Stock Analysis

- Sweden

- /

- Capital Markets

- /

- OM:EQT

Swedish Exchange Growth Companies With High Insider Ownership In July 2024

Reviewed by Simply Wall St

As global markets navigate through a mix of challenges and opportunities, the Swedish stock market remains a focal point for investors seeking growth. Amidst this backdrop, companies with high insider ownership in Sweden are drawing attention for their potential resilience and alignment of interests between shareholders and management. In the current environment, where value stocks are gaining favor internationally, Swedish growth companies with substantial insider ownership may offer an appealing balance of innovation and committed leadership. This can be particularly reassuring to investors in times of economic uncertainty.

Top 10 Growth Companies With High Insider Ownership In Sweden

| Name | Insider Ownership | Earnings Growth |

| CTT Systems (OM:CTT) | 16.9% | 23.4% |

| edyoutec (NGM:EDYOU) | 14.6% | 63.1% |

| Biovica International (OM:BIOVIC B) | 18.5% | 73.8% |

| InCoax Networks (OM:INCOAX) | 18.1% | 104.9% |

| Sileon (OM:SILEON) | 20.3% | 109.3% |

| KebNi (OM:KEBNI B) | 37.8% | 90.4% |

| Yubico (OM:YUBICO) | 37.5% | 43.8% |

| BioArctic (OM:BIOA B) | 34% | 50.9% |

| Calliditas Therapeutics (OM:CALTX) | 11.6% | 52.9% |

| SaveLend Group (OM:YIELD) | 23.3% | 103.4% |

Underneath we present a selection of stocks filtered out by our screen.

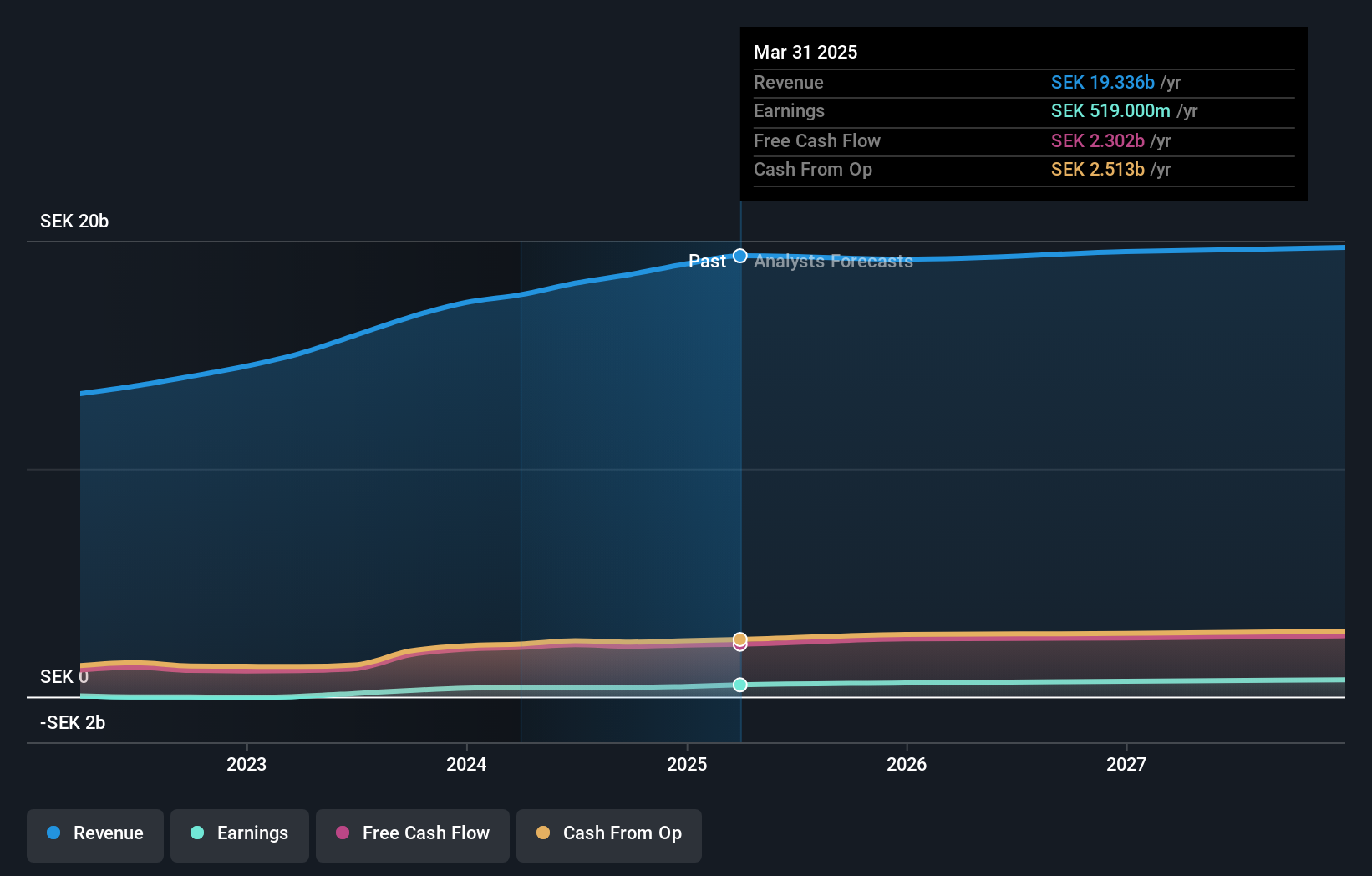

Attendo (OM:ATT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Attendo AB operates in the health and care services sector within Scandinavia and Finland, with a market capitalization of approximately SEK 7.22 billion.

Operations: The company generates its revenue primarily through care and health care services, totaling SEK 18.14 billion.

Insider Ownership: 15.1%

Earnings Growth Forecast: 26.2% p.a.

Attendo, a Swedish healthcare provider, exhibits mixed investment traits. With a P/E ratio of 18.3x, it stands below the Swedish market average of 23.3x, suggesting good value relative to peers. The company's earnings are expected to grow by 26.2% annually, outpacing the market forecast of 15%. However, its dividend track record is unstable and insider buying over the past three months has not been substantial. Recent strategic moves include share repurchases and exploring acquisitions to enhance capital efficiency and growth prospects.

- Click here to discover the nuances of Attendo with our detailed analytical future growth report.

- Our valuation report here indicates Attendo may be undervalued.

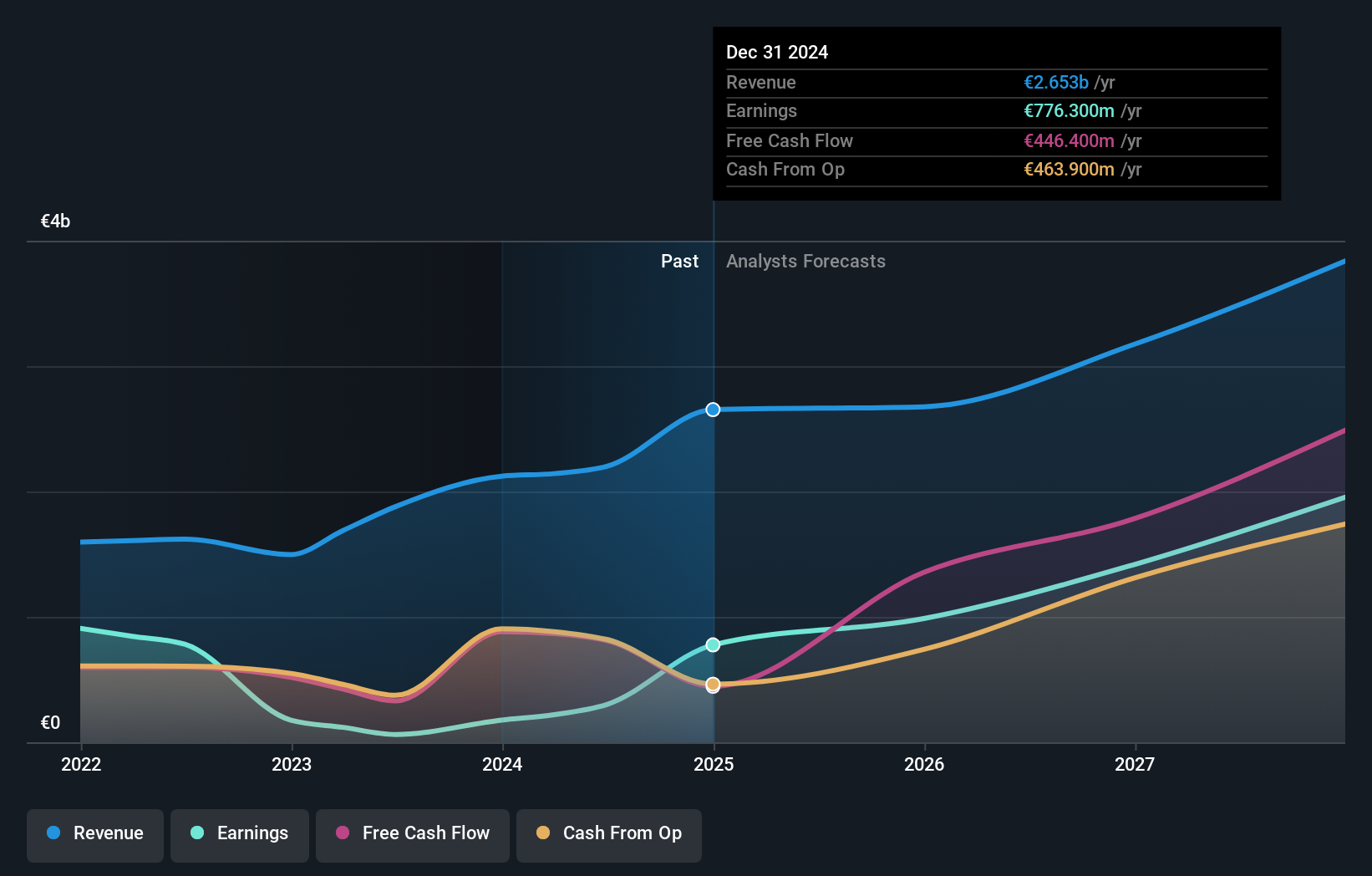

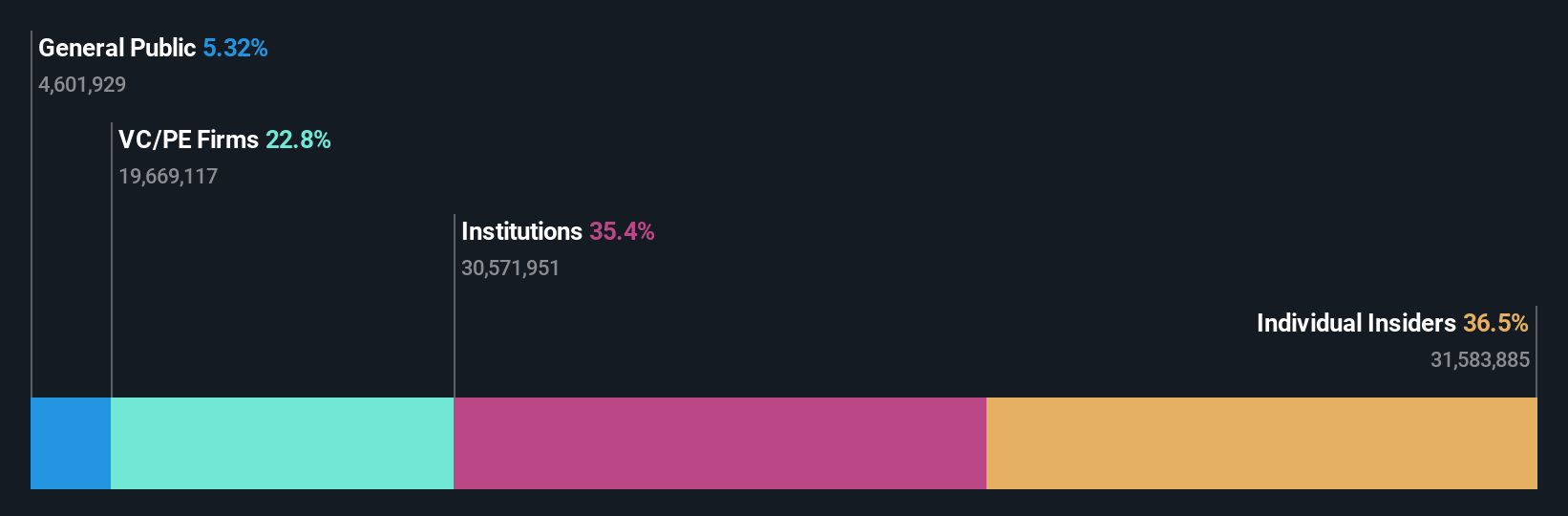

EQT (OM:EQT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: EQT AB (publ) is a global private equity firm specializing in private capital and real asset segments, with a market capitalization of approximately SEK 384.58 billion.

Operations: EQT's revenue is derived primarily from its Private Capital and Real Assets segments, generating €1.28 billion and €0.88 billion respectively.

Insider Ownership: 31%

Earnings Growth Forecast: 57.5% p.a.

EQT, a Swedish private equity firm, demonstrated robust financial performance in the first half of 2024 with revenue and net income significantly increasing from the previous year. The company is actively exploring strategic options including potential sales and acquisitions, such as the possible divestiture of Karo Healthcare AB valued at over €2 billion and discussions to acquire Keywords Studios for £2.2 billion. Despite high insider transactions recently favoring purchases, EQT's future growth is tempered by its revenue growth forecast which trails behind some market expectations.

- Unlock comprehensive insights into our analysis of EQT stock in this growth report.

- According our valuation report, there's an indication that EQT's share price might be on the expensive side.

Yubico (OM:YUBICO)

Simply Wall St Growth Rating: ★★★★★★

Overview: Yubico AB specializes in providing authentication solutions for computers, networks, and online services, with a market capitalization of SEK 22.91 billion.

Operations: The company generates SEK 1.93 billion from its Security Software & Services segment.

Insider Ownership: 37.5%

Earnings Growth Forecast: 43.8% p.a.

Yubico, a Swedish company specializing in secure authentication solutions, reported a 20.4% increase in Q1 2024 sales to SEK 504.4 million, with net income rising to SEK 77.5 million from SEK 54.2 million year-over-year. Despite lower profit margins at 8.6% compared to the previous year's 16.9%, Yubico is projected to outpace the Swedish market with significant annual earnings growth forecasted at approximately 43.8%. The firm recently launched MilSecure Mobile for secure DOD web access and announced substantial insider purchases over the past three months, underscoring strong internal confidence despite recent shareholder dilution.

- Delve into the full analysis future growth report here for a deeper understanding of Yubico.

- Upon reviewing our latest valuation report, Yubico's share price might be too optimistic.

Taking Advantage

- Reveal the 94 hidden gems among our Fast Growing Swedish Companies With High Insider Ownership screener with a single click here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether EQT is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:EQT

EQT

A global private equity firm specializing in private capital and real asset segments.

High growth potential with excellent balance sheet.