9926) | HK$66.50 | HK$132.38 | 49.8% |

Let's take a closer look at a couple of our picks from the screened companies.

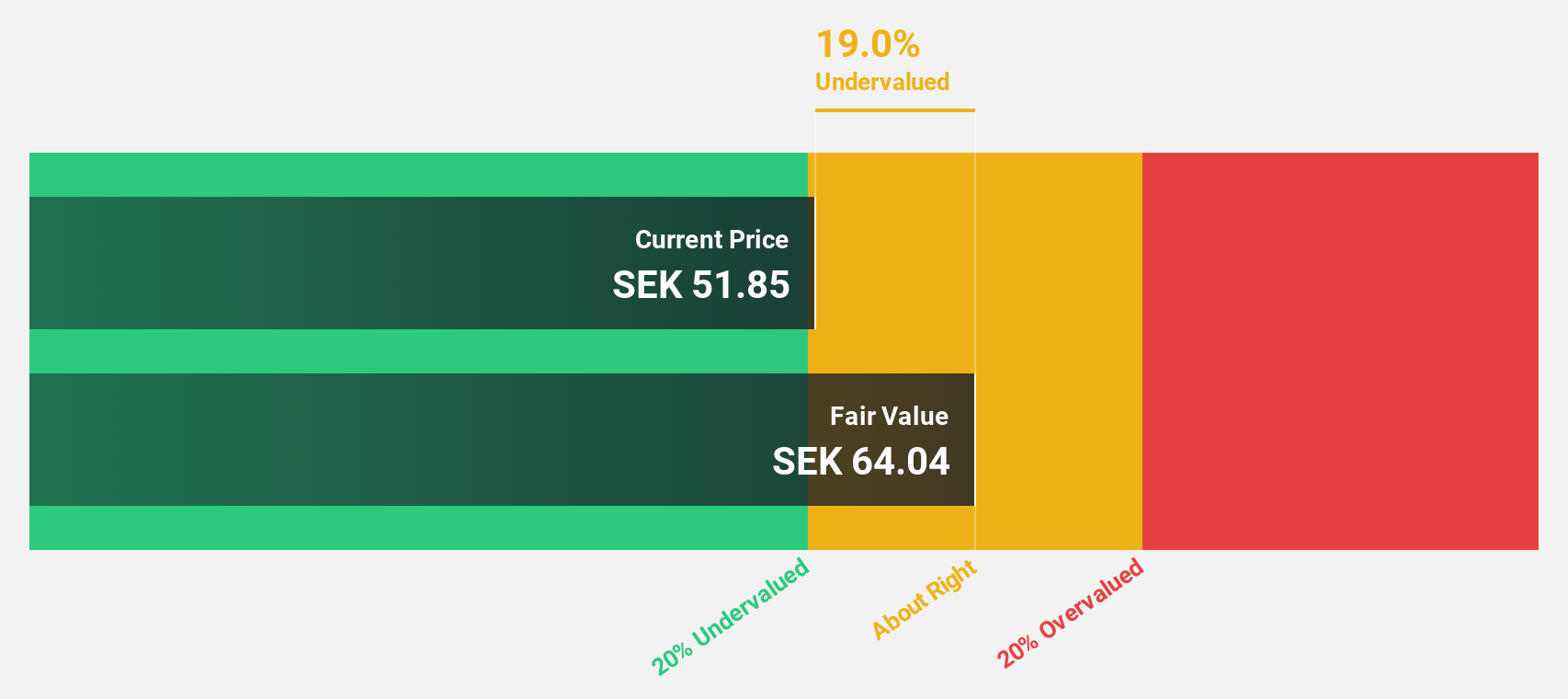

NCAB Group (OM:NCAB)

Overview: NCAB Group AB (publ) is a company that manufactures and sells printed circuit boards (PCBs) across Sweden, the Nordic region, the rest of Europe, North America, and Asia, with a market cap of SEK11.43 billion.

Operations: The company's revenue segments are distributed as follows: East SEK210.60 million, Europe SEK1.91 billion, Nordic SEK756.10 million, and North America SEK786.70 million.

Estimated Discount To Fair Value: 17.9%

NCAB Group is trading at SEK61.15, below its fair value estimate of SEK74.45, indicating undervaluation based on cash flows despite significant insider selling in the past quarter. Earnings are forecast to grow significantly at 24.8% annually, outpacing the Swedish market's growth rate of 15.1%. However, recent earnings show a decline with Q3 revenue at SEK899 million compared to SEK1,030.1 million last year due to economic challenges in Europe affecting sales and profitability.

- According our earnings growth report, there's an indication that NCAB Group might be ready to expand.

- Click here to discover the nuances of NCAB Group with our detailed financial health report.

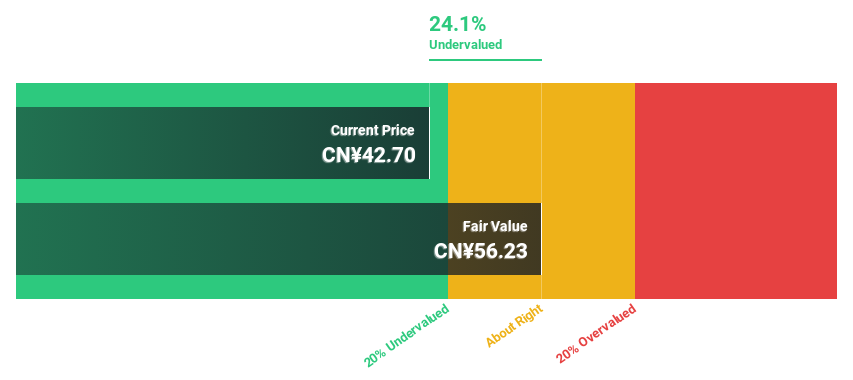

Suzhou Recodeal Interconnect SystemLtd (SHSE:688800)

Overview: Suzhou Recodeal Interconnect System Co., Ltd engages in the development, production, and sale of connection systems and microwave components globally, with a market capitalization of CN¥6.77 billion.

Operations: The company's revenue primarily comes from its Electric Equipment segment, which generated CN¥2.10 billion.

Estimated Discount To Fair Value: 21.7%

Suzhou Recodeal Interconnect System Ltd. is trading at CN¥43, below its estimated fair value of CN¥54.92, highlighting potential undervaluation based on cash flows. Revenue for the first nine months of 2024 increased to CN¥1.59 billion from CN¥1.04 billion a year ago, with net income rising to CN¥105.96 million from CN¥95.81 million, despite lower profit margins than last year and high share price volatility recently observed in the market.

- Our earnings growth report unveils the potential for significant increases in Suzhou Recodeal Interconnect SystemLtd's future results.

- Take a closer look at Suzhou Recodeal Interconnect SystemLtd's balance sheet health here in our report.

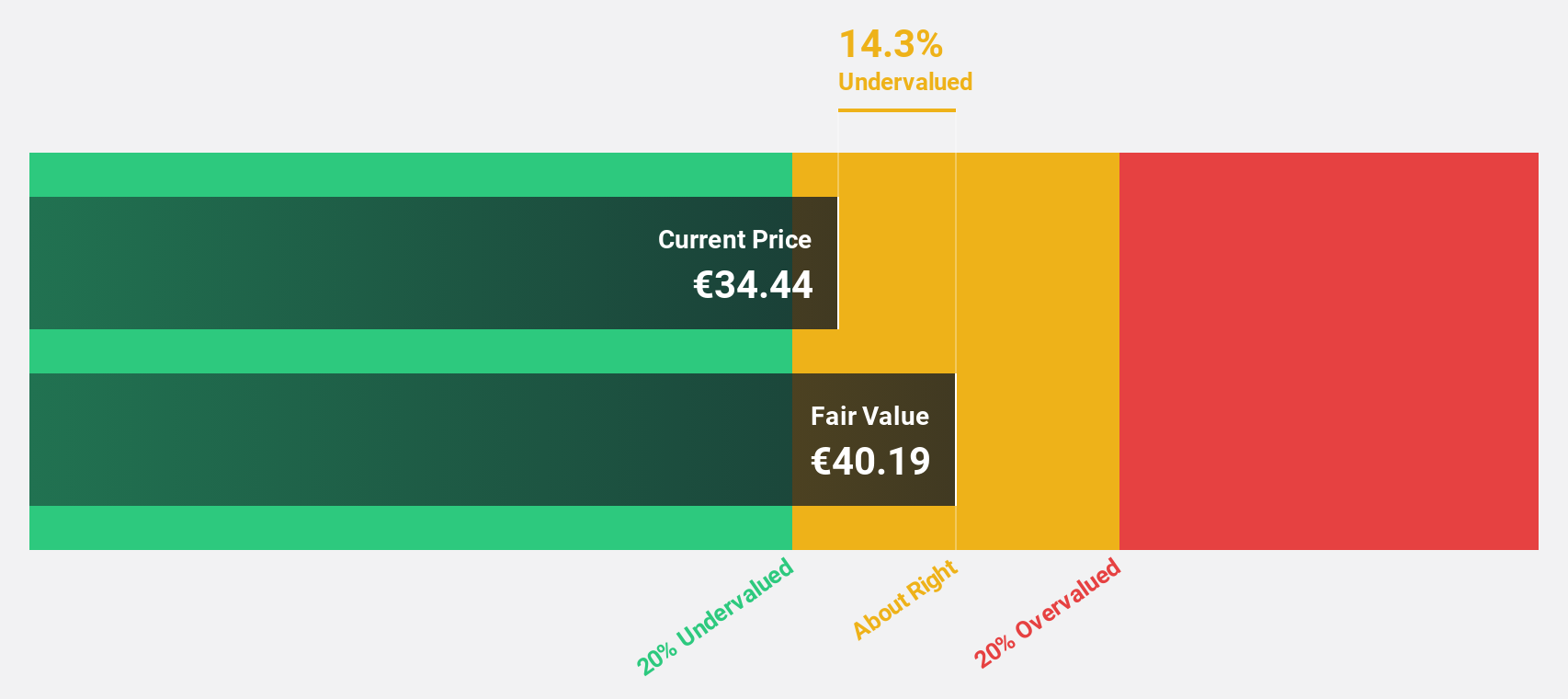

Voestalpine (WBAG:VOE)

Overview: Voestalpine AG processes, develops, manufactures, and sells steel products in Austria, the European Union, and internationally with a market cap of €3.16 billion.

Operations: The company's revenue segments include the Steel Division (€6.30 billion), Metal Forming Division (€3.45 billion), Metal Engineering Division (€4.35 billion), and High Performance Metals Division (€3.71 billion).

Estimated Discount To Fair Value: 21.6%

Voestalpine is trading at €18.46, below its estimated fair value of €23.55, suggesting undervaluation based on cash flows. Despite a challenging year with second-quarter sales dropping to €3.9 billion from €4 billion and net income falling to €25.3 million from €88.5 million, earnings are forecasted to grow significantly at 61.2% annually over the next three years, outpacing the Austrian market's growth rate of 8.7%.

- Our expertly prepared growth report on Voestalpine implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in Voestalpine's balance sheet health report.

Taking Advantage

- Click this link to deep-dive into the 893 companies within our Undervalued Stocks Based On Cash Flows screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NCAB Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:NCAB

NCAB Group

Manufactures and sells printed circuit boards (PCBs) in Sweden, Nordic region, rest of Europe, North America, and Asia.

High growth potential with excellent balance sheet.