- Sweden

- /

- Electronic Equipment and Components

- /

- OM:HEXA B

Hexagon (OM:HEXA B): A Fresh Look at Valuation After Recent Share Price Fluctuations

Reviewed by Simply Wall St

See our latest analysis for Hexagon.

Hexagon’s share price has been moving up and down this year, but momentum has slowed compared to earlier gains. While the latest 1-day share price return sits at 0.97%, and the 1-year total shareholder return stands at a robust 20.87%, more recent performance has softened with a 7-day return of -5.92%. Overall, the stock’s long-term performance remains positive. However, recent results suggest some profit-taking and shifting sentiment around growth potential.

If shifts like these have you reassessing your strategy, it’s a smart moment to widen your search and discover fast growing stocks with high insider ownership

With shares now treading water, the question for investors is whether Hexagon is now undervalued and primed for a rebound, or if the market is already factoring in all of the company’s future growth potential.

Most Popular Narrative: 10.1% Undervalued

Hexagon’s narrative valuation puts fair value notably above the latest share price, capturing attention as the company’s profitability outlook fuels analyst debate about what’s next.

The company's growing base of recurring software and SaaS revenues (particularly in Asset Lifecycle Intelligence and SIG) continues to improve the quality and predictability of Hexagon's revenue streams. This supports gross margin expansion and provides a stabilizing influence on earnings.

Want to know what’s powering this bold valuation call? One powerful trend in Hexagon’s earnings mix could make or break these bullish projections. Unpack what’s behind these high hopes and discover what could surprise the market next.

Result: Fair Value of $121.94 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing margin pressure from higher costs and prolonged weakness in key end-markets could quickly shift sentiment and challenge the current bullish outlook.

Find out about the key risks to this Hexagon narrative.

Another View: Is the Market Overlooking Valuation Risks?

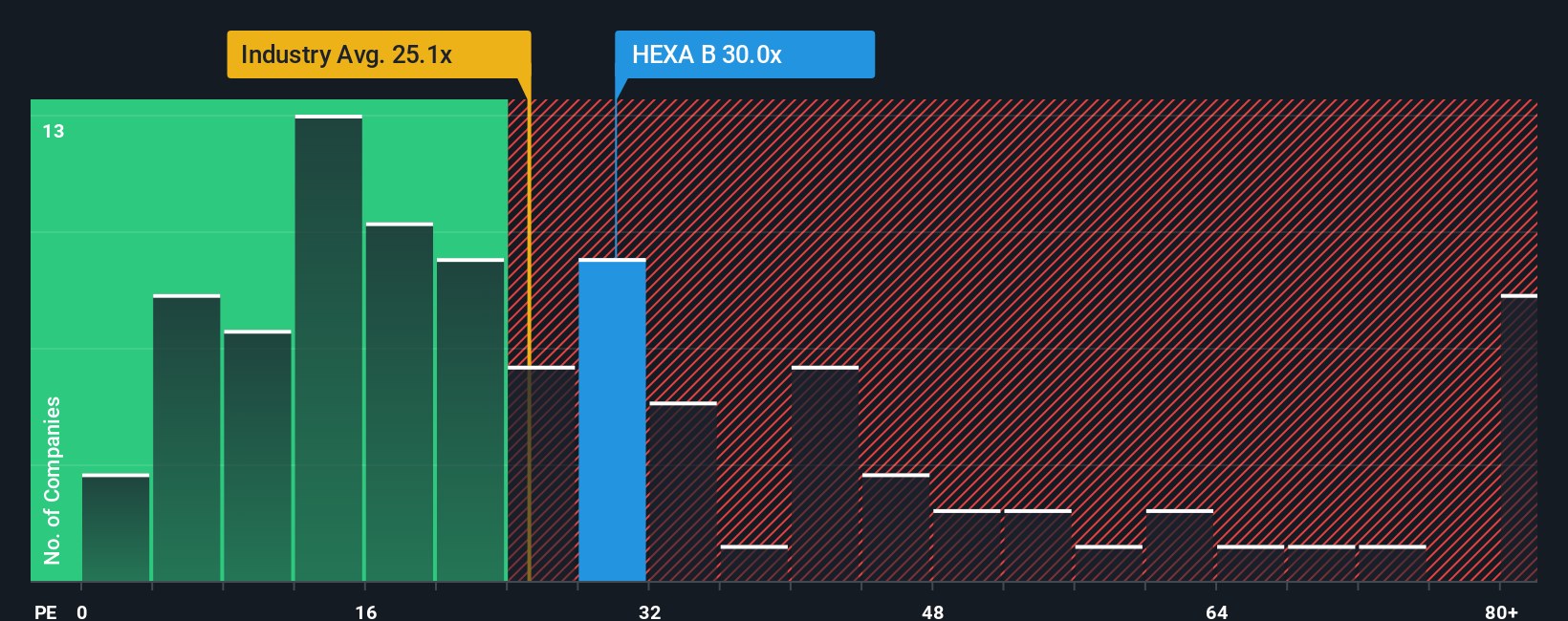

While the narrative approach points to Hexagon being undervalued, a look at its price-to-earnings ratio tells a different story. The company trades at 39.7 times earnings, which is notably higher than both its European industry average of 24.1x and peer average of 25.1x. Even HEXA B’s ratio is above the fair ratio of 38.2x, suggesting that by market standards, the shares look expensive. Does this valuation premium signal confidence in future growth, or could it leave investors exposed if expectations are not met?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hexagon Narrative

Keep in mind, if you see things differently or want to dig into the data yourself, you can shape your own view in just a few minutes, and Do it your way.

A great starting point for your Hexagon research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Make your next investing move with more confidence. Smart investors stay ahead by tracking unique opportunities. Don’t let potential winners pass you by.

- Capture the upside of technological disruption by checking out these 27 AI penny stocks that keep pushing the frontiers of artificial intelligence in real business applications.

- Maximize income potential in your portfolio with these 18 dividend stocks with yields > 3% offering stable yields above 3% from established market leaders.

- Get early access to innovation by hunting through these 26 quantum computing stocks as quantum computing edges closer to transforming entire industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hexagon might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:HEXA B

Hexagon

Provides geospatial and industrial enterprise solutions worldwide.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives