- Sweden

- /

- Electronic Equipment and Components

- /

- OM:HEXA B

Did Hexagon's (OM:HEXA B) EcoSys Integration Lay Groundwork for Stronger Recurring Software Revenue?

Reviewed by Sasha Jovanovic

- Hexagon's Asset Lifecycle Intelligence division and Management Controls Inc. recently announced the launch of the EcoSys + myTrack Connector, an integration providing real-time contractor cost data directly within Hexagon’s project performance platform.

- This solution automates contractor data processes, aiming to streamline financial controls and forecasting for customers managing complex industrial and infrastructure projects worldwide.

- We'll explore how this new automation-focused product could support Hexagon’s investment narrative by strengthening recurring software revenue streams.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

Hexagon Investment Narrative Recap

To own Hexagon stock, investors need to believe in the company's ability to leverage industrial automation and digitalization to grow its high-margin, recurring software streams, despite challenges in certain end-markets. The recent launch of the EcoSys + myTrack Connector could strengthen recurring software revenue, which is an essential short-term catalyst, but by itself does not materially reduce the risk from ongoing margin pressures or earnings volatility, as these are driven by factors beyond just new product launches.

Among Hexagon’s latest announcements, the third quarter earnings report stands out, showing increased sales but a swing to a net loss compared to the same period last year. This highlights the importance of cost control and margin management, even as automation-focused innovations like EcoSys + myTrack aim to support steadier, recurring revenues moving forward.

However, beneath this push toward automation and more predictable revenue streams, investors should be aware that persistent cost base misalignment and margin pressures still...

Read the full narrative on Hexagon (it's free!)

Hexagon's narrative projects €6.3 billion revenue and €1.3 billion earnings by 2028. This requires 5.2% yearly revenue growth and a €358 million earnings increase from €941.9 million today.

Uncover how Hexagon's forecasts yield a SEK116.68 fair value, in line with its current price.

Exploring Other Perspectives

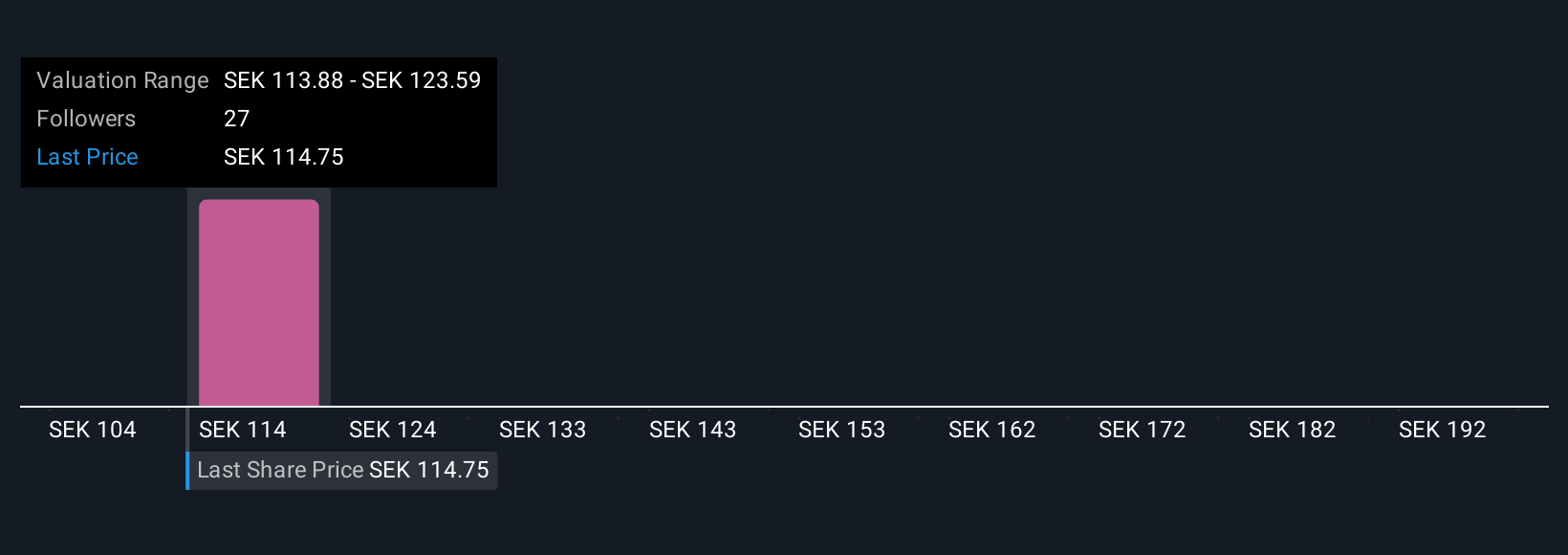

You can find five fair value estimates from the Simply Wall St Community, ranging from SEK104.17 to SEK201.27. While opinions vary, ongoing margin pressure and cost challenges remain central to the company's outlook and could shape shareholder value in the coming years.

Explore 5 other fair value estimates on Hexagon - why the stock might be worth 11% less than the current price!

Build Your Own Hexagon Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hexagon research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Hexagon research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hexagon's overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hexagon might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:HEXA B

Hexagon

Provides geospatial and industrial enterprise solutions worldwide.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives