- Sweden

- /

- Electronic Equipment and Components

- /

- OM:BERNER B

Earnings Not Telling The Story For Berner Industrier AB (STO:BERNER B) After Shares Rise 30%

Berner Industrier AB (STO:BERNER B) shares have continued their recent momentum with a 30% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 69% in the last year.

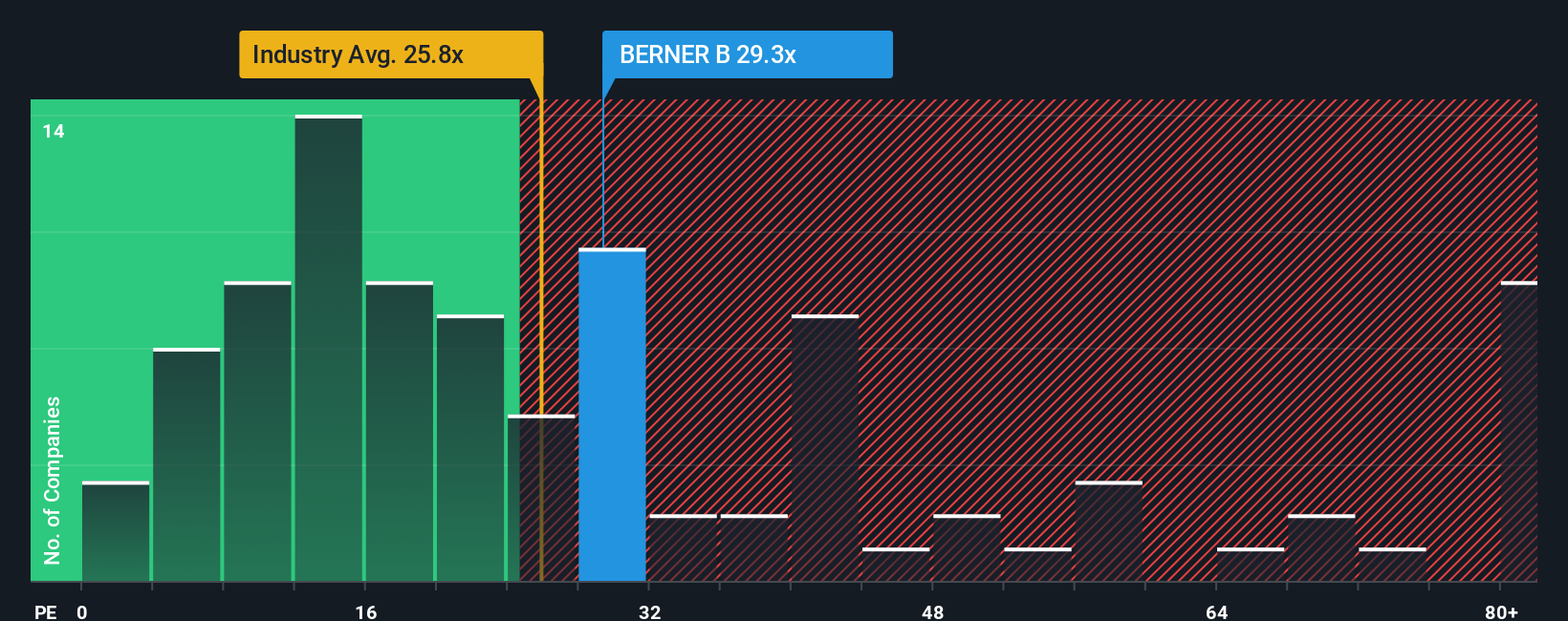

After such a large jump in price, Berner Industrier may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 29.3x, since almost half of all companies in Sweden have P/E ratios under 23x and even P/E's lower than 15x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

Recent times have been advantageous for Berner Industrier as its earnings have been rising faster than most other companies. The P/E is probably high because investors think this strong earnings performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

Check out our latest analysis for Berner Industrier

Does Growth Match The High P/E?

The only time you'd be truly comfortable seeing a P/E as high as Berner Industrier's is when the company's growth is on track to outshine the market.

Retrospectively, the last year delivered a decent 7.2% gain to the company's bottom line. Pleasingly, EPS has also lifted 106% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 17% per year during the coming three years according to the one analyst following the company. That's shaping up to be similar to the 18% per annum growth forecast for the broader market.

In light of this, it's curious that Berner Industrier's P/E sits above the majority of other companies. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for disappointment if the P/E falls to levels more in line with the growth outlook.

The Key Takeaway

Berner Industrier's P/E is getting right up there since its shares have risen strongly. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Berner Industrier's analyst forecasts revealed that its market-matching earnings outlook isn't impacting its high P/E as much as we would have predicted. Right now we are uncomfortable with the relatively high share price as the predicted future earnings aren't likely to support such positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Berner Industrier with six simple checks.

Of course, you might also be able to find a better stock than Berner Industrier. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Berner Industrier might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:BERNER B

Berner Industrier

Engages in the technology distribution, and energy and environment business in Sweden, Norway, Finland, and Denmark.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives