NCAB Group (OM:NCAB) Margin Drop Tests Growth Narrative as Premium Valuation Faces Scrutiny

Reviewed by Simply Wall St

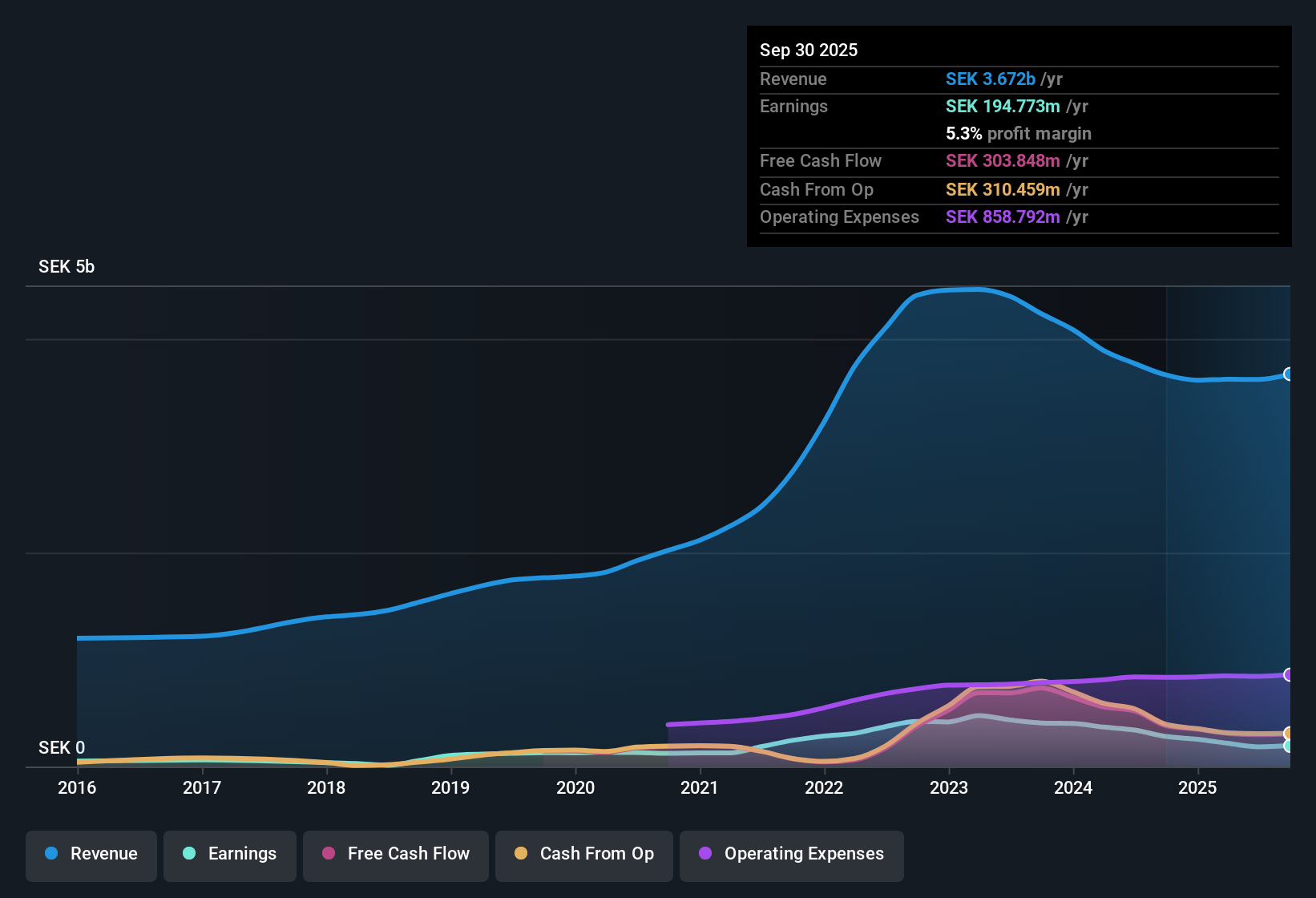

NCAB Group (OM:NCAB) delivered 8.6% annual earnings growth over the past five years and recently reported high quality earnings. However, its net profit margin stands at 5.1%, down from 9% last year. The share price currently sits at SEK57.55, above the estimated fair value of SEK55.56. The stock is trading at a Price-to-Earnings Ratio of 58.5x, a notable premium versus peers and the broader European electronics industry. Investors are eyeing the forecasted 27% earnings growth and 6.6% annual revenue growth as key rewards, while recent margin declines and emerging financial risks temper the outlook.

See our full analysis for NCAB Group.Now let’s see how these headline results compare with the most widely followed narratives and expectations in the community. Sometimes they align, but surprises and fresh questions often emerge.

See what the community is saying about NCAB Group

Profit Margin Recovery Tied to Higher-Value PCBs

- Analysts expect profit margins to rebound from the current 5.1% to 10.3% in three years, as NCAB Group pivots toward advanced, engineering-supported PCB applications that deliver stronger pricing power.

- The analysts' consensus view notes that successful expansion into higher-margin segments, along with the ability to pass through tariff-related costs in North America, could help offset the margin pressures seen from supply chain disruptions and pricing competition.

- Higher-margin PCB categories in aerospace and high-tech markets are supporting resilience, even with Europe facing pricing headwinds.

- Analysts are closely watching if the ongoing sectoral shifts and M&A integration can sustainably drive margins higher, given the drop from last year's 9% margin to the current 5.1%.

- To see how NCAB's margin trends tie into its broader story, check out the numbers behind the consensus narrative for a deeper dive into analyst expectations and future outlook. 📊 Read the full NCAB Group Consensus Narrative.

Forecast Points to 27% Annual Earnings Growth

- Projected annual earnings growth of 27% is well ahead of the Swedish market's 12.6% average, as analysts model SEK 481.0 million in earnings within three years, assuming steady share count.

- The analysts' consensus view highlights that such strong growth forecasts rest on continued sector digitization and electrification, successful pass-through of input costs, and operational gains from recent M&A activity.

- NCAB's customer base is expanding as a result of ongoing consolidation and broadening demand across Europe and the US, suggesting a possible longer-term runway for the high growth modeled by analysts.

- Despite these tailwinds, consensus also flags that maintaining this pace depends on global recovery momentum and flawless execution of strategy, which is not assured given the recent margin compression and external supply risks.

Valuation Lofty vs. Industry and DCF Fair Value

- NCAB Group's 58.5x Price-to-Earnings ratio and SEK 57.55 share price represent a substantial premium compared to both the peer average of 41.3x and the European electronics industry average of 26.0x, and currently stand above the DCF fair value estimate of SEK 55.56.

- The analysts' consensus view underscores that for the premium to make sense, NCAB would need to deliver on its growth targets and then trade down to a PE of 26x by 2028, meaning today's investors are betting on both rapid earnings expansion and multiple compression being realized at the same time.

- If margins and growth targets fall short, the current premium may appear stretched, especially if sector sentiment cools or discount rates rise.

- What stands out is that analysts’ consensus price target (SEK 55.00) is actually below the current market price, implying expectations are already running hot and future outperformance is far from guaranteed.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for NCAB Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Got a unique read on the figures? In just a few minutes, you can build and share your own take on the story. Do it your way

A great starting point for your NCAB Group research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

NCAB Group’s high valuation premium and recent margin declines mean investors face real risk if earnings or growth targets slip.

If you want to focus on opportunities with stronger value upside and less premium risk, check out these 875 undervalued stocks based on cash flows before making your next move.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NCAB Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:NCAB

NCAB Group

Engages in the manufacture and sale of printed circuit boards (PCBs) in Sweden, Nordic region, rest of Europe, North America, and Asia.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives