- Sweden

- /

- Electronic Equipment and Components

- /

- OM:BERNER B

Are Robust Financials Driving The Recent Rally In Christian Berner Tech Trade AB (publ)'s (STO:CBTT B) Stock?

Christian Berner Tech Trade's (STO:CBTT B) stock is up by a considerable 8.1% over the past month. Given the company's impressive performance, we decided to study its financial indicators more closely as a company's financial health over the long-term usually dictates market outcomes. Particularly, we will be paying attention to Christian Berner Tech Trade's ROE today.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

View our latest analysis for Christian Berner Tech Trade

How Is ROE Calculated?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Christian Berner Tech Trade is:

18% = kr32m ÷ kr177m (Based on the trailing twelve months to September 2020).

The 'return' is the income the business earned over the last year. That means that for every SEK1 worth of shareholders' equity, the company generated SEK0.18 in profit.

Why Is ROE Important For Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

A Side By Side comparison of Christian Berner Tech Trade's Earnings Growth And 18% ROE

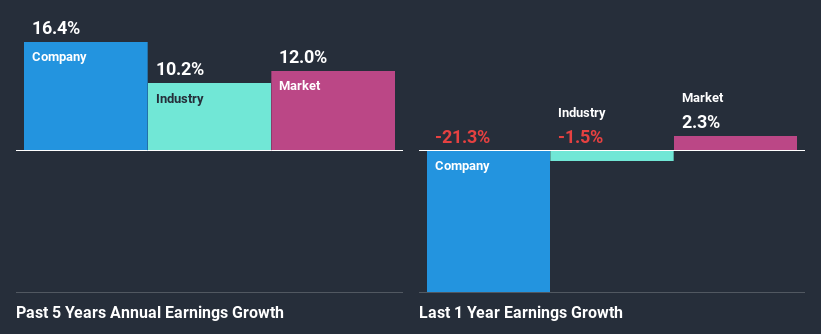

To begin with, Christian Berner Tech Trade seems to have a respectable ROE. Especially when compared to the industry average of 12% the company's ROE looks pretty impressive. This probably laid the ground for Christian Berner Tech Trade's moderate 16% net income growth seen over the past five years.

As a next step, we compared Christian Berner Tech Trade's net income growth with the industry, and pleasingly, we found that the growth seen by the company is higher than the average industry growth of 10%.

Earnings growth is a huge factor in stock valuation. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. This then helps them determine if the stock is placed for a bright or bleak future. If you're wondering about Christian Berner Tech Trade's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is Christian Berner Tech Trade Using Its Retained Earnings Effectively?

With a three-year median payout ratio of 36% (implying that the company retains 64% of its profits), it seems that Christian Berner Tech Trade is reinvesting efficiently in a way that it sees respectable amount growth in its earnings and pays a dividend that's well covered.

Besides, Christian Berner Tech Trade has been paying dividends over a period of six years. This shows that the company is committed to sharing profits with its shareholders. Upon studying the latest analysts' consensus data, we found that the company is expected to keep paying out approximately 39% of its profits over the next three years. Therefore, the company's future ROE is also not expected to change by much with analysts predicting an ROE of 19%.

Conclusion

In total, we are pretty happy with Christian Berner Tech Trade's performance. Particularly, we like that the company is reinvesting heavily into its business, and at a high rate of return. Unsurprisingly, this has led to an impressive earnings growth. The latest industry analyst forecasts show that the company is expected to maintain its current growth rate. To know more about the company's future earnings growth forecasts take a look at this free report on analyst forecasts for the company to find out more.

If you’re looking to trade Christian Berner Tech Trade, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Berner Industrier might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OM:BERNER B

Berner Industrier

Engages in the technology distribution, and energy and environment business in Sweden, Norway, Finland, and Denmark.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success