These 4 Measures Indicate That White Pearl Technology Group (STO:WPTG B) Is Using Debt Safely

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that White Pearl Technology Group AB (STO:WPTG B) does use debt in its business. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

How Much Debt Does White Pearl Technology Group Carry?

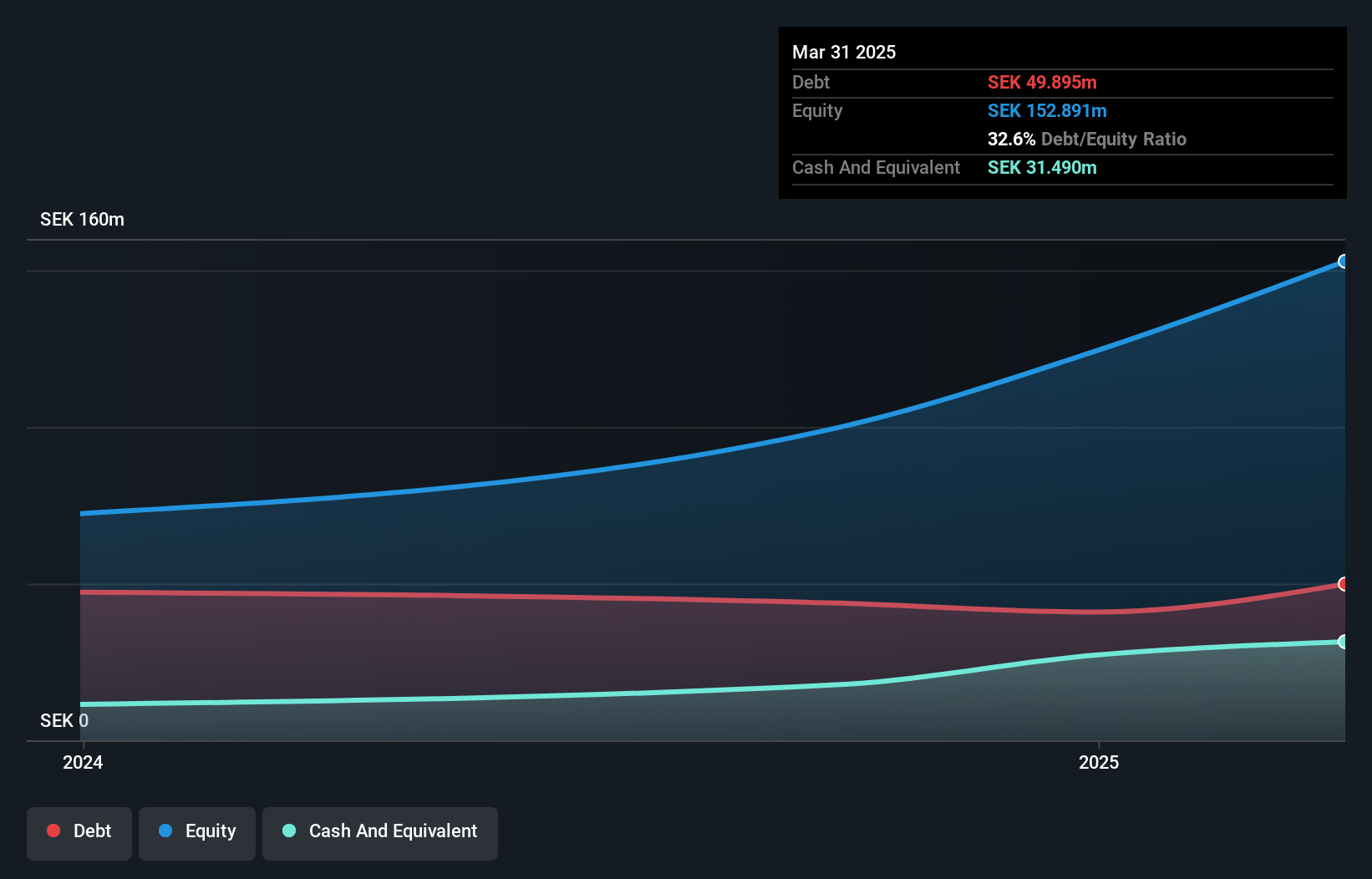

The image below, which you can click on for greater detail, shows that at March 2025 White Pearl Technology Group had debt of kr49.9m, up from kr47.3m in one year. However, it also had kr31.5m in cash, and so its net debt is kr18.4m.

How Healthy Is White Pearl Technology Group's Balance Sheet?

According to the last reported balance sheet, White Pearl Technology Group had liabilities of kr39.3m due within 12 months, and liabilities of kr49.9m due beyond 12 months. Offsetting these obligations, it had cash of kr31.5m as well as receivables valued at kr115.2m due within 12 months. So it actually has kr57.4m more liquid assets than total liabilities.

It's good to see that White Pearl Technology Group has plenty of liquidity on its balance sheet, suggesting conservative management of liabilities. Due to its strong net asset position, it is not likely to face issues with its lenders.

Check out our latest analysis for White Pearl Technology Group

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

White Pearl Technology Group has a low net debt to EBITDA ratio of only 0.32. And its EBIT easily covers its interest expense, being 104 times the size. So we're pretty relaxed about its super-conservative use of debt. In addition to that, we're happy to report that White Pearl Technology Group has boosted its EBIT by 95%, thus reducing the spectre of future debt repayments. There's no doubt that we learn most about debt from the balance sheet. But it is White Pearl Technology Group's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Looking at the most recent two years, White Pearl Technology Group recorded free cash flow of 27% of its EBIT, which is weaker than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Our View

White Pearl Technology Group's interest cover suggests it can handle its debt as easily as Cristiano Ronaldo could score a goal against an under 14's goalkeeper. But, on a more sombre note, we are a little concerned by its conversion of EBIT to free cash flow. Considering this range of factors, it seems to us that White Pearl Technology Group is quite prudent with its debt, and the risks seem well managed. So we're not worried about the use of a little leverage on the balance sheet. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. We've identified 3 warning signs with White Pearl Technology Group , and understanding them should be part of your investment process.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Valuation is complex, but we're here to simplify it.

Discover if White Pearl Technology Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:WPTG B

White Pearl Technology Group

Engages in selling various technology solutions and products in Sweden, Africa, the Middle East, Asia, and Latin America.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives