As the European market navigates a mixed landscape, with the pan-European STOXX Europe 600 Index recently dipping by 0.67% amid tempered expectations for further ECB rate cuts, investors are keenly observing high-growth tech stocks that could thrive despite broader market fluctuations. In such an environment, a strong stock typically exhibits robust fundamentals and innovative potential to capitalize on emerging trends like artificial intelligence and digital transformation, positioning itself well against economic uncertainties and competitive pressures.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Pharma Mar | 26.56% | 58.15% | ★★★★★★ |

| Bonesupport Holding | 27.78% | 51.42% | ★★★★★★ |

| Hacksaw | 26.01% | 37.61% | ★★★★★★ |

| KebNi | 23.66% | 69.18% | ★★★★★★ |

| Comet Holding | 10.81% | 36.12% | ★★★★★☆ |

| CD Projekt | 36.72% | 49.58% | ★★★★★★ |

| Aelis Farma | 108.74% | 130.33% | ★★★★★☆ |

| SyntheticMR | 18.81% | 47.40% | ★★★★★☆ |

| Waystream Holding | 15.92% | 44.85% | ★★★★★☆ |

| Gapwaves | 41.49% | 89.60% | ★★★★★☆ |

We'll examine a selection from our screener results.

Pharma Mar (BME:PHM)

Simply Wall St Growth Rating: ★★★★★★

Overview: Pharma Mar, S.A. is a biopharmaceutical company specializing in the research, development, production, and commercialization of bio-active principles for oncology across various international markets with a market cap of €1.26 billion.

Operations: The company operates in the biopharmaceutical sector, focusing on oncology through the research, development, production, and commercialization of bio-active principles. It serves markets in Spain, China, Germany, Ireland, France, other parts of the European Union, and the United States.

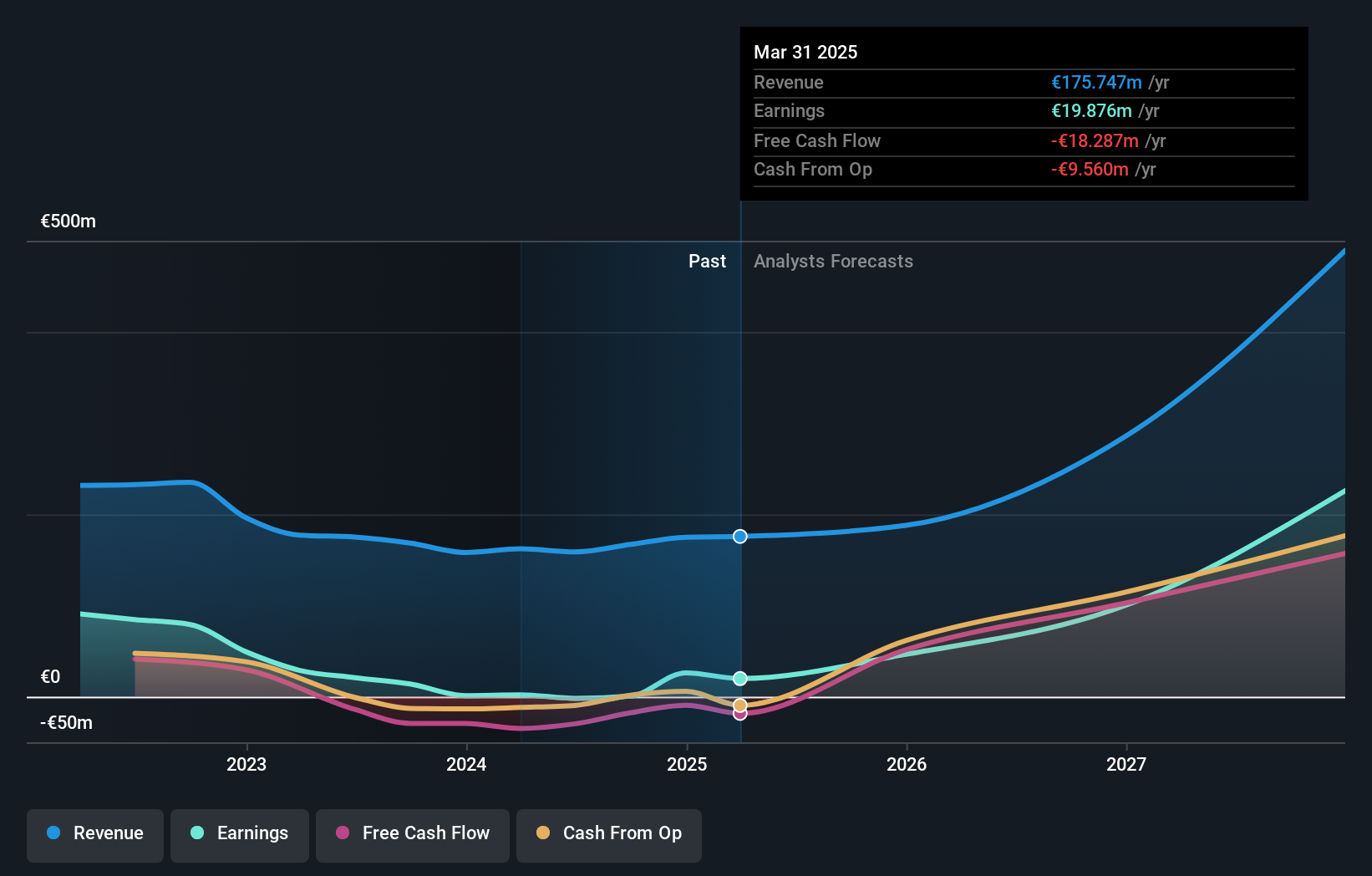

Pharma Mar stands out in the high-growth tech landscape of Europe, demonstrating robust performance with a staggering 5367% earnings growth over the past year and expectations for future revenue and earnings growth at annual rates of 26.6% and 58.15%, respectively. These figures significantly surpass the broader Spanish market's growth rates, highlighting Pharma Mar's exceptional position in its sector. The company's commitment to innovation is evident from its substantial investment in R&D, which is crucial for maintaining its competitive edge and fueling future advancements. Moreover, with a forecasted Return on Equity of 41%, Pharma Mar not only promises strong financial health but also suggests potential for sustained long-term value creation amidst a dynamic industry landscape.

- Dive into the specifics of Pharma Mar here with our thorough health report.

Gain insights into Pharma Mar's historical performance by reviewing our past performance report.

Truecaller (OM:TRUE B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Truecaller AB (publ) develops and publishes mobile caller ID applications for individuals and businesses across India, the Middle East, Africa, and globally, with a market capitalization of approximately SEK9.73 billion.

Operations: Truecaller generates revenue primarily from its communications software segment, amounting to SEK2.02 billion. The company focuses on mobile caller ID applications for both individual and business users across various regions.

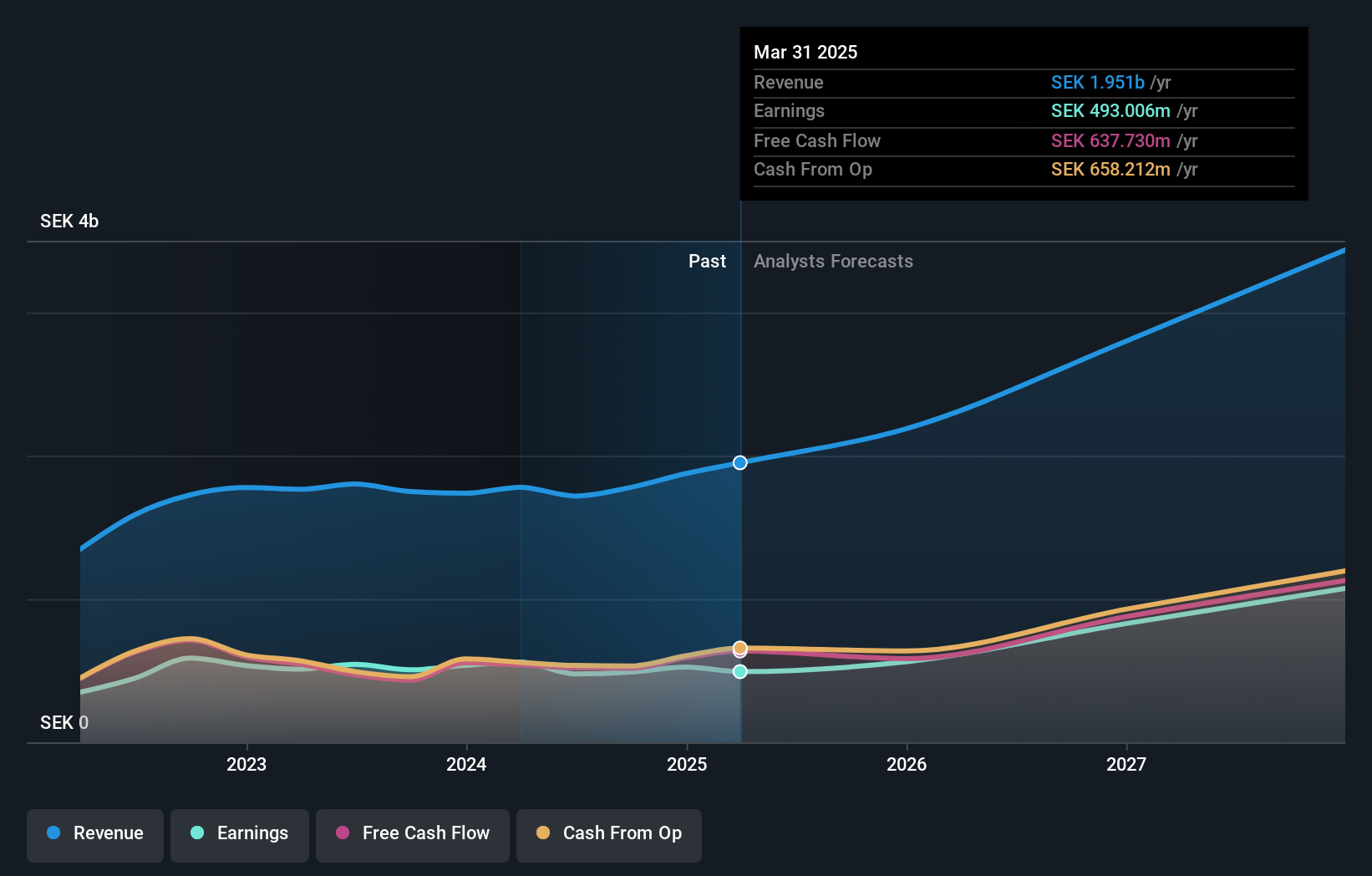

Truecaller, a leader in communication tech, reported a modest increase in sales to SEK 1.49 billion over nine months, up from SEK 1.35 billion year-on-year, though net income dipped to SEK 328.23 million from SEK 373.89 million previously. The company's innovative Verified Business Customer Experience Platform and adVantage AI engine exemplify its commitment to enhancing enterprise-client communications across Europe—key moves that could redefine engagement standards in the sector. With revenue and earnings growth outpacing the Swedish market at annual rates of 16.4% and 17.8%, respectively, Truecaller is strategically positioned to leverage its R&D prowess for sustained advancement amidst evolving market demands.

- Delve into the full analysis health report here for a deeper understanding of Truecaller.

Evaluate Truecaller's historical performance by accessing our past performance report.

Comet Holding (SWX:COTN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Comet Holding AG, along with its subsidiaries, delivers X-ray and RF power technology solutions across Europe, North America, Asia, and other international markets with a market capitalization of CHF1.52 billion.

Operations: The company generates revenue primarily through its Plasma Control Technologies (PCT) segment, contributing CHF287.40 million, followed by the X-Ray Systems (IXS) at CHF109.40 million and Industrial X-Ray Modules (IXM) at CHF96.50 million. These segments reflect its focus on providing advanced technological solutions in various international markets.

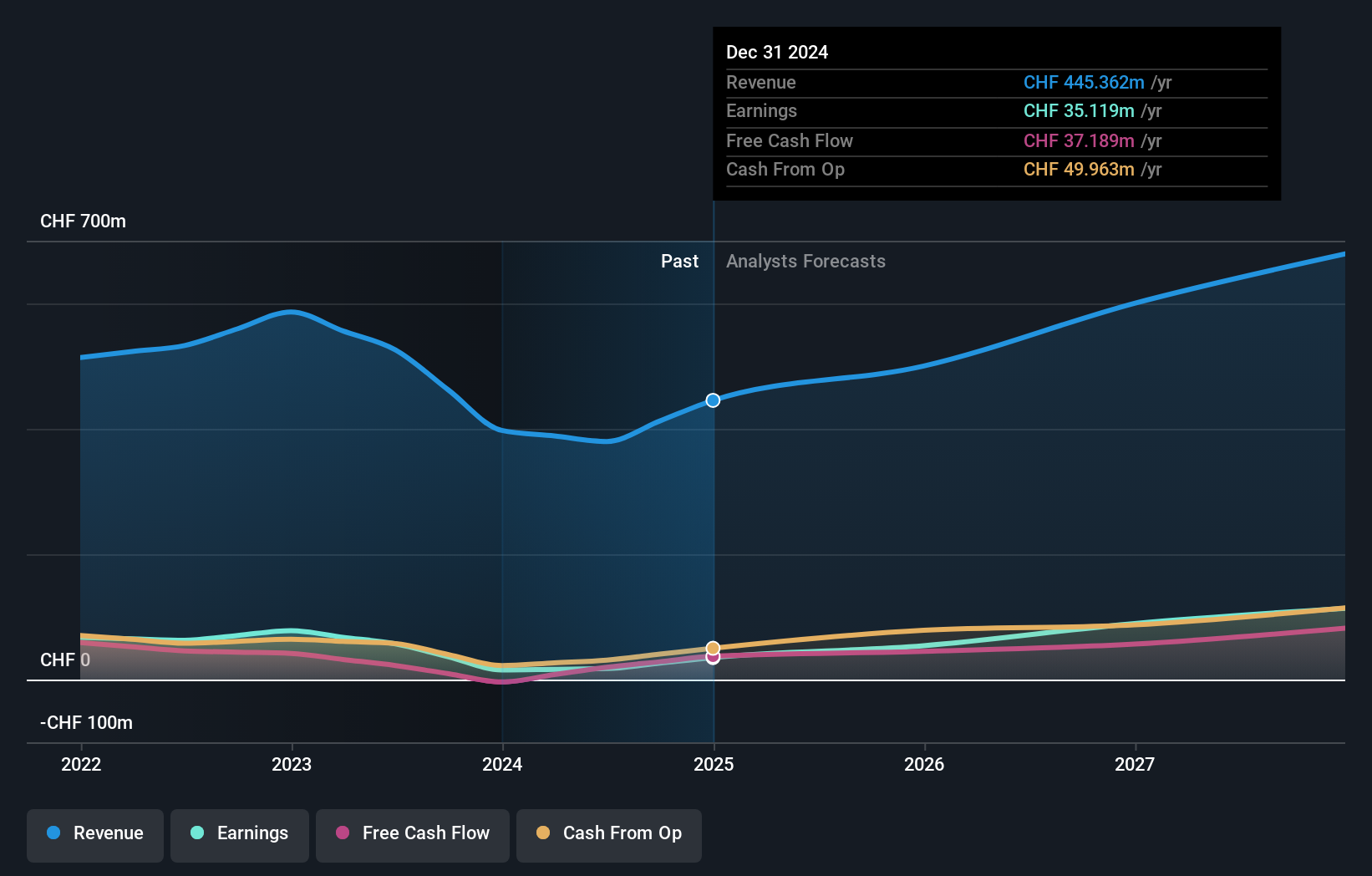

Comet Holding AG, amidst a challenging market, has refined its 2025 earnings guidance, projecting net sales at the lower spectrum between CHF 460 million and CHF 500 million. Despite this cautious outlook, the company's past year's earnings surged by an impressive 122.3%, with forecasts suggesting a robust annual growth rate of 36.1%. This performance starkly contrasts with the broader Electronic industry’s downturn of -1.3% in earnings growth. Comet’s commitment to R&D is evident as it continues to outpace Swiss market expectations with projected revenue growth at 10.8% annually compared to the market's 4.1%. This strategic focus on innovation and quality positions Comet well for future resilience and growth in high-tech sectors.

- Navigate through the intricacies of Comet Holding with our comprehensive health report here.

Review our historical performance report to gain insights into Comet Holding's's past performance.

Taking Advantage

- Discover the full array of 50 European High Growth Tech and AI Stocks right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:PHM

Pharma Mar

A biopharmaceutical company, focuses on the research, development, production, and commercialization of bio-active principles for the use in oncology in Spain, China, Germany, Ireland, France, rest of the European Union, the United States, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives