3 Swedish Insider-Owned Growth Stocks With Up To 22% Revenue Growth

Reviewed by Simply Wall St

As global markets continue to recover and investor sentiment improves, the Swedish market has shown resilience amidst broader economic fluctuations. In this environment, growth companies with high insider ownership can be particularly attractive due to their potential for robust revenue growth and alignment of interests between management and shareholders. In this article, we explore three Swedish insider-owned growth stocks that have demonstrated up to 22% revenue growth.

Top 10 Growth Companies With High Insider Ownership In Sweden

| Name | Insider Ownership | Earnings Growth |

| CTT Systems (OM:CTT) | 16.9% | 24.8% |

| Magle Chemoswed Holding (OM:MAGLE) | 14.9% | 72.2% |

| Biovica International (OM:BIOVIC B) | 18.8% | 73.8% |

| Yubico (OM:YUBICO) | 37.5% | 43.7% |

| BioArctic (OM:BIOA B) | 34% | 102.8% |

| KebNi (OM:KEBNI B) | 37.8% | 86.1% |

| Calliditas Therapeutics (OM:CALTX) | 12.7% | 51.9% |

| InCoax Networks (OM:INCOAX) | 18.1% | 115.5% |

| edyoutec (NGM:EDYOU) | 13.4% | 63.1% |

| OrganoClick (OM:ORGC) | 23.1% | 109.0% |

Let's take a closer look at a couple of our picks from the screened companies.

EQT (OM:EQT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: EQT AB (publ) is a global private equity firm focusing on private capital and real asset segments, with a market cap of SEK396.11 billion.

Operations: Revenue segments include €37.20 million from Central, €878.70 million from Real Assets, and €1.28 billion from Private Capital.

Insider Ownership: 30.9%

Revenue Growth Forecast: 17.9% p.a.

EQT AB (publ) is a prominent growth company in Sweden with significant insider ownership, though recent months have seen substantial insider selling. The firm has shown strong earnings growth, reporting EUR 282 million in net income for H1 2024, up from EUR 120 million the previous year. EQT's earnings are forecast to grow significantly faster than the Swedish market at 56.8% per year, despite revenue growth expectations being slightly below the high-growth threshold of 20%.

- Delve into the full analysis future growth report here for a deeper understanding of EQT.

- According our valuation report, there's an indication that EQT's share price might be on the expensive side.

Vimian Group (OM:VIMIAN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vimian Group AB (publ) operates in the global animal health industry and has a market cap of SEK21.05 billion.

Operations: The company's revenue segments are Medtech (€111.91 million), Diagnostics (€20.63 million), Specialty Pharma (€158.39 million), and Veterinary Services (€53.95 million).

Insider Ownership: 11.1%

Revenue Growth Forecast: 11.9% p.a.

Vimian Group AB, a growth company in Sweden with high insider ownership, reported Q2 2024 sales of EUR 90.99 million, up from EUR 81.31 million a year ago, and net income of EUR 4.87 million compared to EUR 2.99 million previously. The firm’s revenue is forecast to grow at 11.9% per year, faster than the Swedish market's average but below high-growth benchmarks. Insiders have been buying shares substantially in the past three months without significant recent selling.

- Unlock comprehensive insights into our analysis of Vimian Group stock in this growth report.

- Our expertly prepared valuation report Vimian Group implies its share price may be lower than expected.

Yubico (OM:YUBICO)

Simply Wall St Growth Rating: ★★★★★★

Overview: Yubico AB offers authentication solutions for computers, networks, and online services, with a market cap of SEK25.83 billion.

Operations: Yubico's revenue from Security Software & Services amounts to SEK2.09 billion.

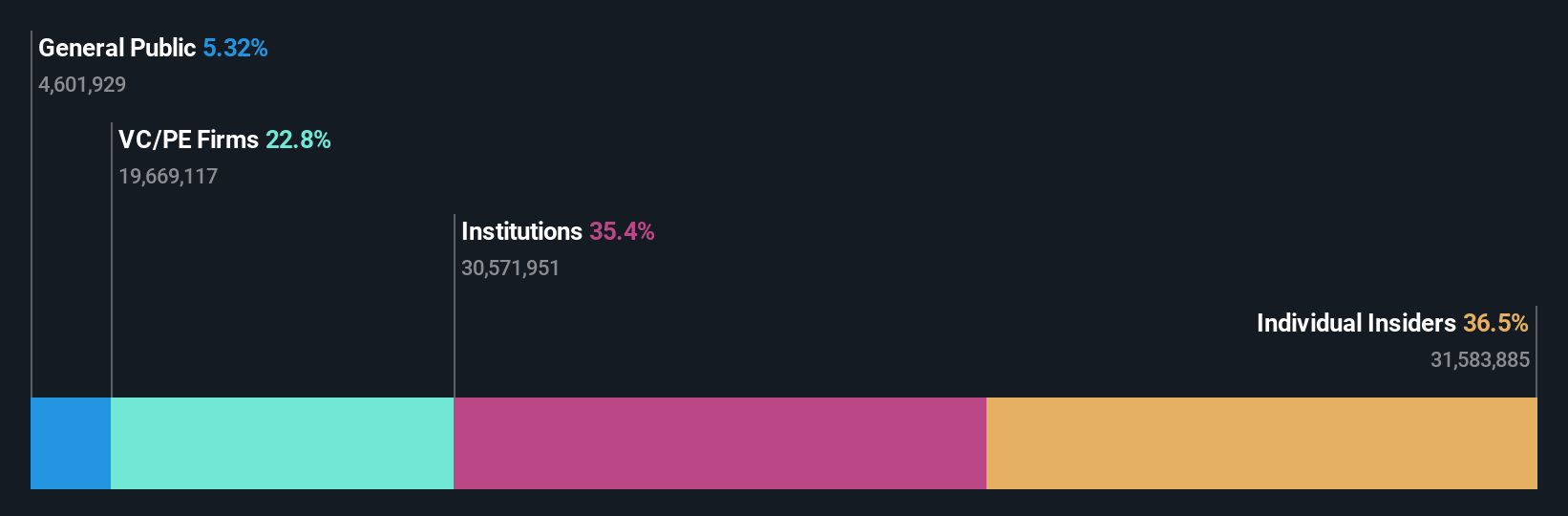

Insider Ownership: 37.5%

Revenue Growth Forecast: 22.5% p.a.

Yubico, a Swedish growth company with high insider ownership, is forecast to see annual earnings growth of 43.7% and revenue growth of 22.5%, both outpacing the market. Despite recent share price volatility and substantial shareholder dilution over the past year, insiders have been net buyers recently. The company's Q2 2024 earnings call on August 15 will provide further insights into its financial health following the launch of MilSecure Mobile in collaboration with Straxis.

- Click to explore a detailed breakdown of our findings in Yubico's earnings growth report.

- Our valuation report here indicates Yubico may be overvalued.

Summing It All Up

- Click through to start exploring the rest of the 89 Fast Growing Swedish Companies With High Insider Ownership now.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:YUBICO

Yubico

Provides authentication solutions for use in computers, networks, and online services.

Exceptional growth potential with excellent balance sheet.