Little Excitement Around Truecaller AB (publ)'s (STO:TRUE B) Earnings As Shares Take 31% Pounding

Unfortunately for some shareholders, the Truecaller AB (publ) (STO:TRUE B) share price has dived 31% in the last thirty days, prolonging recent pain. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 42% share price drop.

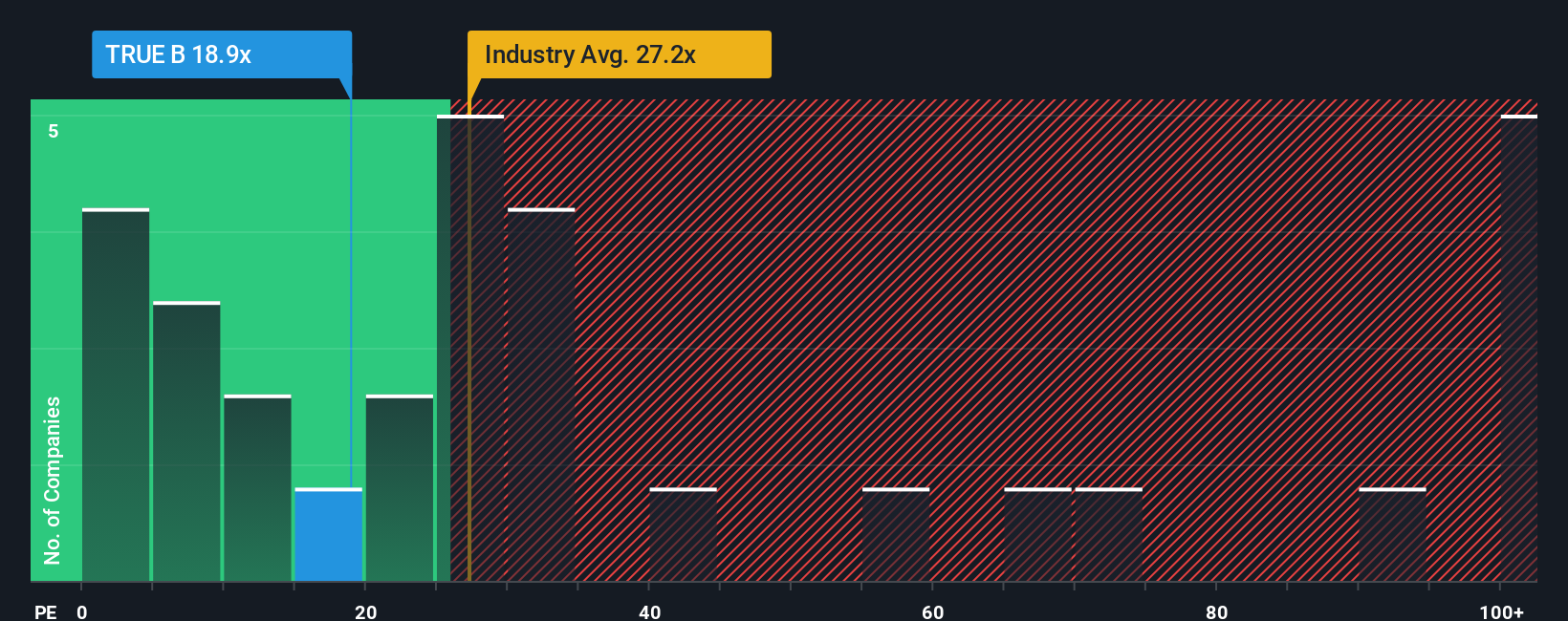

In spite of the heavy fall in price, given about half the companies in Sweden have price-to-earnings ratios (or "P/E's") above 23x, you may still consider Truecaller as an attractive investment with its 18.9x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Truecaller could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Truecaller

Is There Any Growth For Truecaller?

The only time you'd be truly comfortable seeing a P/E as low as Truecaller's is when the company's growth is on track to lag the market.

Retrospectively, the last year delivered a frustrating 1.1% decrease to the company's bottom line. As a result, earnings from three years ago have also fallen 12% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Shifting to the future, estimates from the six analysts covering the company suggest earnings should grow by 11% per annum over the next three years. With the market predicted to deliver 20% growth per annum, the company is positioned for a weaker earnings result.

With this information, we can see why Truecaller is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

Truecaller's P/E has taken a tumble along with its share price. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Truecaller's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Truecaller, and understanding should be part of your investment process.

If these risks are making you reconsider your opinion on Truecaller, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Truecaller might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:TRUE B

Truecaller

Develops and publishes mobile caller ID applications for individuals and business in India, the Middle East, Africa, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives