- Sweden

- /

- Communications

- /

- OM:HMS

Swedish Exchange's Top 3 Value Picks For September 2024

Reviewed by Simply Wall St

As European inflation nears the central bank’s target, the Swedish stock market has shown resilience amid broader economic fluctuations. With value stocks outperforming growth shares by a significant margin recently, investors are increasingly looking for undervalued opportunities. In this context, identifying undervalued stocks can be particularly rewarding, as these investments often provide a solid foundation for growth when market conditions stabilize.

Top 10 Undervalued Stocks Based On Cash Flows In Sweden

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Sleep Cycle (OM:SLEEP) | SEK41.80 | SEK80.12 | 47.8% |

| QleanAir (OM:QAIR) | SEK26.20 | SEK51.12 | 48.7% |

| Concentric (OM:COIC) | SEK227.00 | SEK409.68 | 44.6% |

| Paradox Interactive (OM:PDX) | SEK143.80 | SEK258.31 | 44.3% |

| Lindab International (OM:LIAB) | SEK264.00 | SEK523.59 | 49.6% |

| Dometic Group (OM:DOM) | SEK68.15 | SEK131.06 | 48% |

| Serstech (OM:SERT) | SEK1.34 | SEK2.64 | 49.2% |

| Svedbergs Group (OM:SVED BTA B) | SEK36.30 | SEK65.51 | 44.6% |

| Candles Scandinavia (OM:CANDLE B) | SEK19.50 | SEK37.55 | 48.1% |

| MilDef Group (OM:MILDEF) | SEK82.00 | SEK161.49 | 49.2% |

We'll examine a selection from our screener results.

HMS Networks (OM:HMS)

Overview: HMS Networks AB (publ) provides products that enable industrial equipment to communicate and share information globally, with a market cap of SEK21.50 billion.

Operations: HMS Networks generates revenue primarily from the Wireless Communications Equipment segment, which amounts to SEK3.01 billion.

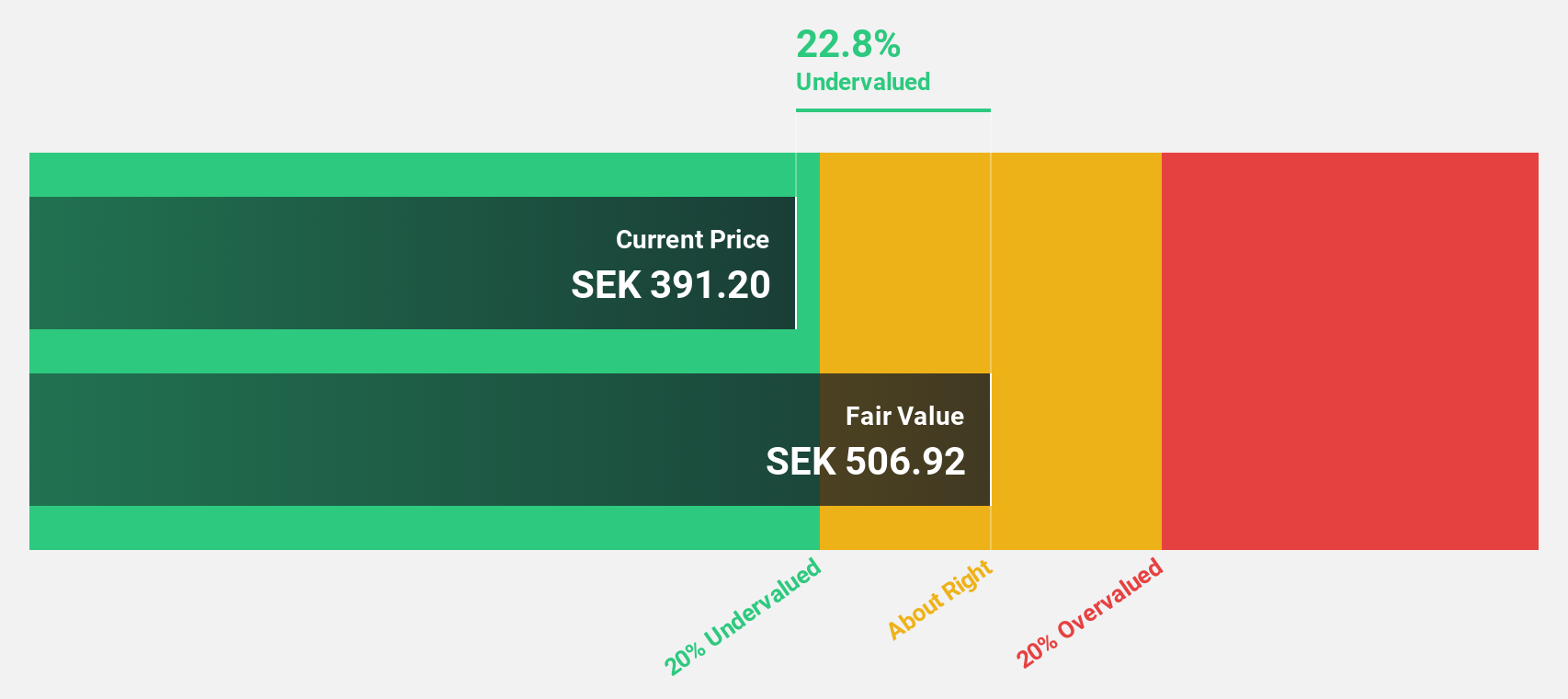

Estimated Discount To Fair Value: 10.7%

HMS Networks is trading at SEK 428.4, which is 10.7% below its estimated fair value of SEK 479.67, indicating it may be undervalued based on cash flows. Despite high debt levels and recent shareholder dilution, the company’s revenue and earnings are forecast to grow significantly faster than the Swedish market at rates of 16% and 29.6% per year respectively. However, profit margins have declined from 20.1% to 14%, reflecting some financial challenges.

- In light of our recent growth report, it seems possible that HMS Networks' financial performance will exceed current levels.

- Click here and access our complete balance sheet health report to understand the dynamics of HMS Networks.

Humble Group (OM:HUMBLE)

Overview: Humble Group AB (publ) refines, develops, and distributes fast-moving consumer products in Sweden and internationally, with a market cap of SEK5.46 billion.

Operations: The company's revenue segments include Future Snacking (SEK950 million), Sustainable Care (SEK2.30 billion), Quality Nutrition (SEK1.53 billion), and Nordic Distribution (SEK2.67 billion).

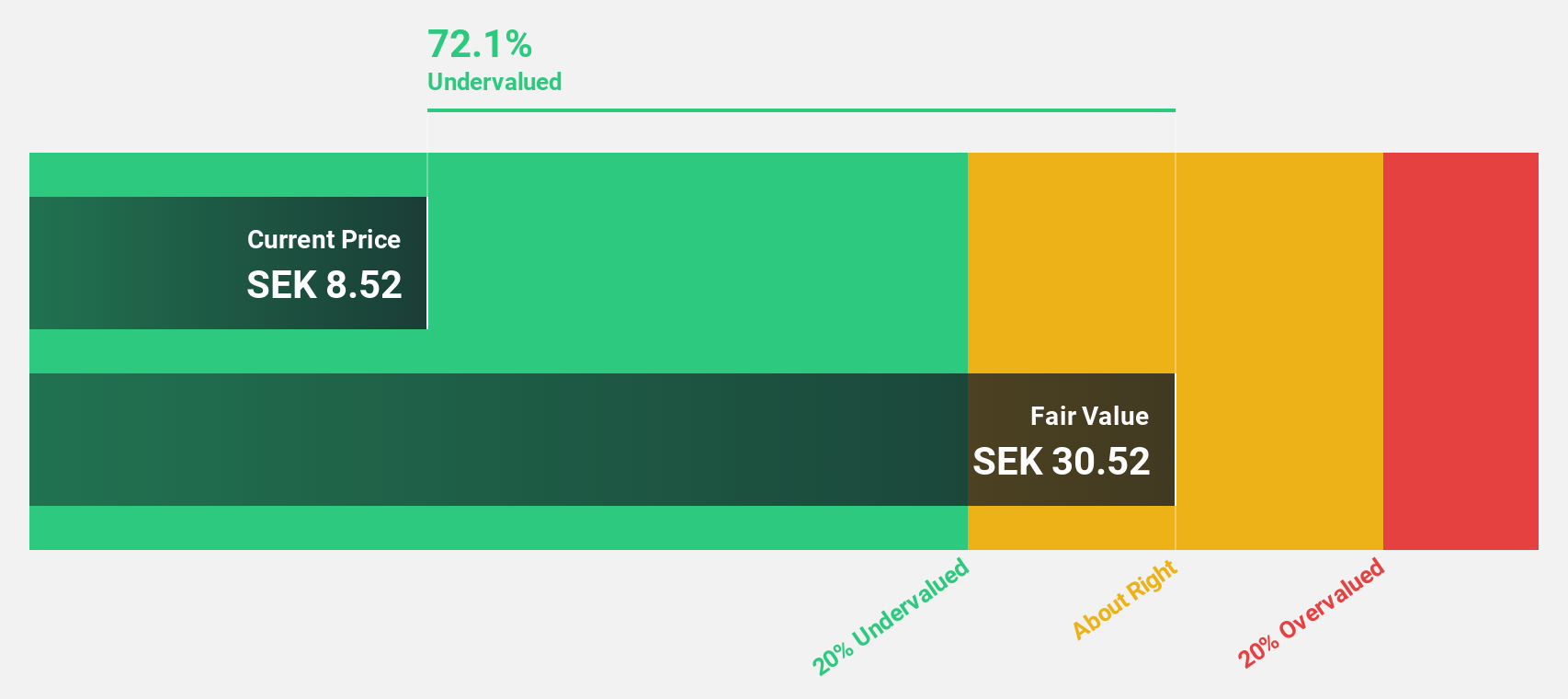

Estimated Discount To Fair Value: 37.5%

Humble Group, trading at SEK 12.22, is significantly undervalued based on cash flows with an estimated fair value of SEK 19.55. Revenue growth is projected at 11.5% annually, outpacing the Swedish market's 1%. Earnings are expected to grow by 78.3% per year, becoming profitable within three years. Recent earnings reports show a positive trend with net income of SEK 32 million for Q2 and SEK 55 million for H1 2024, reversing previous losses.

- Our growth report here indicates Humble Group may be poised for an improving outlook.

- Navigate through the intricacies of Humble Group with our comprehensive financial health report here.

Sweco (OM:SWEC B)

Overview: Sweco AB (publ) is a global provider of architecture and engineering consultancy services with a market cap of SEK60.38 billion.

Operations: Sweco's revenue segments include SEK1.47 billion from the UK, SEK3.50 billion from Norway, SEK8.74 billion from Sweden, SEK3.97 billion from Belgium, SEK3.24 billion from Denmark, SEK3.67 billion from Finland, SEK3.00 billion from the Netherlands, and SEK2.71 billion from Germany & Central Europe.

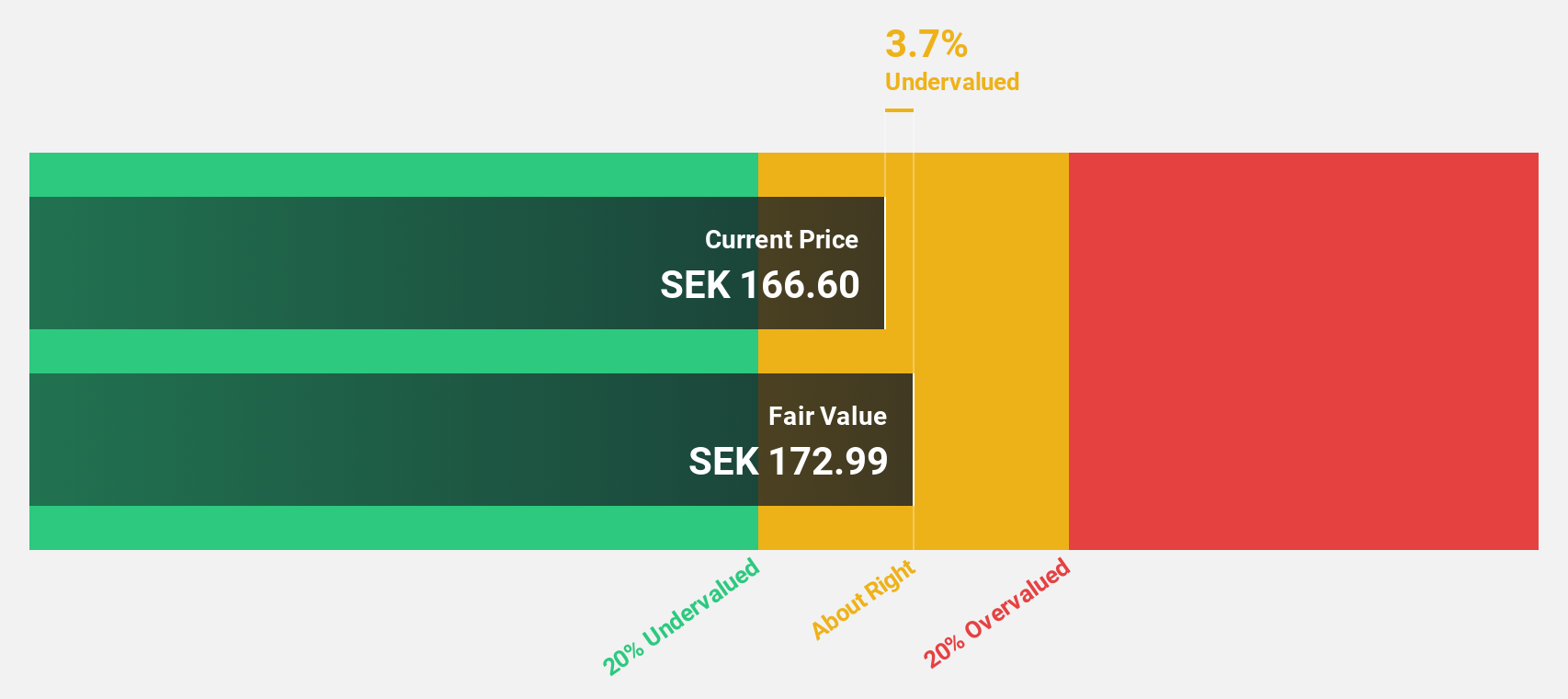

Estimated Discount To Fair Value: 27.2%

Sweco, trading at SEK 168, is undervalued based on cash flows with an estimated fair value of SEK 230.9. Earnings are forecast to grow by 17.3% annually, outpacing the Swedish market's 15.2%. Recent Q2 results show sales of SEK 8.08 billion and net income of SEK 540 million, up from SEK 7.25 billion and SEK 357 million respectively a year ago. Sweco secured significant contracts including a EUR 21 million agreement with the Danish Ministry of Defence Estate Agency and a SEK 400 million project for the Swedish Transport Administration.

- Our expertly prepared growth report on Sweco implies its future financial outlook may be stronger than recent results.

- Get an in-depth perspective on Sweco's balance sheet by reading our health report here.

Next Steps

- Access the full spectrum of 41 Undervalued Swedish Stocks Based On Cash Flows by clicking on this link.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HMS Networks might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:HMS

HMS Networks

Engages in the provision of products that enable industrial equipment to communicate and share information worldwide.

Reasonable growth potential with mediocre balance sheet.